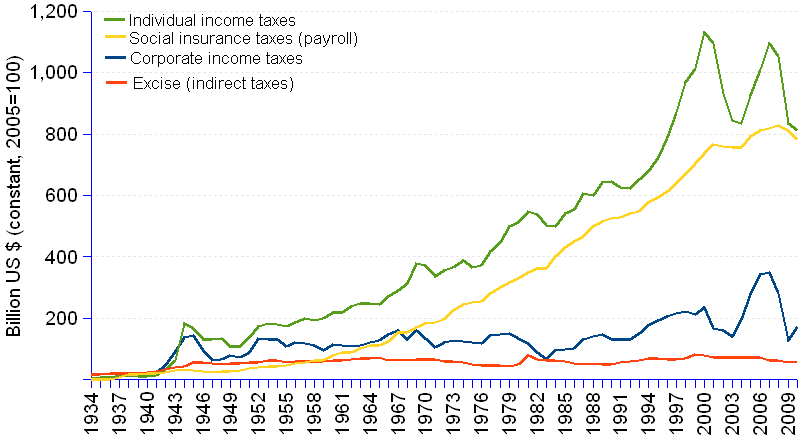

The tax burden of the US individual taxpayers grew twice as fast in constant dollars (2005=100) as the economy from 1934 to 2010. The total individual taxes, that is the sum of both income taxes and payroll taxes grew from $5.4 billion in 1934 to $1,593.5 billion in 2010, at an awesome annual rate of 7.77%, exactly 2.06 times higher than the 3.77% average annual growth rate of US GDP.

Currently, individual taxes account for a 12% share of GDP. They shrink corporation income taxes to lilliputian size. In spite of the strong economy growth over the period, corporate taxes stayed low, accounting in 2010 to a mere 1.31% share of GDP, or less than a tenth the size of individual taxes.

Tax revenues from individuals, which represented 15% of federal receipts in 1934, are currently the primary source of federal receipts, accounting for a share of 81.6% of the latter, while corporate taxes amount to only 8.85% of total receipts. This raises a couple of big issues.

Income and payroll tax revenues are highly vulnerable to the economic climate. A cycle of stagnation or recession will dramatically put a ceiling on the amount of revenues that the federal government can pump from those sources. This has been happening since 2008, and is likely to remain the case for some time.

Furthermore, encumbered with a large debt almost the size of GDP, and with a series of growing budget deficits, the federal government needs to increase receipts, but will hardly be capable of finding workable alternatives to tax increases. The crux is to evaluate how bigger a share of the economy can be taken from taxpayers who already give away a sizable chunk of 12% of GDP?

The USA do not only have a monetary, or a trade deficit, or a weak production problem to address – the fiscal problem is asserting itself as a very tough one to solve.

