To assess the options underlying the government budget one needs more than the receipts and spending dollar values – a meaningful comparison term is required. For this purpose, one can use the total economic output of the nation, which gross domestic product (GDP) is expected to measure.

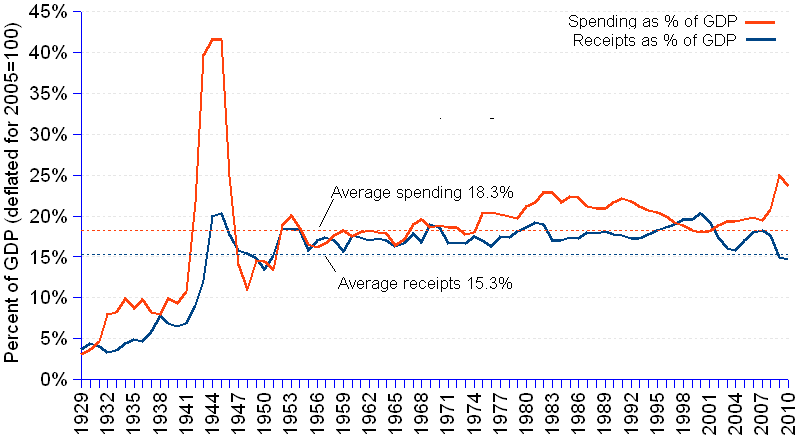

From 1929 to 2010, US GDP grew significantly at an annual average rate of 3.27%. However, government took an increasing share of the economy away from the private economic agents in the form of tax revenues and other receipts. In 1929, total government receipts accounted for a small 3.73% share of GDP, but they increased to a share of 14.75% of GDP in 2010, at an annual average growth rate of 5.04% (doubling time 14 years). Over the 82-year period, the average share of GDP taken by government receipts amounts to 15.3%.

Considering that by definition GDP equals private consumption plus private savings plus tax payments, any tax increase implies necessarily a commensurate decrease of consumption, or savings, or both.

In a context of low level of unemployment and little unused production capacity, a constraint on private consumption is like putting the brakes on the economy. Less consumption induces less output, which increases unused capacity and reduces employment levels, causing a downward trend of tax revenues and a likely increase of spending in social relief benefits. The latter couple of effects are patently portrayed in the chart for the last few years, widening the gap between the red and the blue lines.

Should the constraint apply mainly on savings, there would be less capital available for investment, thus jeopardizing the future performance of the economy, in other terms, just postponing the evils mentioned in the preceding paragraph. In short, one ahould wish that government receipts do not grow in the long run at a rate higher than the growth rate of GDP.

On the government spending side, growth occurs must faster than with receipts and with GDP. In 1929, spending accounted for a mere 3.02% share of GDP, whereas this share swelled to 23.57% in 2010, at an annual rate of 5.93% (doubling time 12 years, 2 years less than receipts). Unsurprisingly, spending has a period average of 18.26% of GDP, about 3 percentage points higher than receipts.

If, over such a long period, average spending is considerably higher than average receipts, one may conclude that budget deficit is the rule. That is precisely what the chart says : the red line of spending tends to unfold regularly above the blue line of receipts, the area between the two representing the budget deficit as a percentage of GDP.

High spending levels may have both positive and negative consequences. If used to stimulate consumption (e.g. tax refunds or other tax expenditures aimed at supporting the consumers' purchasing power) or investment (e.g. public investment, or financial incentives to private investment), government spending may produce a "multiplier effect" that benefits the economy over a period of a few years.

If used in unproductive activities, such as financing of warfare, it just increases the burden carried by taxpayers without any obvious benefit for the economy at large. In the case of the US, notwithstanding the costly defense spending with the wars in Iraq, Afghanistan and elsewhere, the current heavier items on the spending side are the entitlement programs of social security, Medicare and the federal share of Medicaid, estimated to account for a share of GDP above 10%. The US aging population, combined with the rising health cost per patient seem likely to push these expenditures upwards and keep spending under a heavy upwards strain.

Under "normal" inflation, continued deficits add up to the government debt year after year. Since the debt cannot grow faster than GDP forever, and considering that the US is unable to follow Germany's example in achieving a trade surplus – instead it showed a current account deficit of US$ -481.2 billion in 2010 –, large budget deficits must eventually be reduced through increases in taxes, or reductions in spending, or both.

