In the PIIGS (Portugal, Ireland, Italy, Greece, Spain) area, as in the rest of the world, babies are not asked whether they wish to be born — for good or for bad, they just happen by their parents' decree. Unfortunately, there is another parental legacy that they would gladly dispense with. This is the costly welcome gift endowed by PIIGS societies to all newly born children — and all other citizens for that matter —, that is an external debt worth, in constant US dollars (2005=100), $35 thousand in Italy and up to $436 thousand in Ireland.

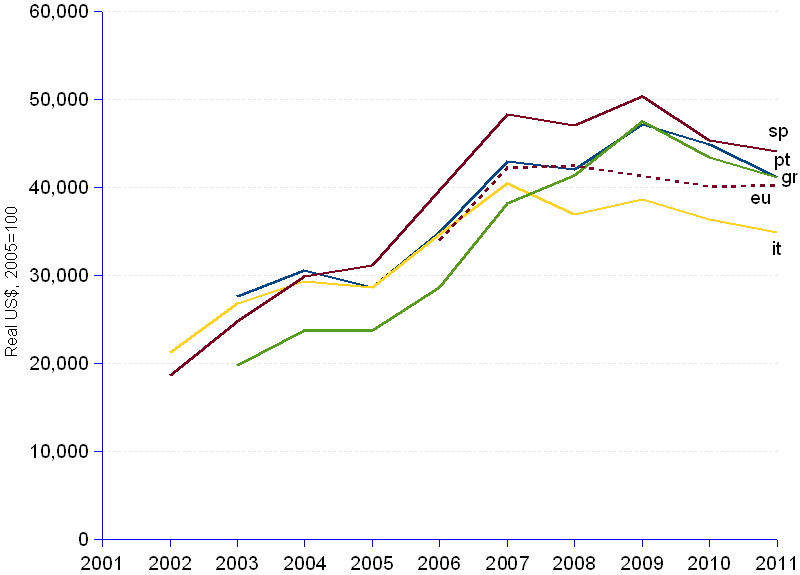

The chart shows how the Gross external debt per capita evolved from 2002 to 2011 for each country, except Ireland which simply is out of scale, and for the Euro zone as a comparison baseline. The record is not flattering. Euro zone debt per capita amounts to $40 thousand. Among the PIIGS, only Italy is below that ratio and, as already noted, Ireland's ratio is ten fold as high.

Trends are a cause for concern. External debt per capita increased at annual average rates of over 5% in Portugal and Italy (doubling time 13 years), around 10% in Greece and Spain (doubling time 7 years), and above 13% in Ireland (doubling time 5.5 years). Meanwhile, economic wealth as measured by GDP, also in real US dollars, lagged behind with average rates of between 4.3% (Italy) and 7% (Greece). In other words, indebtedness ran much faster than wealth.

The 2008 financial crisis and the resulting credit crunch substantially altered the situation, not for better, but for worse. Surely, one remarks an obvious dip of the debt per capita in all countries as from 2009. This might be good news if other factors, such as economic growth, employment, income per capita, social benefits or tax deductions remained the same. Alas, this is by no means the case. The financial crisis became an economic crisis too, entailing economic stagnation or outright recession, spreading unemployment, loss or freezing of income, and a paraphernalia of crisis-reinforcing austerity programs severely reducing state-redistributed social benefits on one hand, and dramatically increasing taxes and other mandatory contributions on the other hand.

What compounds the problem is that most of the debt is accounted for by the banking system and the government, on which common citizens have limited, if any controlling power. Prospects are gloomy : PIIGS newly born citizens will find it hard to bring down the problem to manageable proportions soon enough to be able to enjoy the good things of life.

Gross External Debt per capita | ||||||||||||||||||

Year¹ |

Portugal |

Ireland |

Italy |

Greece |

Spain |

Euro area |

||||||||||||

| Gross external debt | Population | External debt per capita |

Gross external debt | Population | External debt per capita |

Gross external debt | Population | External debt per capita |

Gross external debt | Population | External debt per capita |

Gross external debt | Population | External debt per capita |

Gross external debt | Population | External debt per capita |

|

| (Billion real US$)² | (Million) | (real US$)² | (Billion real US$)² | (Million) | (real US$)² | (Billion real US$)² | (Million) | (real US$²) | (Billion real US$²) | (Million) | (real US$²) | (Billion real US$)² | (Million) | (real US$)² | (Billion real US$)² | (Million) | (real US$)² | |

| 2002 | 10.4 | 552 | 3.9 | 140,272 | 1,213 | 57.2 | 21,214 | 11.0 | 769 | 41.3 | 18,605 | 318.2 | ||||||

| 2003 | 287 | 10.4 | 27,527 | 780 | 4.0 | 195,264 | 1,543 | 57.6 | 26,789 | 217 | 11.0 | 19,722 | 1,041 | 42.0 | 24,788 | 320.2 | ||

| 2004 | 321 | 10.5 | 30,565 | 1,087 | 4.1 | 267,125 | 1,703 | 58.2 | 29,272 | 262 | 11.1 | 23,662 | 1,277 | 42.7 | 29,902 | 322.3 | ||

| 2005 | 302 | 10.5 | 28,648 | 1,336 | 4.2 | 321,206 | 1,676 | 58.6 | 28,593 | 263 | 11.1 | 23,681 | 1,350 | 43.4 | 31,110 | 324.2 | ||

| 2006 | 369 | 10.6 | 34,903 | 1,708 | 4.3 | 400,793 | 2,042 | 58.9 | 34,637 | 319 | 11.1 | 28,648 | 1,748 | 44.1 | 39,616 | 11,081 | 326.0 | 33,995 |

| 2007 | 455 | 10.6 | 42,915 | 2,133 | 4.4 | 489,586 | 2,398 | 59.4 | 40,392 | 427 | 11.2 | 38,176 | 2,166 | 44.9 | 48,255 | 13,837 | 327.8 | 42,209 |

| 2008 | 446 | 10.6 | 42,010 | 2,169 | 4.4 | 490,030 | 2,205 | 59.8 | 36,857 | 465 | 11.2 | 41,343 | 2,142 | 45.6 | 47,026 | 13,984 | 329.5 | 42,438 |

| 2009 | 501 | 10.6 | 47,118 | 2,176 | 4.5 | 487,907 | 2,327 | 60.2 | 38,665 | 536 | 11.3 | 47,508 | 2,309 | 45.9 | 50,297 | 13,657 | 330.8 | 41,290 |

| 2010 | 478 | 10.6 | 44,885 | 2,082 | 4.5 | 464,504 | 2,201 | 60.5 | 36,386 | 491 | 11.3 | 43,410 | 2,087 | 46.1 | 45,288 | 13,303 | 331.7 | 40,108 |

| 2011 | 461 | 11.2 | 41,132 | 2,031 | 4.7 | 436,232 | 2,244 | 64.5 | 34,823 | 492 | 12.0 | 41,110 | 2,153 | 48.8 | 44,089 | 14,003 | 348.5 | 40,176 |

| Average annual change rate | 6.1% | 5.1% | 15.6% | 13.4% | 7.1% | 5.7% | 10.7% | 9.6% | 12.1% | 10.1% | 4.8% | 3.4% | ||||||

| ¹ All years show 4th Quarter values, except 2011 that is 3rd Quarter. | ||||||||||||||||||

| ² Constant US dollars, 2005=100. | ||||||||||||||||||

Sources: JEDH for external debt, and United Nations Population Division for population estimates.