areppim: information, pure and simple

True, even policy makers can learn from past mistakes. The 2008 global sub-prime

crisis led to a drastic turning of the screw, euphemistically labeled austerity policy

, that sent millions of people into the depths of poverty and hardship and placed the economy in a cul-de-sac. The planetary economic collapse that ensued the 2019 Covid-19 pandemic is eliciting far different measures from governments and central banks. The Maastricht criteria

have been at least temporarily waived. A downpour of government spending and streams of liquidity have substituted for the counter-productive and abhorred austerity measures of the past. So far, with some success. In spite of a global economic setback – in 2020 the world output contracted by 3.3 percent year-on-year, unprecedented in living memory

says the IMF (International Monetary Fund) – , the ravages have been partially contained for the time being.

And yet the outlook is ugly. Close to 95 million more people are estimated to have fallen below the threshold of extreme poverty in 2020 compared with pre-pandemic projections

warns the IMF. Income inequality is likely to increase significantly because of the pandemic […] deterioration of many firms’ and households’ balance sheets (particularly among those with a high propensity to consume out of income) and the expiration of loan repayment moratoria

may significantly rise the threat of an economic deadlock in the medium-term, foresees the IMF.

Whatever the social and economic prospects may be, it does not require rocket science to anticipate a period of sweeping distress – exception made of the ultra-rich whose assets have grown astronomically thanks to the pandemic.

The Covid-19 health crisis is far from being prevailed upon, and it is bound to continue consuming ever greater state resources. Logistical supply chains are a shambles, causing inflation to show in practically all consumer prices. Employment is faltering, causing incomes to rarefy. The economy is sick of both a weakening demand and a spasmodic offer in a context of shrinking revenues. Governments and central banks have granted some much-needed respite by providing direct assistance to troubled businesses and individuals, or by mitigating the risk of financial delinquencies through moratoria on overdue payments and loan guarantees.

All this is but procrastination, it delays the deadline without erasing the eventual reckoning. As time goes by, the situation will only deteriorate. Some robust measures are required. The irony is that policy makers have only a meager bag of tricks to take the world out of the rut. They pick once again their usual and favored recipe : recovery through the upturn of private consumption and the swelling of product offers. It succeeded ever since World War 2. Why shouldn’t it work now ? More tourism, more travel, more disposable goods, more fashionable throwaways, more everything…

This entails a double headache. First, in a world of growing inequality, the masses are by and large insolvent and there will be a limit – however high it may be – to the level of indebtedness that households, banks and the states can afford. Second, policy makers are currently struggling with the conundrum of keeping the world warming at 1.5°C while assuring the viability of their country's economic future. May we give a piece of advice to the incumbent policy makers ? Promise the moon, the stars, just anything, gain time, and prepare a slick new career during the remaining term of office.

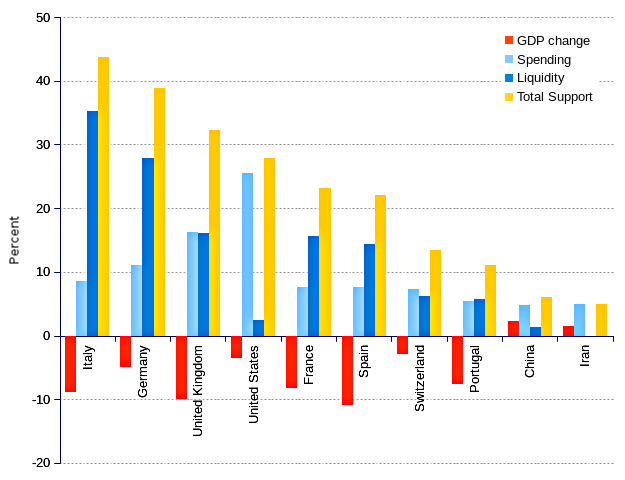

The table below shows the support effort deployed by the set of countries that areppim has been following since the pandemic declaration. The amount of total support reached 44 percent of GDP in Italy, with a median of 23 percent. Even the wealthy and least affected by the GDP contraction (a comparatively modest -3 percent) Switzerland deployed a total support effort of 14 percent of GDP. Surprisingly, Portugal, whose output losses of about 8 percent will most unlikely be offset by the ailing tourism services and commodity exports, did not take advantage of the leeway bestowed by the European Union and the Central European Bank to rescue the economy by spending more abundantly (as the United States did), instead of providing a liquidity support that only postpones the settlement of accounts without mitigating the risks of insolvency.

| Country | GDP change 2020 (percent) | Budgetary support ¹ | Liquidity support ² | Total support ³ |

|---|---|---|---|---|

| (percent of GDP) | ||||

| China | 2.27 | 4.8 | 1.3 | 6.1 |

| France | -8.232 | 7.6 | 15.6 | 23.2 |

| Germany | -4.903 | 11 | 27.8 | 38.8 |

| Iran | 1.516 | 4.9 | … | 4.9 |

| Italy | -8.871 | 8.5 | 35.3 | 43.8 |

| Portugal | -7.587 | 5.4 | 5.7 | 11.1 |

| Spain | -10.964 | 7.6 | 14.4 | 22 |

| Switzerland | -2.983 | 7.3 | 6.2 | 13.5 |

| United Kingdom | -9.92 | 16.2 | 16.1 | 32.3 |

| United States | -3.505 | 25.5 | 2.4 | 27.9 |

| Global | -3.3 | 9.2 | 6.1 | 15.3 |

| Highest (Italy) | 43.8 | |||

| Lowest (Iran) | 4.9 | |||

| Median | 22.6 | |||

| ¹ Budgetary support : additional state spending by way of targeted subsidies, cash transfers to individuals, financial aids to businesses, tax relief, emergency social protection, paid training, etc. ² Liquidity support : state provides credit guarantees, low-interest loan guarantees, micro loans, risk sharing, liquidity support by central bank, etc. ³ Total support : sum of budgetary and liquidity support. | ||||

| Sources : IMF - World Economic Outlook, Managing Divergent Recoveries, Full text, April 2021, and IMF - Fiscal Monitor Database of Country Fiscal Measures in Response to the COVID-19 Pandemic, April 2021 Charts and maps. | ||||