areppim: information, pure and simple

ITU (International Telecommunications Union) estimates that by the end of 2018 there were 8.2 billion mobile subscribers worldwide, corresponding to a global penetration of 95%. This averages 10.7 mobile phones for 10 living persons.

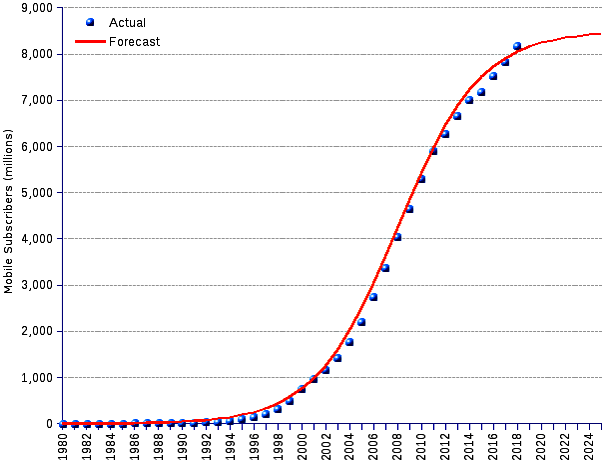

Our new forecast (compare with 2017, 2013, 2012, 2011, and 2008 forecasts) shows ITU's data of actual mobile subscriptions from 1980 through 2018, represented by blue dots, and areppim's forecast till 2025, represented by the S-shaped red line. The model anticipates a global market size of 8.4 billion subscribers by 2025, at 99.3% of saturation (estimated at 8.5 billion), equivalent to 104% of the population.

Global mobile subscribers have grown much faster than population. However, as indicated in the table below, growth slows down significantly in the developed countries (3.8%), while it runs faster in the developing countries (13.8%). Until 2008, when it reached its growth midpoint, subscribers increased at the global annual rate of 54.7%, doubling in size every 1.6 years. Thereafter, from 2009 to 2018 the rate slowed down to only 6.47%. As the market matures, approaching saturation, population growth (0.94% annually from 2019 to 2025) overtakes subscribers growth (0.56%), causing the percent of active subscribers to the population to drop from the current 107% to 104% in 2025, to eventually decline to 100% or 101%, or about one subscriber per living person.

The people's need to communicate fed the mobile boom as it had already driven the success of its fixed-line phone ancestor. The convergence of telephony and Internet bolstered its organic growth, augmenting its basic telephony capability with a myriad of well-known functionalities. The strides made by the plain 1995 cell phone to become the high-performance, multi-purpose 2018 smart phone, more powerful and more capable than the traditional personal computer, are impressive. Mobiles can make a dinner reservation, find a taxi, guide you in a city, exhibit your transportation ticket, pay your purchase, prove your id, find a dog walker or even arrange your dry cleaning.

Taking the number of subscribers as a proxy for the number of devices provides only an approximation. Joe Smith may have three or four subscriptions for one single cell phone. One for his personal calls, another for professional calls, a third for use in a country where he travels frequently, one more for his home alarm system, etc. Be it as it may, one can take for sure three broad statements. Number one, there is a really huge number of mobile phones out there; number two, the market approaches saturation; and three the planet is not large enough to ingurgitate many more devices. This is surely a major concern for device manufacturers wondering how to keep their business firing on all cylinders.

Big phone companies are already feeling the crunch. In early January 2019, Apple dramatically lowered its sales revenue projection due to sluggish iPhone demand. The South Koreans Samsung and LG also struggle to cope with declining sales. Contract manufacturers, such as Foxconn and Pegatron, are already curtailing their production capacity. Smart phone sales have stopped growing. Users feel less compelled to acquire new models, as they don't find in them any new features worth the expense. This is a bad omen for smart phone manufacturers who could see sales slumping throughout the years to come.

Should the deluge of mobile phones be a concern also for the average person, likely a regular subscriber and owner of a mobile device? The answer is a double yes: the great heap of phones matters for everyone, whether or not a mobile user. We gloss over the human issues raised by the binge utilization of mobile phones. After all, players in the mobile market are explicitly keen to make their devices, applications, services and contents addictive

, so as to influence the attitudes, preferences, desires, fears, longings, cravings and wants of the crowds.

