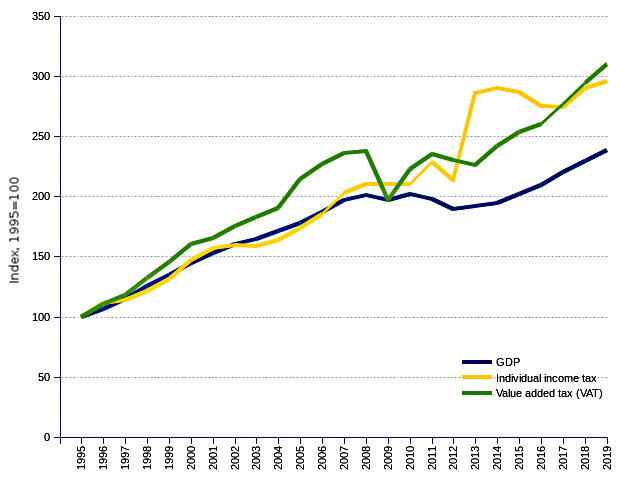

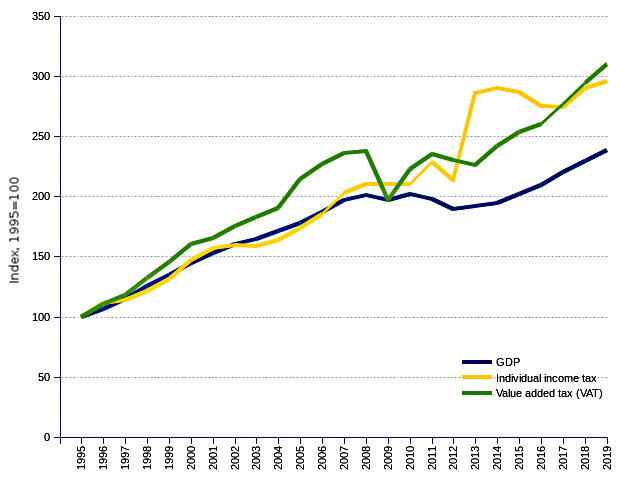

Portugal's tax burden continues rising in absolute values, while stabilizing at 37 percent of GDP. In the recent years of the alleged post-austerity policy, and despite the official rhetoric claiming a slowdown of the fiscal pressure, the overall fiscal burden grew faster (4.35 percent) than GDP (4.25 percent). The increases fell mainly upon the value added tax (5.21 percent) and the social contributions (5.08 percent).

A case of creative finance

In 2011, facing a big financial crisis, Portugal requested a €78 billion IMF-EU (International Monetary Fund-European Union) bailout package, which was granted on very stringent austerity conditions, under the Troika, IMF, EU, and ECB (European Central Bank) supervision. GDP came to a standstill, unemployment climbed to two-digit numbers thus curtailing individual income tax and social contributions receipts, and consumption suffered, thus shrinking receipts from VAT (value added tax). The government compensated the shortfall by a huge rise of the individual income tax, including a large array of surtaxes. During the Troika-controlled period, roughly from 2011 to 2015, GDP grew by a lame 0.01 percent, against an increase of total tax receipts of 3.14 percent, made up of a 6.41 percent growth of income tax and 2.58 percent growth of VAT.

Come 2016, the new coalition government grabs power promising the end of austerity and the alleviating of the tax pressure. The dilemma is that, under its policies, the government cannot keep such promises. The “wise guys” in power solved the imbroglio quite easily. First, they lifted a couple of highly visible fiscal restraints (namely the surtax on the income tax, and some cuts on civil servants and pensioner paychecks), and offered that as a token of their good faith. Second, they started a systematic use of freezing selected legislature-approved budget items. During the budget debates, they would boast of their generosity, knowing well that those items were empty pods that would never be appropriated. Third, they practically emptied the lists of goods and services at reduced VAT rates, allocating them to the standard 23 percent rate bracket.

