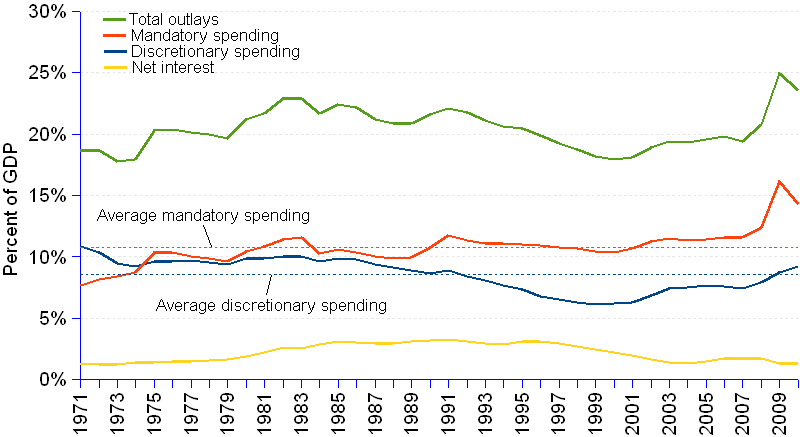

The US fiscal situation is cause for concern. During the 39-year period covered here, federal outlays grew somewhat faster – 0.6% per year – than GDP. However, since about year 2000, federal spending, after having regularly decreased from 1991 to 2000, gained speed until 2008 – with occasional slowdowns in 2004 and 2007 – and ran away after the 2008 crisis. The growth differential between GDP and federal outlays, the latter growing on average 2.8% per year faster than GDP, simply means that the economy growth has been unable to offset the spending growth. Such an unbalanced financial situation may develop many worrisome consequences.

Discretionary spending has fallen relative to mandatory spending from 10.9% of GDP in 1971 to 9.2% in 2010, accounting on average for 8.5% of GDP. Defense expenditures used to dominate domestic discretionary spending but have trended downwards since the height of the Vietnam war in the late 1960s, and now account for a relatively smaller share of federal spending. Even with recent increases in defense spending due to the global war on terrorism (GWOT), more specifically the costly Iraq and Afghanistan wars, defense spending, which accounted for 7% of GDP in 1971, took up a share of 4.7% of the economy in 2010.

Domestic discretionary spending, the other major component of the discretionary spending category, rose in the mid-1970s, partly due to expansion of social spending and partly because of the severity of the 1974-1975 recession. In the wake of the 2008 financial and economic downturn, it again trended upwards as a result of high spending levels related to "automatic stabilizer" programs, like unemployment compensation and the supplemental nutrition assistance program (SNAP) commonly known as the food stamp program, and subsequent policy actions taken by the federal government to address the recession.

Mandatory spending, excluding offsetting receipts, took a higher share of GDP, going from 7.7% of GDP in 1971 to 14.3% in 2010, accounting on average for 10.8% of GDP. The Medicare Act of 1965 extended health benefits for most retirees and greatly expanded federal financial support for indigent health care through the Medicaid program. Other programs, such as supplemental security income (SSI) and the earned income tax credit (EITC) introduced in the 1970s, also increased the number of beneficiaries. As the average age of population rose and as life expectancy has increased simultaneously, the number of beneficiaries of Social Security and Medicare has grown in proportion thus causing spending to increase.

The growth of mandatory spending is also due to the fact that health care spending has grown far faster than the overall economy, all attempts to control health costs having only produced temporary or modest results. During the last decade, the yearly growth of mandatory spending has nevertheless been the lowest amongst all budget categories (3.2%),largely overtaken by discretionary spending (4.0%) and especially defense (4.7%).

The 2009 spike of mandatory spending's share of 16.2% of GDP is explained by the enactment of powers given to the federal government to rescue the economy by providing unlimited funds if necessary to help Fannie Mae and Freddie Mac to remain solvent, or to purchase troubled assets, assist domestic automakers and provide other assistance to financial institutions.

Net interest spending achieved its highest values in the 1980s, and took a downward trend in the years 2000, never to go beyond its average share of 2.2% of GDP. In spite of a rising government debt, the amount of interest spending could be kept on check thanks to the low interest rates that dominate this period.