Especially worrisome are the consequences of the stealthy spreading of mobile technology to an increasingly vast field of social interactions. A tight information cobweb is being built around each person, sensing, tracking, interpreting and recording each and every step, whether the user is actively using, or just carrying a dozing device. In a growing number of instances, from public services to banks, ticket offices, utility companies, health care centers, commercial enterprises, etc. a mobile subscription has become a default prerequisite for service delivery. In the process, those organizations capture and register a wealth of information about their counterparts. This intrusive and asymmetrical prying, carried out without proper control by the end-users, often filed and sold surreptitiously to unauthorized third parties, leads to the relentless dissolution of privacy, and eventually of freedom.

The truth is that today's mobile phones are exceptionally handy spying artifacts. How can we be sure? Simple: specialists have documented in detail how the so-called mobile ecosystem

has been progressively configured as a comprehensive spying platform. Mobile operating systems and their utilities are designed for spying. So are widely used applications like Facebook. So is the service provisioning and delivery infrastructure of telecom operators. And apps embedded with spying software keep getting uncovered in popular app stores.

If that were not enough, the U.S. administration says so, the Chinese and a handful of other governments suggest so. Huawei is the second largest smart phone maker behind Samsung and before Apple. According to the FBI, Huawei smart phones can be used to gather information covertly, making the Chinese firm a mammoth espionage agency. Not only that. The emerging 5G networks, touted to bring two orders of magnitude better performance than 4G, are premised to become the unifying mobile communication infrastructure of the future — also for autonomous vehicles, smart-cities and weapon systems. And Huawei is a leader in 5G wireless technology...

So much for the Universal Declaration of Human Rights, article 12, stating that No one shall be subjected to arbitrary interference with his privacy, family, home or correspondence (...). Everyone has the right to the protection of the law against such interference or attacks.

Those billions of mobile phones have many other nefarious effects, before and after their useful life span. One should consider their full life cycle, from raw material extraction and material processing, through manufacturing and use, to final waste disposal. What is their imprint on the depletion of natural resources, and on the preservation of healthy natural surroundings?

The demand for electronic goods, which for many people represent a higher standard of living, is expected to keep growing, even if at a lower speed in some instances. The trend is supported by the harsh competition in telecommunication markets that brings down the price of services and devices, as well as by advances in computing power, mobile broadband technologies, and component design. More people can thus afford purchasing new technology. As a consequence more equipment will be eventually thrown away. The trend is boosted by the consumerist behavior consisting of discarding used devices and buying new ones instead of keeping or repairing. The average smart phone life span in China, U.S.A. and major European countries is in the 18 months to 24 months brackets. In the past three years, the worldwide sales of (new) mobile phones reached approximately 1.5 billion units annually. The switch-off of 2G GSM networks (on-going and to be generally completed in advanced countries by 2020), and later of 3G UMTS infrastructure (from 2025 onwards) will force all those still relying upon older handsets to upgrade to 4G-5G devices, sustaining those sales figures.

Contrary to their modest and clean demeanor, electronic devices are actually voracious and foul. A researcher at the United Nations University in Tokyo measured the elements needed to make a 2-gram chip. It takes 1.7 kg of fossil energy, 1 m³ of nitrogen, 72 grams of chemicals and 32 liters of water. By comparison, it takes 1.5 tons of fossil energy to build a 750 kg car. The ratio of the energy input to build the car is 2 to 1, while for the chip it is 630 to 1. The demure micro-chip, so frugal in appearance, has in fact a gargantuan appetite.

In addition to chips, a modern mobile phone may contain 500 to 1,000 different components necessitating a wide group of raw materials, for instance coltan (for capacitors), gold (connections), gallium (LEDs), germanium (WiFi chip), antimony (battery plates), neodymium (micro-magnets), indium (display), etc. The European Union, concerned about the sustained supply of what they name Critical Raw Materials, of which they identified 27 in the 2017 exercise, reports that some of these elements will be particularly sought after by the leading industries. The future global resource use could double between 2010 and 2030, (...) the demand for certain raw materials [is expected to increase] by a factor of 20 by 2030.

.

The surging demand exerts much strain on the extraction of metallic ores. The global quantity extracted rose from 3.72 billion tons in 1980 to 5.8 billion tons in 2002 and is expected to reach 11.14 billion tons in 2020. If the populations of emerging countries adopted technologies and lifestyles similar to those prevailing in the OECD countries, the global demand for metals would be 3 to 9 times greater than the amount currently used in the world.