As a result, during the 2011-2019 period, the tax burden grew faster (4.35 percent) than GDP (4.25 percent), thanks to the fast growth of VAT (5.21 percent) and social contributions (5.08 percent). As expectable, individual income tax did not fall from the preceding period peak – indeed it did budge upwards by 0.81 percent.

Tax revenue and social contributions, Portugal, 1995 - 2018

Tax revenue and social contributions, Portugal, 1995 - 2018

| | 1995 | 1996 | 1997 | 1998 | 1999 | 2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018P | 2019P | Average change rates |

|---|

| | million Euro | Index | %of GDP | million Euro | Index | %of GDP | million Euro | Index | %of GDP | million Euro | Index | %of GDP | million Euro | Index | %of GDP | million Euro | Index | %of GDP | million Euro | Index | %of GDP | million Euro | Index | %of GDP | million Euro | Index | %of GDP | million Euro | Index | %of GDP | million Euro | Index | %of GDP | million Euro | Index | %of GDP | million Euro | Index | %of GDP | million Euro | Index | %of GDP | million Euro | Index | %of GDP | million Euro | Index | %of GDP | million Euro | Index | %of GDP | million Euro | Index | %of GDP | million Euro | Index | %of GDP | million Euro | Index | %of GDP | million Euro | Index | %of GDP | million Euro | Index | %of GDP | million Euro | Index | %of GDP | million Euro | Index | %of GDP | million Euro | Index | %of GDP | Troika: 2011-2015 | Coalition: 2016-2019 |

| GDP | 89,029 | 100 | | 94,352 | 106 | | 102,331 | 115 | | 111,353 | 125 | | 119,603 | 134 | | 128,414 | 144 | | 135,775 | 153 | | 142,554 | 160 | | 146,068 | 164 | | 152,248 | 171 | | 158,553 | 178 | | 166,260 | 187 | | 175,483 | 197 | | 179,103 | 201 | | 175,416 | 197 | | 179,611 | 202 | | 176,096 | 198 | | 168,296 | 189 | | 170,492 | 192 | | 173,054 | 194 | | 179,713 | 202 | | 186,490 | 209 | | 195,947 | 220 | | 204,305 | 229 | | 212,303 | 238 | | 0.01% | 4.25% |

| Tax burden¹ | 27,963 | 100 | 31 | 30,333 | 108 | 32 | 32,861 | 118 | 32 | 36,280 | 130 | 33 | 39,703 | 142 | 33 | 43,002 | 154 | 33 | 45,085 | 161 | 33 | 48,279 | 173 | 34 | 48,358 | 173 | 33 | 50,955 | 182 | 33 | 54,471 | 195 | 34 | 57,975 | 207 | 35 | 61,484 | 220 | 35 | 62,581 | 224 | 35 | 58,467 | 209 | 33 | 60,461 | 216 | 34 | 62,298 | 223 | 35 | 57,831 | 207 | 34 | 63,238 | 226 | 37 | 64,050 | 229 | 37 | 66,408 | 237 | 37 | 68,216 | 244 | 37 | 71,597 | 256 | 37 | 75,847 | 271 | 37 | 78,728 | 282 | 37 | 1.89% | 4.35% |

| Total tax receipts² | 19,153 | 100 | 22 | 21,058 | 110 | 22 | 22,593 | 118 | 22 | 24,893 | 130 | 22 | 27,588 | 144 | 23 | 29,538 | 154 | 23 | 30,586 | 160 | 23 | 32,648 | 170 | 23 | 31,921 | 167 | 22 | 33,642 | 176 | 22 | 36,035 | 188 | 23 | 38,739 | 202 | 23 | 41,581 | 217 | 24 | 41,850 | 219 | 23 | 37,256 | 195 | 21 | 39,082 | 204 | 22 | 41,084 | 215 | 23 | 38,677 | 202 | 23 | 42,778 | 223 | 25 | 43,581 | 228 | 25 | 45,611 | 238 | 25 | 46,593 | 243 | 25 | 48,890 | 255 | 25 | 51,998 | 271 | 25 | 53,372 | 279 | 25 | 3.14% | 4.01% |

