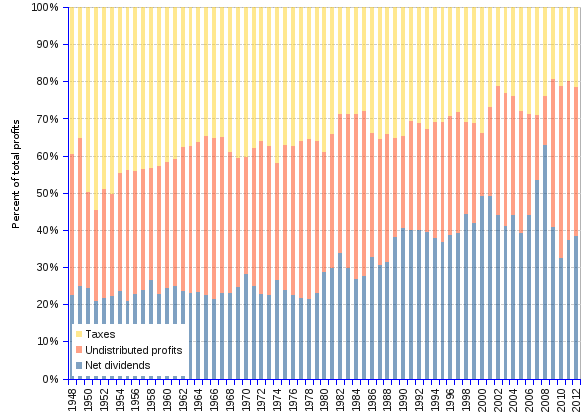

In 2008, just as the financial and economic global crisis devastated the economies, 62.9% of US corporate profits were given to shareholders as dividends, whereas business kept 13% to serve its own development needs, and 24.1% were given to the state in the form of taxes. This split contrasts with the 1948 situation, when taxes collected a hefty 39.5%, undistributed profits amounted to 37.9% and shareholders had to make do with dividends amounting to 22.3% of profits.

The economy contraction since 2008, changed the stage to some extent, the dividends share decreasing to a trough of 32.4% in 2010, only to start a recovery thereafter, climbing to 38.3% in 2012. Variations did not affect much the percentage allocated to taxes that remains stuck to a customary narrow band around 20%, give or take a couple of percent points.

One may wonder how compatible is the currently prevailing "maximized shareholder value" practice with the actual needs of today's economy. The 2008 crisis exposed the frailty of the corporate world. The emphasis placed on rewarding shareholders is an unsurmountable obstacle to the creation of badly needed reserves. Indeed, as the crisis amply demonstrated, a wide spectrum of industries — headed by the banking and financial services, the construction, the automotive industries — had to be rescued by the taxpayer, because they lacked an adequate cushion to face the sudden market bumps. But this is only one aspect of the problem.

For long, corporations have successfully avoided funding the entirety of their own operational costs. Such costs as those incurred to repair damages caused by land, water and air pollution, by the destruction of living species, or by the offensive depletion of common resources, are simply ignored by corporate cost accounting, and duly "externalized" — a litotes meaning that the problem is dispatched to the taxpayer to be taken care of. At a time when business enterprises are pressed to take ownership of the recycling of the worn products they sold, to reduce their carbon emissions, to increase their energy efficiency or to clean up their own waste, they should be required to consider a more balanced split of profits between reserves and tax on the one side, and dividends on the other side.

Net dividends ¹, Undistributed profits ² and Taxes on corporate profits | |||||||

Year | Corporate profits | Net Dividends | Undistributed profits | Taxes on corporate profits | Net Dividends | Undistributed profits | Taxes on corporate profits |