US federal total receipts, 1934-2010 | ||||||

Year |

Individual Income Taxes |

Social Insurance and Retirement Receipts (Payroll taxes) |

Corporation Income Taxes |

Excise Taxes ¹ |

Other ² |

Total Receipts |

| 2010 | 812.0 | 781.5 | 173.0 | 60.5 | 103.7 | 1,953.5 |

| 2009 | 835.0 | 812.8 | 126.1 | 57.0 | 69.0 | 1,920.4 |

| 2008 | 1,054.8 | 828.8 | 280.2 | 62.0 | 72.5 | 2,323.7 |

| 2007 | 1,094.6 | 818.1 | 348.3 | 61.2 | 69.1 | 2,415.9 |

| 2006 | 1,011.0 | 811.4 | 342.7 | 71.7 | 70.2 | 2,331.0 |

| 2005 | 927.2 | 794.1 | 278.3 | 73.1 | 57.5 | 2,153.6 |

| 2004 | 836.0 | 757.9 | 195.7 | 72.2 | 144.3 | 1,942.9 |

| 2003 | 843.5 | 757.7 | 140.0 | 71.8 | 81.2 | 1,894.1 |

| 2002 | 931.8 | 760.7 | 160.7 | 72.7 | 85.8 | 2,011.7 |

| 2001 | 1,096.9 | 765.5 | 166.7 | 73.1 | 94.4 | 2,196.6 |

| 2000 | 1,133.1 | 736.5 | 233.8 | 77.7 | 103.5 | 2,284.6 |

| 1999 | 1,013.6 | 705.1 | 212.8 | 81.2 | 93.4 | 2,106.1 |

| 1998 | 969.0 | 668.7 | 220.6 | 67.4 | 87.7 | 2,013.5 |

| 1997 | 872.2 | 637.9 | 215.6 | 67.3 | 74.8 | 1,867.8 |

| 1996 | 790.0 | 613.1 | 206.8 | 65.0 | 73.9 | 1,748.8 |

| 1995 | 723.9 | 594.2 | 192.6 | 70.5 | 76.8 | 1,658.0 |

| 1994 | 679.9 | 577.8 | 175.8 | 69.1 | 73.2 | 1,575.8 |

| 1993 | 651.6 | 547.5 | 150.2 | 61.4 | 65.0 | 1,475.8 |

| 1992 | 621.9 | 540.5 | 131.0 | 59.5 | 72.9 | 1,425.9 |

| 1991 | 625.8 | 529.7 | 131.2 | 56.7 | 67.8 | 1,411.2 |

| 1990 | 646.6 | 526.4 | 129.5 | 49.0 | 77.8 | 1,429.3 |

| 1989 | 641.1 | 517.0 | 148.6 | 49.5 | 69.6 | 1,425.8 |

| 1988 | 598.9 | 499.1 | 141.1 | 52.6 | 65.8 | 1,357.4 |

| 1987 | 606.1 | 468.3 | 129.6 | 50.1 | 65.0 | 1,319.2 |

| 1986 | 554.5 | 451.1 | 100.3 | 52.3 | 64.0 | 1,222.2 |

| 1985 | 543.3 | 430.6 | 99.6 | 58.5 | 60.2 | 1,192.2 |

| 1984 | 499.3 | 400.5 | 95.2 | 62.5 | 57.6 | 1,115.2 |

| 1983 | 501.6 | 362.8 | 64.3 | 61.3 | 52.6 | 1,042.6 |

| 1982 | 537.3 | 363.6 | 88.8 | 65.5 | 59.6 | 1,114.9 |

| 1981 | 547.5 | 349.9 | 117.1 | 78.2 | 54.9 | 1,147.5 |

| 1980 | 511.1 | 330.5 | 135.3 | 50.9 | 55.1 | 1,082.9 |

| 1979 | 497.8 | 317.5 | 150.1 | 42.8 | 50.5 | 1,058.7 |

| 1978 | 448.0 | 299.4 | 148.4 | 45.5 | 47.7 | 989.0 |

| 1977 | 417.5 | 282.1 | 145.4 | 46.5 | 50.4 | 941.9 |

| 1976 | 370.8 | 255.8 | 116.7 | 47.8 | 48.8 | 839.9 |

| 1975 | 364.6 | 251.9 | 121.0 | 49.3 | 44.7 | 831.5 |

| 1974 | 387.9 | 244.8 | 125.9 | 54.9 | 44.8 | 858.4 |

| 1973 | 367.3 | 224.5 | 128.6 | 57.8 | 42.8 | 821.0 |

| 1972 | 355.7 | 197.4 | 120.8 | 58.1 | 46.4 | 778.4 |