Outlays by Major Categories of Spending | ||||||

Year |

GDP(Billion constant US$, 2005=100) |

Discretionary spending ¹(%) |

Mandatory spending ²(%) |

Net interest(%) |

Total outlays(%) |

|

| Total | of which Defense | |||||

| 2010 | 13,248.3 | 9.2% | 4.7% | 14.3% | 1.3% | 23.6% |

| 2009 | 12,880.5 | 8.8% | 4.7% | 16.2% | 1.3% | 24.9% |

| 2008 | 13,228.9 | 7.9% | 4.3% | 12.4% | 1.8% | 20.8% |

| 2007 | 13,228.9 | 7.4% | 3.9% | 11.6% | 1.7% | 19.4% |

| 2006 | 12,976.3 | 7.6% | 3.9% | 11.6% | 1.7% | 19.8% |

| 2005 | 12,638.4 | 7.7% | 3.9% | 11.5% | 1.5% | 19.6% |

| 2004 | 12,263.9 | 7.5% | 3.8% | 11.4% | 1.3% | 19.3% |

| 2003 | 11,840.7 | 7.4% | 3.6% | 11.5% | 1.4% | 19.4% |

| 2002 | 11,552.9 | 6.9% | 3.3% | 11.2% | 1.6% | 18.9% |

| 2001 | 11,347.2 | 6.3% | 3.0% | 10.7% | 2.0% | 18.1% |

| 2000 | 11,226.0 | 6.2% | 3.0% | 10.4% | 2.2% | 18.0% |

| 1999 | 10,779.9 | 6.1% | 2.9% | 10.5% | 2.5% | 18.2% |

| 1998 | 10,283.5 | 6.3% | 3.1% | 10.7% | 2.7% | 18.8% |

| 1997 | 9,854.4 | 6.6% | 3.3% | 10.8% | 2.9% | 19.2% |

| 1996 | 9,434.0 | 6.8% | 3.4% | 10.9% | 3.1% | 19.9% |

| 1995 | 9,093.8 | 7.3% | 3.7% | 11.0% | 3.1% | 20.4% |

| 1994 | 8,870.7 | 7.6% | 4.0% | 11.1% | 2.9% | 20.6% |

| 1993 | 8,523.5 | 8.1% | 4.4% | 11.1% | 3.0% | 21.1% |

| 1992 | 8,287.0 | 8.4% | 4.8% | 11.3% | 3.1% | 21.8% |

| 1991 | 8,015.1 | 8.9% | 5.3% | 11.7% | 3.2% | 22.1% |

| 1990 | 8,033.8 | 8.6% | 5.2% | 10.8% | 3.2% | 21.6% |

| 1989 | 7,885.9 | 8.9% | 5.5% | 10.0% | 3.1% | 20.9% |

| 1988 | 7,613.9 | 9.1% | 5.7% | 9.9% | 3.0% | 20.9% |

| 1987 | 7,313.3 | 9.4% | 6.0% | 10.0% | 2.9% | 21.2% |

| 1986 | 7,086.6 | 9.8% | 6.1% | 10.4% | 3.0% | 22.2% |

| 1985 | 6,849.3 | 9.9% | 6.0% | 10.6% | 3.1% | 22.4% |

| 1984 | 6,577.2 | 9.7% | 5.8% | 10.3% | 2.8% | 21.7% |

| 1983 | 6,136.1 | 10.0% | 5.9% | 11.6% | 2.5% | 22.9% |

| 1982 | 5,870.9 | 10.0% | 5.7% | 11.4% | 2.6% | 22.9% |

| 1981 | 5,987.2 | 9.8% | 5.1% | 10.9% | 2.2% | 21.7% |

| 1980 | 5,838.8 | 9.9% | 4.8% | 10.4% | 1.9% | 21.2% |

| 1979 | 5,855.0 | 9.4% | 4.6% | 9.6% | 1.7% | 19.7% |

| 1978 | 5,677.7 | 9.5% | 4.6% | 9.9% | 1.5% | 20.0% |

| 1977 | 5,377.6 | 9.7% | 4.8% | 10.0% | 1.5% | 20.2% |

| 1976 | 5,141.3 | 9.6% | 4.9% | 10.4% | 1.5% | 20.4% |

| 1975 | 4,879.5 | 9.6% | 5.3% | 10.3% | 1.4% | 20.3% |

| 1974 | 4,890.1 | 9.2% | 5.4% | 8.7% | 1.4% | 18.0% |

| 1973 | 4,917.1 | 9.4% | 5.6% | 8.4% | 1.3% | 17.8% |

| 1972 | 4,647.8 | 10.4% | 6.4% | 8.1% | 1.3% | 18.6% |

| 1971 | 4,413.1 | 10.9% | 7.0% | 7.7% | 1.3% | 18.7% |

| Annual change rate 1971-2010 | 2.9% | -0.4% | -1.0% | 1.6% | 0.1% | 0.6% |

| Annual change rate 2000-2010 | 1.7% | 4.0% | 4.7% | 3.2% | -5.1% | 2.8% |

| Average 1971-2010 | 8.5% | 4.7% | 10.8% | 2.2% | 20.4% | |

| ¹ Discretionary spending is controlled by annual congressional appropriations acts. | ||||||

| ² Mandatory spending encompasses spending on entitlement programs and spending controlled by laws other than annual appropriation acts. Entitlement programs such as Social Security, Medicare, and Medicaid make up the bulk of mandatory spending. Offsetting receipts are excluded here. | ||||||

Sources: US Congressional Budget Office, Bureau of Economic Analysis.