Developing countries are struggling with the environmental effects of increased extraction rates. Huge volumes of waste and wastewater; air, water and soil pollution and contamination; release of hazardous chemicals and materials; dissipation losses. Not to speak of the scramble for resources responsible for many wars, violence, forced labor and population exodus in the mineral-rich areas of Africa, South America and Asia.

As global demand for many metals continues to rise, lower quality ores are mined, leading to an overall decrease in ore grades. Although extraction methods continue to improve, the mining of lower-grade ore using techniques such as open pit mining and ultra-deep mining (from 5,000 to 6,000 meters below the surface) entails massive earthmoving to extract the same quantity of ore. The cost is soil disruption, water use and pollution, and energy consumption, all on a huge scale. To provide an order of magnitude, it takes the gold miner Barrick an average of 2.31 tons (spread from 75 kg to 5,704 kg) of spoil (rock and soil) to produce just 1 gram of gold. Think of the 11.14 billion tons of metallic ores expected to be needed by 2020. Applying the 2.31 tons to 1 gr ratio, or whatever ratio of preference, conjures up the sinister vision of the planet torn to tatters to feed the industry.

In order to supply the world with the much-wanted metallic ores, mining enterprises have launched underwater sea-bed prospecting projects. To turn a profit, companies would need to collect three million metric tons of dry nodules a year, yielding about 37,000 metric tons of nickel, 32,000 metric tons of copper, 6,000 metric tons of cobalt and 750,000 metric tons of manganese. A varied array of life at a scale of 50 microns or larger live on the nodules or in the sediment. Most of these creatures will die from the scouring or be smothered by the sediment cloud as it settles. Given that nodules take millions of years to form and that biological communities are very slow to develop, harvested regions are unlikely to recover on any human time-scale. If only 30 percent of a nodule is desirable metals, 70 percent is waste, typically a slurry. Slurry from millions of ocean nodules will be new material that has to go somewhere.

Continents and oceans, the quest for mineral ores will leave no stone unturned — the ubiquitous mobile phone gladly participating in the onslaught.

Leaping through the manufacturing and the use phases, let us take a glance of the disposal phase. Discarded mobile phones are part of e-waste. The global quantity of e-waste generated in 2016 was around 44.7 million tons (Mt) or 6.1 kg per inhabitant. In 2017, the world e-waste generation will likely exceed 46 Mt. The amount of e-waste is expected to grow to 52.2 Mt in 2021, with an annual growth rate of 3 to 4%.

Increasing volumes of electronic waste raise two big concerns. An environmental one, because its improper and unsafe treatment and disposal through open burning or in dump sites, pose very serious risks to the environment and human health. An economic one, because the total value of all raw materials present in e-waste, most of which are just thrown-away, is estimated at 55 billion Euros (60 billion USD) in 2016. To address such pressing issues, regulators developed standards and procedures for e-waste triage, collection, take-back, recycling, and final disposal. However, available statistics show only lack-luster results.

Only 20% (8.9 Mt) of e-waste generated worldwide in 2016 is documented to be collected and properly recycled. The remaining 80% (35.8 Mt) of e-waste is not documented. Approximately 76% (34.1 Mt) of e-waste is untraced and unreported, probably dumped, traded, or recycled under substandard conditions. In the higher income countries, 4% (1.7 Mt) of e-waste is thrown into the residual waste.

How much do discarded mobile phones weigh in the mass of e-waste? Impossible to tell, surely far too much, since out of the 60 different elements making up a smart phone, only about 10 can be

recovered through different technical processes, all barely economically viable, if at all. Which leads to the logical deduction that, in addition to the convenient communications device that they unequivocally are, mobile phones hide many deleterious traits. These could be kept in check through the well-known reduce, reuse, repair, recycle

approach; so: how much longer will our society continue to limit the life span of devices to 18 - 24 months, whereas they should last 10 times longer?