| Individual income tax | 4,595 | 100 | 5 | 5,101 | 111 | 5 | 5,239 | 114 | 5 | 5,572 | 121 | 5 | 6,036 | 131 | 5 | 6,769 | 147 | 5 | 7,220 | 157 | 5 | 7,310 | 159 | 5 | 7,276 | 158 | 5 | 7,528 | 164 | 5 | 7,993 | 174 | 5 | 8,502 | 185 | 5 | 9,329 | 203 | 5 | 9,638 | 210 | 5 | 9,653 | 210 | 6 | 9,641 | 210 | 5 | 10,513 | 229 | 6 | 9,794 | 213 | 6 | 13,123 | 286 | 8 | 13,326 | 290 | 8 | 13,154 | 286 | 7 | 12,618 | 275 | 7 | 12,608 | 274 | 6 | 13,317 | 290 | 7 | 13,584 | 296 | 6 | 6.41% | 0.81% |

| Corporate income tax³ | 1,888 | 100 | 2 | 2,333 | 124 | 2 | 2,927 | 155 | 3 | 3,152 | 167 | 3 | 3,870 | 205 | 3 | 4,457 | 236 | 3 | 4,048 | 214 | 3 | 4,317 | 229 | 3 | 3,323 | 176 | 2 | 3,929 | 208 | 3 | 3,901 | 207 | 2 | 4,494 | 238 | 3 | 5,815 | 308 | 3 | 6,093 | 323 | 3 | 4,544 | 241 | 3 | 4,670 | 247 | 3 | 5,278 | 280 | 3 | 4,362 | 231 | 3 | 5,327 | 282 | 3 | 4,718 | 250 | 3 | 5,405 | 286 | 3 | 5,399 | 286 | 3 | 5,956 | 316 | 3 | 6,493 | 344 | 3 | 6,306 | 334 | 3 | 2.97% | 3.93% |

| Value added tax (VAT) | 6,075 | 100 | 7 | 6,690 | 110 | 7 | 7,170 | 118 | 7 | 8,030 | 132 | 7 | 8,804 | 145 | 7 | 9,733 | 160 | 8 | 10,021 | 165 | 7 | 10,668 | 176 | 7 | 11,076 | 182 | 8 | 11,569 | 190 | 8 | 13,001 | 214 | 8 | 13,764 | 227 | 8 | 14,333 | 236 | 8 | 14,424 | 237 | 8 | 11,971 | 197 | 7 | 13,527 | 223 | 8 | 14,265 | 235 | 8 | 13,995 | 230 | 8 | 13,710 | 226 | 8 | 14,682 | 242 | 8 | 15,368 | 253 | 9 | 15,767 | 260 | 8 | 16,809 | 277 | 9 | 17,865 | 294 | 9 | 18,828 | 310 | 9 | 2.58% | 5.21% |

| Total social contributions | 8,810 | 100 | 10 | 9,275 | 105 | 10 | 10,268 | 117 | 10 | 11,387 | 129 | 10 | 12,115 | 138 | 10 | 13,465 | 153 | 10 | 14,499 | 165 | 11 | 15,631 | 177 | 11 | 16,438 | 187 | 11 | 17,313 | 197 | 11 | 18,437 | 209 | 12 | 19,236 | 218 | 12 | 19,902 | 226 | 11 | 20,731 | 235 | 12 | 21,210 | 241 | 12 | 21,378 | 243 | 12 | 21,213 | 241 | 12 | 19,153 | 217 | 11 | 20,460 | 232 | 12 | 20,468 | 232 | 12 | 20,796 | 236 | 12 | 21,623 | 245 | 12 | 22,707 | 258 | 12 | 23,849 | 271 | 12 | 25,356 | 288 | 12 | -0.55% | 5.08% |

P - Provisional

¹ – Includes imputed social contributions.

² – Includes taxes on production and imports, capital taxes and other taxes.

³ – Perceived by central Government, municipal taxes excluded.

Source: Statistics Portugal, National Accounts, INE |