Mobile Phone Market Forecast - 2017

ITU (International Telecommunications Union) estimates that by the end of 2017 there will be 7.7 billion mobile subscribers worldwide, corresponding to a global penetration of 94%. This averages 10.3 mobile phones for 10 people, or more than one device per living person.

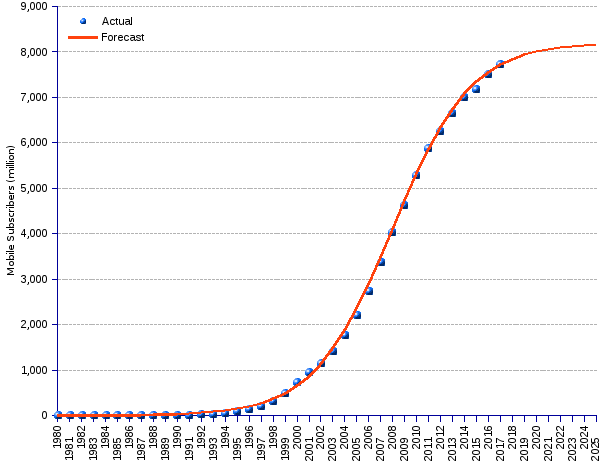

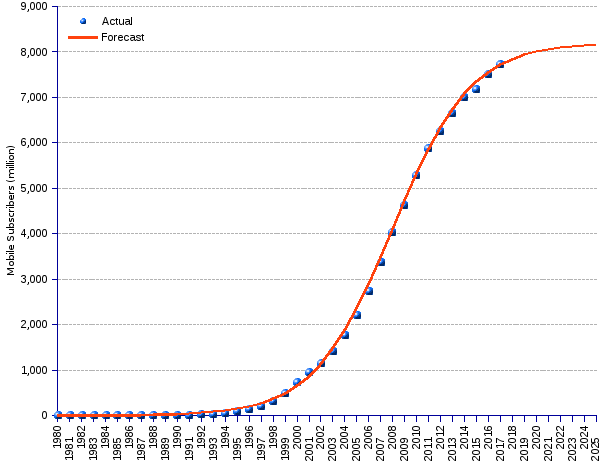

Our new forecast (compare with 2013, 2012, 2011, and 2008 forecasts) shows ITU's data of actual mobile subscriptions from 1980 through 2017, represented by blue dots, and areppim's forecast till 2025, represented by the S-shaped red line. The model anticipates a global market size of 8.17 billion subscribers by 2025, corresponding to 101% of the projected world population, and close to market saturation estimated at 8.21 billion.

Despite the fact that, at the end of 2017, there are as many mobile-cellular subscriptions as people on earth and 95 per cent of the global population lives in an area that is covered by a mobile-cellular signal, mobile usage is not yet evenly spread. Indeed, while many people have multiple subscriptions or devices, especially in the developed economies, a large chunk of the population, especially in the developing economies, has not access to mobile services, mostly because many people simply cannot afford the cost.

ITU's 2016 edition of the "Measuring the Information Society" report provides a summary of the mobile technology status. Some highlights:

- Many people still do not own or use a mobile phone. In developing economies, close to 20 per cent of the population, on average, are still not using a mobile phone.

- Most people who do not own or use a mobile phone are among the youngest (5-14 years old) and the oldest (over 74 years old) segments of the population.

- Significant gender gaps exist in mobile-phone adoption and the gap is larger for mobile-phone ownership than for mobile-phone use. Also, people living in rural areas are less likely to own or use a mobile phone than people in urban areas.

- Mobile-cellular prices continued to fall in 2015, and more steeply than in previous years. The Asia and the Pacific region has the lowest average price for mobile-cellular services of all regions.

- Fixed-broadband prices continued to drop significantly in 2015 but remained highest, and clearly non-affordable, in a number of less developed countries.

- The decrease in mobile-broadband prices goes hand in hand with an increase in the intensity of use.

- People in most low-income countries get lower speeds and quality for their money.

- Mobile-broadband is cheaper and more widely available than fixed-broadband, but is still not deployed in the majority of less developed countries.

- Affordability, mainly the cost of the handset, rather than the cost of the service itself, is the stronger barrier to mobile-phone ownership in several developing economies.