| Year | World | Developed Countries | Developing Countries | Forecasts ¹ World | ||||

|---|---|---|---|---|---|---|---|---|

| (millions) | (% of inhabitants) | (millions) | (% of inhabitants) | (millions) | (% of inhabitants) | (millions) | (% of inhabitants) | |

| 1980 | 0.02 | 2.56 | 0.06 | |||||

| 1981 | 0.06 | 3.42 | 0.08 | |||||

| 1982 | 0.10 | 4.57 | 0.10 | |||||

| 1983 | 0.15 | 6.11 | 0.13 | |||||

| 1984 | 0.32 | 8.16 | 0.17 | |||||

| 1985 | 0.75 | 10.89 | 0.22 | |||||

| 1986 | 1.45 | 14.54 | 0.29 | |||||

| 1987 | 2.55 | 19.42 | 0.38 | |||||

| 1988 | 4.33 | 25.92 | 0.50 | |||||

| 1989 | 7.35 | 34.58 | 0.66 | |||||

| 1990 | 11.21 | 46.13 | 0.87 | |||||

| 1991 | 16.00 | 61.51 | 1.1 | |||||

| 1992 | 23.00 | 81.96 | 1.5 | |||||

| 1993 | 34.00 | 109 | 2.0 | |||||

| 1994 | 56.00 | 145 | 2.6 | |||||

| 1995 | 91.00 | 193 | 3.4 | |||||

| 1996 | 145 | 256 | 4.4 | |||||

| 1997 | 215 | 338 | 5.7 | |||||

| 1998 | 318 | 445 | 7.5 | |||||

| 1999 | 490 | 585 | 9.7 | |||||

| 2000 | 738 | 763 | 12.5 | |||||

| 2001 | 961 | 990 | 16.0 | |||||

| 2002 | 1,157 | 1,272 | 20.3 | |||||

| 2003 | 1,417 | 1,618 | 25.5 | |||||

| 2004 | 1,763 | 2,032 | 31.6 | |||||

| 2005 | 2,205 | 33.9 | 992 | 82.1 | 1,213 | 22.9 | 2,512 | 38.6 |

| 2006 | 2,745 | 41.7 | 1,127 | 92.9 | 1,618 | 30.1 | 3,053 | 46.3 |

| 2007 | 3,368 | 50.6 | 1,243 | 102.0 | 2,125 | 39.1 | 3,639 | 54.5 |

| 2008 | 4,030 | 59.7 | 1,325 | 107.8 | 2,705 | 49.0 | 4,250 | 62.9 |

| 2009 | 4,640 | 68.0 | 1,383 | 112.1 | 3,257 | 58.2 | 4,860 | 71.1 |

| 2010 | 5,290 | 76.6 | 1,404 | 113.3 | 3,887 | 68.5 | 5,446 | 78.7 |

| 2011 | 5,890 | 84.2 | 1,406 | 113.1 | 4,483 | 78.0 | 5,987 | 85.6 |

| 2012 | 6,261 | 88.5 | 1,443 | 115.7 | 4,817 | 82.7 | 6,467 | 91.3 |

| 2013 | 6,661 | 93.1 | 1,479 | 118.2 | 5,183 | 87.8 | 6,881 | 96.1 |

| 2014 | 6,996 | 96.7 | 1,527 | 122.0 | 5,468 | 91.4 | 7,227 | 99.8 |

| 2015 | 7,181 | 97.4 | 1,563 | 125.2 | 5,618 | 91.7 | 7,509 | 102.5 |

| 2016 | 7,511 | 100.7 | 1,587 | 126.8 | 5,924 | 95.5 | 7,736 | 104.5 |

| 2017 | 7,814 | 103.6 | 1,594 | 127.0 | 6,220 | 99.0 | 7,914 | 105.7 |

| 2018 ² | 8,160 | 107.0 | 1,616 | 128.0 | 6,545 | 102.8 | 8,054 | 106.5 |

| 2019 | 8,161 | 106.8 | ||||||

| 2020 | 8,243 | 106.8 | ||||||

| 2021 | 8,306 | 106.6 | ||||||

| 2022 | 8,354 | 106.2 | ||||||

| 2023 | 8,390 | 105.7 | ||||||

| 2024 | 8,417 | 105.1 | ||||||

| 2025 | 8,437 | 104.4 | ||||||

| 2026 | 8,453 | 103.7 | ||||||

| 2027 | 8,464 | 102.9 | ||||||

| 2028 | 8,473 | 102.2 | ||||||

| 2029 | 8,480 | 101.4 | ||||||

| 2030 | 8,484 | 100.7 | ||||||

| Average annual change rate | 40.5%: 1980-2018; 6.5%: 2009-2018; 10.6%: 2005-2018. | 3.8% | 13.8% | 19.7% | ||||

| ¹ Logistic growth function. Parameters: Saturation M = 8,499 million; Midpoint tm = 2008; Growth time Δ t = 15.18.

² ITU's estimates. | ||||||||

Source: ITU-International Telecommunications Union