| 1971 | 337.7 | 185.3 | 104.9 | 65.1 | 39.9 | 732.9 |

| 1970 | 371.8 | 182.4 | 135.0 | 64.6 | 39.1 | 792.9 |

| 1969 | 377.7 | 168.9 | 158.8 | 65.9 | 37.7 | 809.0 |

| 1968 | 312.2 | 154.1 | 130.2 | 64.0 | 34.4 | 695.0 |

| 1967 | 291.4 | 154.5 | 160.9 | 65.0 | 33.1 | 704.8 |

| 1966 | 270.7 | 124.7 | 146.8 | 63.8 | 32.7 | 638.7 |

| 1965 | 245.0 | 111.7 | 127.8 | 73.1 | 28.9 | 586.5 |

| 1964 | 248.9 | 112.3 | 120.1 | 70.2 | 24.2 | 575.6 |

| 1963 | 247.0 | 102.8 | 112.0 | 68.5 | 22.8 | 553.1 |

| 1962 | 239.1 | 89.4 | 107.7 | 65.8 | 21.0 | 522.9 |

| 1961 | 219.8 | 87.4 | 111.4 | 63.1 | 20.2 | 501.9 |

| 1960 | 218.9 | 79.0 | 115.6 | 62.8 | 21.1 | 497.4 |

| 1959 | 200.2 | 63.9 | 94.4 | 57.7 | 15.9 | 432.1 |

| 1958 | 191.6 | 62.0 | 110.8 | 58.7 | 16.3 | 439.4 |

| 1957 | 200.9 | 56.4 | 119.4 | 59.4 | 15.1 | 451.3 |

| 1956 | 187.6 | 54.3 | 121.7 | 57.9 | 13.2 | 434.8 |

| 1955 | 173.3 | 47.4 | 107.7 | 55.0 | 11.2 | 394.6 |

| 1954 | 181.2 | 44.2 | 129.4 | 61.0 | 11.7 | 427.4 |

| 1953 | 184.5 | 42.2 | 131.4 | 61.1 | 11.5 | 430.7 |

| 1952 | 174.9 | 40.4 | 132.9 | 55.4 | 10.7 | 414.4 |

| 1951 | 137.7 | 36.1 | 89.8 | 55.1 | 10.1 | 328.8 |

| 1950 | 107.6 | 29.6 | 71.4 | 51.6 | 9.2 | 269.3 |

| 1949 | 107.4 | 26.1 | 77.3 | 51.8 | 9.6 | 272.1 |

| 1948 | 133.1 | 25.8 | 66.7 | 50.7 | 10.1 | 286.3 |

| 1947 | 130.5 | 24.9 | 62.7 | 52.5 | 9.7 | 280.2 |

| 1946 | 129.8 | 25.1 | 95.8 | 56.4 | 9.7 | 316.9 |

| 1945 | 165.8 | 31.1 | 144.2 | 56.5 | 9.8 | 407.4 |

| 1944 | 182.5 | 32.2 | 137.4 | 44.1 | 9.0 | 405.1 |

| 1943 | 61.7 | 28.9 | 90.6 | 38.8 | 7.6 | 227.6 |

| 1942 | 32.6 | 24.5 | 47.2 | 34.0 | 8.0 | 146.3 |

| 1941 | 14.2 | 20.9 | 22.9 | 27.5 | 8.4 | 93.9 |

| 1940 | 10.3 | 20.5 | 13.8 | 22.7 | 8.0 | 75.3 |

| 1939 | 12.0 | 18.5 | 13.1 | 21.8 | 7.9 | 73.3 |

| 1938 | 14.8 | 17.8 | 14.8 | 21.5 | 8.9 | 77.8 |

| 1937 | 12.2 | 6.5 | 11.6 | 21.0 | 9.0 | 60.3 |

| 1936 | 7.9 | 0.6 | 8.4 | 19.0 | 9.9 | 45.8 |

| 1935 | 6.2 | 0.4 | 6.2 | 17.0 | 12.8 | 42.6 |

| 1934 | 5.1 | 0.4 | 4.4 | 16.3 | 9.5 | 35.6 |

| Annual average chage rate | 6.93% | 10.48% | 5.08% | 1.75% | 3.19% | 5.41% |

| ¹ Excise taxes are indirect taxes such as taxes on alcohol, tobacco, fuels, telephone, and include highway, airport, hazardous substances and other trust funds. | ||||||

| ² Other receipts include estate and gift taxes, customs duties and fees and miscellaneous receipts. | ||||||

Sources: US Government Printing Office, Bureau of Economic Analysis.