The Maastricht convergence criteria demand Euro zone members to keep government debt under 60% of GDP. By the end of 2010, PIIGS were well above the benchmark (ECB Fiscal Dashboard) :

This huge public debt comprises loans by domestic and foreign creditors. Although high debt entails serious issues irrespective of the nationality of the creditors, the portion of debt borrowed from non-residents — commercial banks, governments or financial institutions — poses a particular problem. While domestic loans may be paid in local currency to resident creditors upon whom the government holds strong bargaining power, external debt, including interests, must be paid in the currency in which the loan was made to creditors capable of harsh financial retaliation in case of non-compliance.

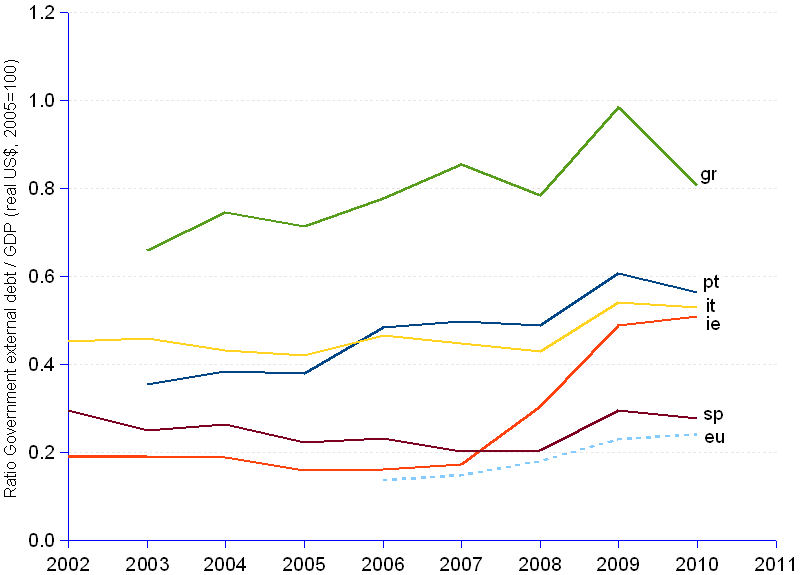

A big chunk of PIIGS public debt is owed to non-resident creditors. As shown in the chart, this portion is above or close to the Maastricht mark in several countries of the PIIGS area. The long term trend of the external public debt follows an upward path, with annual average growth rates going from 5% to 19% (doubling time of 14 to 4 years), generally higher than GDP growth rates.

A debt crisis occurs when a country with a weak economy is unable to produce and sell goods and generate a flow of profitable returns strong enough to repay external debt. The International Monetary Fund (IMF) is one of the agencies that keep track of the country's external debt and drive the recovery process in coordination, in the case of PIIGS, with the European Central Bank (ECB) and the EU Commission. The debt crisis stroke in sequence Greece (23 Apr 2009), Ireland (21 Nov 2010) and Portugal (6 Apr 2011), after they had employed a number of subterfuges to turn around Maastricht rules, hide the real situation of their national accounts, and escape the consequences of their finances mismanagement. Unfortunately, since 2009, in an environment of widespread GDP stagnation and correlated poor export performance, government external debt pursues its rise in Portugal, Ireland and Spain, and keeps at high levels in Greece and Italy, sending an advance warning of an increasingly severe situation to come.

Most of the external government debt consists of the so-called "sovereign debt", in other words bonds issued by the national government in Euros or a foreign currency, in order to finance the issuing country's economy. To repay this debt, governments count on a flow of government revenue fed by taxes on a growing GDP and a positive trade balance. However, the misuse of funds in wrongly selected projects, such as the financing of onerous military expenditure in Greece, or in contributions "à fonds perdu" or at non-economic conditions to rescue failing financial and non-financial industries, as it is the case in Ireland, Portugal and Spain, or to finance projects whose payback is complacently valuated, can impair exports and weaken GDP. The hoped for fiscal revenue will abort, making it difficult to repay sovereign debt. Such a risk translates into higher interest rates and credit freezing, further worsening the debtor's situation.

