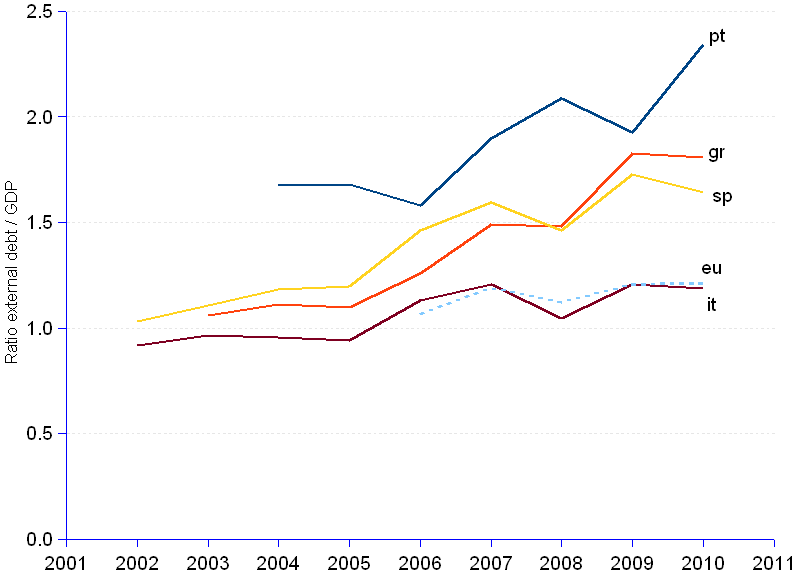

A country's solvency, in other words the ability to meet its contractual obligations towards creditors, may be assessed in a quick and rough way by the ratio of external debt over GDP (gross domestic product). By the end of 2010, debt ascended to 2.3 times GDP in Portugal, 10.9 in Ireland (not charted, because it is out of scale), 1.2 in Italy, 1.8 in Greece, 1.6 in Spain and, as a comparison baseline, 1.2 for the Euro zone. Trends are alarming. The average annual growth rate of debt for the period in analysis goes from 6% (doubling time 12 years) in Portugal, up to 11% (doubling time 7 years) in Greece, 12% (doubling time 6 years) in Spain and 16% (doubling time 5 years) in Ireland.

A high debt to GDP ratio indicates that the nation's solvency is at risk. The higher the debt, the heavier the burden of reimbursements of principal and payment of interests. This is bad for growth. Resources that could otherwise be channeled to investment or consumption will be taken away from the economic agents, mainly by means of tax increases, reduction of social contributions and curtailment of credit, and reallocated to the debt service. There is evidence that when public debt is in a range of 85% of GDP, a further 10 percentage point increase reduces trend growth by more than one tenth of 1 percentage point. For corporate debt, the threshold is close to 90%, and the impact is roughly half as big.

This worrying situation may be rendered worse by the interplay of other factors. If the debtor country is expected to experience difficulties to meet its obligations, interest rates, which grow with the perceived risk, will tend to rise. At the turning point where interest rates become higher than the economic growth rate, debt sustainability is seriously undermined, and the spiral of rising debt and falling growth becomes a real threat to the country's standing.

In this respect, the PIIGS are at a spot. Their economies have slowed down considerably since 2008, at a negative annual change rate of -6% in Portugal and Italy, -7% in Greece and Spain, and -11% in Ireland. At the same time, interests went dramatically up. Currently, 10-year government bond rates reach 5.6% for Italy, 5.92% for Spain, 12.65% for Portugal and 21.25% for Greece (http://markets.ft.com/RESEARCH/Markets/Government-Bond-Spreads, retrieved 19 April 2012). Short of a miracle, there is no practical recipe to enable an economy that recedes at a rate of -6% or -7% yearly, to honor long-term debt at interest rates of 13% or 21%, and recover its health in a foreseeable future.