| Billion current USD | Percent of corporate profits | ||||||

| 1948 | 31.4 | 7.0 | 11.9 | 12.4 | 22.3% | 37.9% | 39.5% |

| 1949 | 29.1 | 7.2 | 11.6 | 10.2 | 24.7% | 39.9% | 35.1% |

| 1950 | 36.1 | 8.8 | 9.3 | 17.9 | 24.4% | 25.8% | 49.6% |

| 1951 | 41.2 | 8.6 | 10.1 | 22.6 | 20.9% | 24.5% | 54.9% |

| 1952 | 39.7 | 8.6 | 11.7 | 19.4 | 21.7% | 29.5% | 48.9% |

| 1953 | 40.3 | 8.9 | 11.1 | 20.3 | 22.1% | 27.5% | 50.4% |

| 1954 | 39.5 | 9.3 | 12.6 | 17.6 | 23.5% | 31.9% | 44.6% |

| 1955 | 50.2 | 10.5 | 17.6 | 22.0 | 20.9% | 35.1% | 43.8% |

| 1956 | 49.6 | 11.3 | 16.4 | 22.0 | 22.8% | 33.1% | 44.4% |

| 1957 | 49.1 | 11.7 | 16.0 | 21.4 | 23.8% | 32.6% | 43.6% |

| 1958 | 43.9 | 11.6 | 13.3 | 19.0 | 26.4% | 30.3% | 43.3% |

| 1959 | 55.5 | 12.6 | 19.2 | 23.7 | 22.7% | 34.6% | 42.7% |

| 1960 | 54.7 | 13.4 | 18.5 | 22.8 | 24.5% | 33.8% | 41.7% |

| 1961 | 55.9 | 13.9 | 19.2 | 22.9 | 24.9% | 34.3% | 41.0% |

| 1962 | 64.0 | 15.0 | 24.9 | 24.1 | 23.4% | 38.9% | 37.7% |

| 1963 | 70.5 | 16.2 | 27.9 | 26.4 | 23.0% | 39.6% | 37.4% |

| 1964 | 77.7 | 18.2 | 31.4 | 28.2 | 23.4% | 40.4% | 36.3% |

| 1965 | 89.3 | 20.2 | 38.0 | 31.1 | 22.6% | 42.6% | 34.8% |

| 1966 | 96.1 | 20.7 | 41.6 | 33.9 | 21.5% | 43.3% | 35.3% |

| 1967 | 93.9 | 21.5 | 39.5 | 32.9 | 22.9% | 42.1% | 35.0% |

| 1968 | 101.7 | 23.5 | 38.6 | 39.6 | 23.1% | 38.0% | 38.9% |

| 1969 | 98.4 | 24.2 | 34.2 | 40.0 | 24.6% | 34.8% | 40.7% |

| 1970 | 86.2 | 24.3 | 27.2 | 34.8 | 28.2% | 31.6% | 40.4% |

| 1971 | 100.6 | 25.0 | 37.5 | 38.2 | 24.9% | 37.3% | 38.0% |

| 1972 | 117.2 | 26.8 | 48.0 | 42.3 | 22.9% | 41.0% | 36.1% |

| 1973 | 133.4 | 29.9 | 53.5 | 50.0 | 22.4% | 40.1% | 37.5% |

| 1974 | 125.7 | 33.2 | 39.7 | 52.8 | 26.4% | 31.6% | 42.0% |

| 1975 | 138.9 | 33.0 | 54.3 | 51.6 | 23.8% | 39.1% | 37.1% |

| 1976 | 174.3 | 39.0 | 70.0 | 65.3 | 22.4% | 40.2% | 37.5% |

| 1977 | 205.8 | 44.8 | 86.6 | 74.4 | 21.8% | 42.1% | 36.2% |

| 1978 | 238.6 | 50.8 | 102.9 | 84.9 | 21.3% | 43.1% | 35.6% |

| 1979 | 249.0 | 57.5 | 101.4 | 90.0 | 23.1% | 40.7% | 36.1% |

| 1980 | 223.6 | 64.1 | 72.3 | 87.2 | 28.7% | 32.3% | 39.0% |

| 1981 | 247.5 | 73.8 | 89.4 | 84.3 | 29.8% | 36.1% | 34.1% |

| 1982 | 229.9 | 77.7 | 85.6 | 66.5 | 33.8% | 37.2% | 28.9% |

| 1983 | 279.8 | 83.5 | 115.7 | 80.6 | 29.8% | 41.4% | 28.8% |

| 1984 | 337.9 | 90.8 | 149.5 | 97.5 | 26.9% | 44.2% | 28.9% |

| 1985 | 354.5 | 97.5 | 157.5 | 99.4 | 27.5% | 44.4% | 28.0% |

| 1986 | 324.4 | 106.2 | 108.5 | 109.7 | 32.7% | 33.4% | 33.8% |

| 1987 | 366.0 | 112.3 | 123.2 | 130.4 | 30.7% | 33.7% | 35.6% |

| 1988 | 414.9 | 129.9 | 143.3 | 141.6 | 31.3% | 34.5% | 34.1% |

| 1989 | 414.2 | 158.0 | 110.2 | 146.1 | 38.1% | 26.6% | 35.3% |

| 1990 | 417.2 | 169.1 | 102.7 | 145.4 | 40.5% | 24.6% | 34.9% |

| 1991 | 451.3 | 180.5 | 132.2 | 138.6 | 40.0% | 29.3% | 30.7% |

| 1992 | 475.3 | 189.5 | 137.1 | 148.7 | 39.9% | 28.8% | 31.3% |

| 1993 | 522.0 | 205.3 | 145.6 | 171.0 | 39.3% | 27.9% | 32.8% |

| 1994 | 621.9 | 236.0 | 192.8 | 193.1 | 37.9% | 31.0% | 31.1% |

| 1995 | 703.0 | 259.0 | 226.2 | 217.8 | 36.8% | 32.2% | 31.0% |

| 1996 | 786.1 | 303.5 | 251.1 | 231.5 | 38.6% | 31.9% | 29.4% |

| 1997 | 865.8 | 339.5 | 280.9 | 245.4 | 39.2% | 32.4% | 28.3% |

| 1998 | 804.1 | 357.1 | 198.7 | 248.4 | 44.4% | 24.7% | 30.9% |

| 1999 | 830.2 | 347.9 | 223.5 | 258.8 | 41.9% | 26.9% | 31.2% |

| 2000 | 781.2 | 384.7 | 131.4 | 265.1 | 49.2% | 16.8% | 33.9% |

| 2001 | 754.0 | 370.6 | 180.2 | 203.3 | 49.2% | 23.9% | 27.0% |

| 2002 | 907.2 | 400.2 | 314.7 | 192.3 | 44.1% | 34.7% | 21.2% |

| 2003 | 1,056.4 | 434.0 | 378.6 | 243.8 | 41.1% | 35.8% | 23.1% |

| 2004 | 1,283.3 | 564.1 | 413.2 | 306.1 | 44.0% | 32.2% | 23.9% |

| 2005 | 1,477.7 | 580.5 | 484.8 | 412.4 | 39.3% | 32.8% | 27.9% |

| 2006 | 1,646.5 | 726.0 | 447.1 | 473.4 | 44.1% | 27.2% | 28.8% |

| 2007 | 1,529.0 | 818.9 | 264.6 | 445.5 | 53.6% | 17.3% | 29.1% |

| 2008 | 1,285.1 | 808.6 | 167.3 | 309.1 | 62.9% | 13.0% | 24.1% |

| 2009 | 1,392.6 | 568.7 | 554.4 | 269.4 | 40.8% | 39.8% | 19.3% |

| 2010 | 1,740.6 | 563.9 | 806.0 | 370.6 | 32.4% | 46.3% | 21.3% |

| 2011 | 1,877.7 | 701.6 | 801.9 | 374.2 | 37.4% | 42.7% | 19.9% |

| 2012 | 2,009.5 | 770.3 | 804.3 | 434.8 | 38.3% | 40.0% | 21.6% |

| Average annual change rate | 6.71% | 7.62% | 6.81% | 5.72% | 0.85% | 0.09% | -0.94% |

| ¹ Payments in cash or other assets, excluding the corporation's own stock, made by corporations to stockholders, after eliminating double counting. ² The portion of corporate profits that remains after taxes and dividends have been paid. Undistributed profits feed the corporation's reserves for ulterior self-financing. ³ Income that arises from current production, measured before income taxes. | |||||||

Sources: see BEA - US Bureau of Economic Analysis