All of the above call for a threefold comment:

- First, what do we really mean by mobile phone? The 1980 cell phone was a cumbersome device, offering a plain-vanilla voice telephony service, limited to the geography covered by the specific mobile operator until the introduction of the digital GSM technology in 1991. It evolved thereafter to include the exchange of data, pictures and multimedia, and an array of services such as Global Positioning System (GPS), location-based services or video-conferencing. Today, mobile phones are not even named as such, but rather known as smartphones. A plain mobile phone is currently known as dumb-phone... Smartphones can do almost anything a tech-crazy can dream of. They compete with computers, video recorders, music-playing devices, high-definition cameras, location positioning devices, game consoles, and are used for a wide range of tasks, including but only secondarily to place a telephone call. Such an evolution raises a technical issue. It is not statistically congruent to treat different objects as a single statistical unit — which makes statistical analyses such as areppim's debatable.

- Second, the ITU's highlights according to which many people still do not fully benefit from the mobile technology potential, lead to believe that the changes induced by the mobile phone in the way many people live, communicate, and entertain themselves, are such a great benefit for mankind that everybody should drool with envy. Alas, the real advantage for the user is mitigated by the congestion of the often worthless, undesired, unpleasant, intrusive, and unsafe services foisted on him by a myriad of service providers recklessly determined to monetize any and everything. From a communications tool that it was built to be, the mobile phone became a device designed to create dependency, and to transform the casual user into a mere 'hit' unit that, added to many others, is expected to generate streams of revenue for the mobile value chain agencies. Instead of a liberating tool, it is rather a debasing device.

- Third, the market is saturated. Sales growth depends less of targeting yet untapped segments, which are mostly unprofitable or insolvent as suggested by the ITU report, than from grabbing market share from competitors. The turnover of mobile vendor leaders, the downward pressure on handset prices, and the drive to differentiate the offerings by cramming the devices with marginally attractive features are symptoms of the predicament. It is unclear what suppliers will do to get out of the rut. Survival is becoming a big concern.

Mobile Cellular Phone Subscribers

(million)

| Year | Actual | Forecast ¹ |

|---|

| 1980 | 0.02 | 1.62 |

| 1981 | 0.06 | 2.19 |

| 1982 | 0.10 | 2.97 |

| 1983 | 0.15 | 4.03 |

| 1984 | 0.32 | 5.47 |

| 1985 | 0.75 | 7.42 |

| 1986 | 1.45 | 10.05 |

| 1987 | 2.55 | 13.63 |

| 1988 | 4.33 | 18.47 |

| 1989 | 7.35 | 25.04 |

| 1990 | 11.21 | 33.92 |

| 1991 | 16.00 | 45.94 |

| 1992 | 23.00 | 62.18 |

| 1993 | 34.00 | 84.11 |

| 1994 | 56.00 | 114 |

| 1995 | 91.00 | 153 |

| 1996 | 145 | 207 |

| 1997 | 215 | 278 |

| 1998 | 318 | 372 |

| 1999 | 490 | 497 |

| 2000 | 738 | 660 |

| 2001 | 961 | 870 |

| 2002 | 1,157 | 1,137 |

| 2003 | 1,417 | 1,470 |

| 2004 | 1,763 | 1,874 |

| 2005 | 2,205 | 2,350 |

| 2006 | 2,745 | 2,893 |

| 2007 | 3,368 | 3,486 |

| 2008 | 4,030 | 4,107 |

| 2009 | 4,640 | 4,728 |

| 2010 | 5,290 | 5,321 |

| 2011 | 5,890 | 5,864 |

| 2012 | 6,261 | 6,340 |

| 2013 | 6,661 | 6,744 |

| 2014 | 6,996 | 7,077 |

| 2015 | 7,184 | 7,344 |

| 2016 | 7,511 | 7,554 |

| 2017 | 7,740 | 7,717 |

| 2018 | | 7,842 |

| 2019 | | 7,936 |

| 2020 | | 8,007 |

| 2021 | | 8,061 |

| 2022 | | 8,100 |

| 2023 | | 8,130 |

| 2024 | | 8,152 |

| 2025 | | 8,168 |

| Average annual change rate | 42.13% | |

¹ Logistic growth function.

² ITU's estimates. |

Source: ITU-International Telecommunications Union