A default happens when the borrower government fails to pay interest or principal on schedule, whether because it is unable or unwilling to do so. In face of the debtor's default, the only recourse for the lender, unable to seize the government's assets, is to renegotiate the terms of the loan. A country that defaults on its sovereign debt will have difficulty obtaining a loan in the future, a serious threat to a modern and open economy. The rescue plans requested by Greece, Ireland and Portugal and imposed on them by the IMF, ECB and EU are aimed at preventing these countries from defaulting.

Notwithstanding the positive words and wishful thinking of the overseers and monitors delegated by IMF & partners, the outlook for PIIGS does not justify much optimism. Short of a strong turnaround of the world economy inducing a booming demand for exports from these countries, it seems technically unfeasible to overcome their debt situation by applying the range of financial disciplinary measures that seem more adept to cripple the economy and kill the patient while claiming to cure the illness.

Ratio of Government External Debt to GDP (gross domestic product) | ||||||||||||||||||

Year¹ |

Portugal |

Ireland |

Italy |

Greece |

Spain |

Euro area |

||||||||||||

| Govt external debt ² | GDP ² | Gvt ext debt/ |

Govt external debt ² | GDP ² | Gvt ext debt/ |

Govt external debt ² | GDP ² | Gvt ext debt/ |

Govt external debt ² | GDP ² | Gvt ext debt/ |

Govt external debt ² | GDP ² | Gvt ext debt/ |

Govt external debt ² | GDP ² | Gvt ext debt/ |

|

| 2002 | 143 | 25 | 133 | 0.19 | 598 | 1,323 | 0.45 | 159 | 220 | 745 | 0.30 | 7,491 | ||||||

| 2003 | 61 | 172 | 0.35 | 32 | 168 | 0.19 | 734 | 1,602 | 0.46 | 135 | 205 | 0.66 | 235 | 939 | 0.25 | 9,054 | ||

| 2004 | 73 | 191 | 0.38 | 36 | 192 | 0.19 | 769 | 1,786 | 0.43 | 176 | 236 | 0.75 | 285 | 1,079 | 0.26 | 10,088 | ||

| 2005 | 72 | 191 | 0.38 | 32 | 202 | 0.16 | 745 | 1,778 | 0.42 | 171 | 240 | 0.71 | 252 | 1,130 | 0.22 | 10,132 | ||

| 2006 | 94 | 195 | 0.48 | 35 | 215 | 0.16 | 841 | 1,805 | 0.47 | 197 | 254 | 0.78 | 275 | 1,196 | 0.23 | 1,419 | 10,406 | 0.14 |

| 2007 | 108 | 218 | 0.50 | 42 | 244 | 0.17 | 891 | 1,991 | 0.45 | 245 | 287 | 0.86 | 274 | 1,357 | 0.20 | 1,711 | 11,625 | 0.15 |

| 2008 | 113 | 232 | 0.49 | 74 | 243 | 0.30 | 908 | 2,114 | 0.43 | 246 | 314 | 0.78 | 300 | 1,467 | 0.20 | 2,238 | 12,461 | 0.18 |

| 2009 | 130 | 214 | 0.61 | 99 | 202 | 0.49 | 1,039 | 1,926 | 0.54 | 289 | 294 | 0.98 | 394 | 1,336 | 0.29 | 2,597 | 11,316 | 0.23 |

| 2010 | 116 | 207 | 0.56 | 97 | 191 | 0.51 | 980 | 1,854 | 0.53 | 220 | 272 | 0.81 | 351 | 1,272 | 0.28 | 2,641 | 10,976 | 0.24 |

| 2011 | 122 | 124 | 907 | 213 | 357 | 2,959 | ||||||||||||

| Avge annual change rate | 9.1% | 4.7% | 6.8% | 19.4% | 4.6% | 13.2% | 4.8% | 4.3% | 2.0% | 5.9% | 7.0% | 3.0% | 5.5% | 6.9% | -0.8% | 15.8% | 4.9% | 15.2% |

| ¹ All years show 4th Quarter values, except 2011 that is 3rd Quarter. | ||||||||||||||||||

| ² Billion real US$, 2005=100. | ||||||||||||||||||

Sources: JEDH for external debt, and World DataBank for GDP estimates.