Federal receipts and spending as a percentage of GDP | |||||

Year |

GDP(billion real US$) ¹ |

Receipts |

Spending |

||

| (billion real US$) ¹ | (% of GDP) | (billion real US$) ¹ | (% of GDP) | ||

| 2010 | 13,248.3 | 1,953.5 | 14.75% | 3,122.9 | 23.57% |

| 2009 | 12,880.5 | 1,920.4 | 14.91% | 3,209.1 | 24.91% |

| 2008 | 13,228.9 | 2,323.7 | 17.57% | 2,745.8 | 20.76% |

| 2007 | 13,228.9 | 2,415.9 | 18.26% | 2,567.1 | 19.41% |

| 2006 | 12,976.3 | 2,331.0 | 17.96% | 2,571.4 | 19.82% |

| 2005 | 12,638.4 | 2,153.6 | 17.04% | 2,472.0 | 19.56% |

| 2004 | 12,263.9 | 1,942.9 | 15.84% | 2,369.3 | 19.32% |

| 2003 | 11,840.7 | 1,894.0 | 16.00% | 2,295.3 | 19.39% |

| 2002 | 11,552.9 | 2,011.7 | 17.41% | 2,183.0 | 18.90% |

| 2001 | 11,347.2 | 2,196.5 | 19.36% | 2,054.9 | 18.11% |

| 2000 | 11,226.0 | 2,284.6 | 20.35% | 2,018.1 | 17.98% |

| 1999 | 10,779.9 | 2,106.1 | 19.54% | 1,961.4 | 18.20% |

| 1998 | 10,283.5 | 2,013.5 | 19.58% | 1,932.6 | 18.79% |

| 1997 | 9,854.4 | 1,867.8 | 18.95% | 1,893.7 | 19.22% |

| 1996 | 9,434.0 | 1,748.8 | 18.54% | 1,878.2 | 19.91% |

| 1995 | 9,093.8 | 1,658.0 | 18.23% | 1,859.1 | 20.44% |

| 1994 | 8,870.7 | 1,575.8 | 17.76% | 1,830.3 | 20.63% |

| 1993 | 8,523.5 | 1,475.8 | 17.31% | 1,801.9 | 21.14% |

| 1992 | 8,287.0 | 1,425.9 | 17.21% | 1,805.3 | 21.78% |

| 1991 | 8,015.1 | 1,411.2 | 17.61% | 1,771.5 | 22.10% |

| 1990 | 8,033.8 | 1,429.3 | 17.79% | 1,735.7 | 21.60% |

| 1989 | 7,885.9 | 1,425.8 | 18.08% | 1,645.1 | 20.86% |

| 1988 | 7,613.9 | 1,357.4 | 17.83% | 1,589.0 | 20.87% |

| 1987 | 7,313.3 | 1,319.2 | 18.04% | 1,550.4 | 21.20% |

| 1986 | 7,086.6 | 1,222.2 | 17.25% | 1,573.7 | 22.21% |

| 1985 | 6,849.3 | 1,192.2 | 17.41% | 1,537.0 | 22.44% |

| 1984 | 6,577.2 | 1,115.2 | 16.96% | 1,425.3 | 21.67% |

| 1983 | 6,136.1 | 1,042.6 | 16.99% | 1,403.3 | 22.87% |

| 1982 | 5,870.9 | 1,114.9 | 18.99% | 1,345.8 | 22.92% |

| 1981 | 5,987.2 | 1,147.5 | 19.17% | 1,298.7 | 21.69% |

| 1980 | 5,838.8 | 1,082.9 | 18.55% | 1,237.5 | 21.20% |

| 1979 | 5,855.0 | 1,058.7 | 18.08% | 1,151.8 | 19.67% |

| 1978 | 5,677.7 | 989.0 | 17.42% | 1,135.5 | 20.00% |

| 1977 | 5,377.6 | 941.9 | 17.51% | 1,084.0 | 20.16% |

| 1976 | 5,141.3 | 839.9 | 16.34% | 1,047.6 | 20.38% |

| 1975 | 4,879.5 | 831.5 | 17.04% | 990.2 | 20.29% |

| 1974 | 4,890.1 | 858.4 | 17.55% | 878.4 | 17.96% |

| 1973 | 4,917.1 | 821.0 | 16.70% | 874.0 | 17.78% |

| 1972 | 4,647.8 | 778.4 | 16.75% | 866.1 | 18.63% |

| 1971 | 4,413.1 | 732.9 | 16.61% | 823.1 | 18.65% |