The aging population in the European countries will make it worse. On one hand, the numbers of pensionable people will increase. This will strain public finances that currently use pension fund contributions as assets to balance their accounts, whereas they are a liability to be repaid in due course. On the other hand, aging will reduce the workforce, thus reducing future growth and enlarging the chasm between debt service obligations and economic growth. A high debt to GDP ratio also suggests that the country does not have much potential left to service external debt by shifting resources from production of domestic goods and services to the production of exports. An economy with a largely autonomous internal market, where exportables represent a small proportion of GDP can do it. However, economies such as Portugal or Ireland, heavily dependent of foreign trade do not benefit from much slack.

Ratio Gross External Debt over GDP (gross domestic product) | ||||||||||||||||||

Year¹ |

Portugal |

Ireland |

Italy |

Greece |

Spain |

Euro area |

||||||||||||

| Gross external debt ² | GDP ² | External debt/GDP |

Gross external debt ² | GDP ² | External debt/GDP |

Gross external debt ² | GDP ² | External debt/GDP |

Gross external debt ² | GDP ² | External debt/GDP |

Gross external debt ² | GDP ² | External debt/GDP |

Gross external debt ² | GDP ² | External debt/GDP |

|

| 2002 | 143 | 552 | 133 | 4.1 | 1,213 | 1,323 | 0.9 | 159 | 769 | 745 | 1.0 | 7,491 | ||||||

| 2003 | 287 | 172 | 780 | 168 | 4.6 | 1,543 | 1,602 | 1.0 | 217 | 205 | 1.1 | 1,041 | 939 | 1.1 | 9,054 | |||

| 2004 | 321 | 191 | 1.7 | 1,087 | 192 | 5.7 | 1,703 | 1,786 | 1.0 | 262 | 236 | 1.1 | 1,277 | 1,079 | 1.2 | 10,088 | ||

| 2005 | 302 | 191 | 1.7 | 1,336 | 202 | 6.6 | 1,676 | 1,778 | 0.9 | 263 | 240 | 1.1 | 1,350 | 1,130 | 1.2 | 10,132 | ||

| 2006 | 369 | 195 | 1.6 | 1,708 | 215 | 7.9 | 2,042 | 1,805 | 1.1 | 319 | 254 | 1.3 | 1,748 | 1,196 | 1.5 | 11,081 | 10,406 | 1.1 |

| 2007 | 455 | 218 | 1.9 | 2,133 | 244 | 8.7 | 2,398 | 1,991 | 1.2 | 427 | 287 | 1.5 | 2,166 | 1,357 | 1.6 | 13,837 | 11,625 | 1.2 |

| 2008 | 446 | 232 | 2.1 | 2,169 | 243 | 8.9 | 2,205 | 2,114 | 1.0 | 465 | 314 | 1.5 | 2,142 | 1,467 | 1.5 | 13,984 | 12,461 | 1.1 |

| 2009 | 501 | 214 | 1.9 | 2,176 | 202 | 10.8 | 2,327 | 1,926 | 1.2 | 536 | 294 | 1.8 | 2,309 | 1,336 | 1.7 | 13,657 | 11,316 | 1.2 |

| 2010 | 478 | 207 | 2.3 | 2,082 | 191 | 10.9 | 2,201 | 1,854 | 1.2 | 491 | 272 | 1.8 | 2,087 | 1,272 | 1.6 | 13,303 | 10,976 | 1.2 |

| 2011 | 461 | 2,031 | 2,244 | 492 | 2,153 | 14,003 | ||||||||||||

| Avge annual growth rate | 6.1% | 2.4% | 5.8% | 15.6% | 4.6% | 11.5% | 7.1% | 4.3% | 3.7% | 10.7% | 7.0% | 8.4% | 12.1% | 6.9% | 5.6% | 4.8% | 4.9% | 3.3% |

| GDP change rate 2008-2010 | -6% | -11% | -6% | -7% | -7% | -2% | ||||||||||||

| ¹ All years show 4th Quarter values, except 2011 that is 3rd Quarter. | ||||||||||||||||||

| ² Billion real US$, 2005=100. | ||||||||||||||||||

Sources: JEDH for external debt, and World DataBank for GDP estimates.