| 1970 | 4,269.9 | 792.9 | 18.57% | 804.6 | 18.84% |

| 1969 | 4,261.7 | 809.0 | 18.98% | 795.0 | 18.66% |

| 1968 | 4,133.2 | 695.0 | 16.81% | 809.3 | 19.58% |

| 1967 | 3,942.2 | 704.8 | 17.88% | 745.7 | 18.92% |

| 1966 | 3,845.4 | 638.7 | 16.61% | 656.8 | 17.08% |

| 1965 | 3,610.1 | 586.5 | 16.24% | 593.5 | 16.44% |

| 1964 | 3,392.1 | 575.6 | 16.97% | 605.9 | 17.86% |

| 1963 | 3,206.9 | 553.1 | 17.25% | 577.8 | 18.02% |

| 1962 | 3,072.6 | 522.9 | 17.02% | 560.4 | 18.24% |

| 1961 | 2,897.1 | 501.9 | 17.33% | 519.7 | 17.94% |

| 1960 | 2,830.7 | 497.4 | 17.57% | 495.8 | 17.51% |

| 1959 | 2,762.3 | 432.1 | 15.64% | 502.2 | 18.18% |

| 1958 | 2,577.8 | 439.4 | 17.05% | 454.7 | 17.64% |

| 1957 | 2,601.3 | 451.3 | 17.35% | 432.0 | 16.61% |

| 1956 | 2,549.5 | 434.8 | 17.05% | 411.8 | 16.15% |

| 1955 | 2,500.2 | 394.6 | 15.78% | 412.6 | 16.50% |

| 1954 | 2,332.6 | 427.4 | 18.32% | 434.5 | 18.63% |

| 1953 | 2,347.0 | 430.7 | 18.35% | 470.9 | 20.06% |

| 1952 | 2,243.9 | 414.4 | 18.47% | 423.9 | 18.89% |

| 1951 | 2,161.4 | 328.8 | 15.21% | 289.9 | 13.41% |

| 1950 | 2,005.6 | 269.3 | 13.43% | 290.6 | 14.49% |

| 1949 | 1,844.5 | 272.1 | 14.75% | 268.1 | 14.53% |

| 1948 | 1,854.1 | 286.3 | 15.44% | 205.1 | 11.06% |

| 1947 | 1,776.2 | 280.2 | 15.78% | 251.0 | 14.13% |

| 1946 | 1,791.9 | 316.9 | 17.68% | 445.4 | 24.86% |

| 1945 | 2,011.9 | 407.4 | 20.25% | 836.4 | 41.57% |

| 1944 | 2,035.6 | 405.1 | 19.90% | 845.6 | 41.54% |

| 1943 | 1,883.0 | 227.6 | 12.09% | 744.8 | 39.55% |

| 1942 | 1,618.2 | 146.3 | 9.04% | 351.2 | 21.70% |

| 1941 | 1,365.7 | 93.9 | 6.88% | 147.2 | 10.78% |

| 1940 | 1,166.6 | 75.3 | 6.46% | 108.9 | 9.34% |

| 1939 | 1,073.2 | 73.3 | 6.83% | 106.4 | 9.91% |

| 1938 | 992.4 | 77.8 | 7.84% | 78.8 | 7.94% |

| 1937 | 1,028.3 | 60.3 | 5.86% | 84.8 | 8.25% |

| 1936 | 978.3 | 45.8 | 4.68% | 96.1 | 9.82% |

| 1935 | 864.9 | 42.6 | 4.92% | 75.7 | 8.75% |

| 1934 | 794.6 | 35.6 | 4.48% | 78.8 | 9.91% |

| 1933 | 716.4 | 25.4 | 3.54% | 58.4 | 8.15% |

| 1932 | 725.6 | 23.8 | 3.28% | 57.6 | 7.94% |

| 1931 | 835.1 | 34.0 | 4.07% | 39.0 | 4.68% |

| 1930 | 892.6 | 39.7 | 4.45% | 32.5 | 3.64% |

| 1929 | 976.9 | 36.4 | 3.73% | 29.5 | 3.02% |

| Annual average change rate | 3.27% | 5.04% | 1.71% | 5.93% | 2.57% |

| Maximum | 20.35% | 41.57% | |||

| Minimum | 3.28% | 3.02% | |||

| Average | 15.31% | 18.26% | |||

| ¹ Current dollars deflated with the GDP deflator, 2005=100. | |||||

Sources: US Government Printing Office, Bureau of Economic Analysis.