areppim: information, pure and simple

The current U.S. debt raises a sizable amount of concern among the financial pundits.

The chorus of voices warning about the dangers of record US government debt is growing louder. In the past 24 hours, JPMorgan (JPM) CEO Jamie Dimon and Ray Dalio, founder of the world’s biggest hedge fund, have weighed in with concerns about America’s debt pile…

Last month, the IMF said the high and rising level of US government debt risked driving up borrowing costs around the world and undermining global financial stability.

That warning followed an even blunter message from the head of the CBO, the US Congress’s independent fiscal watchdog, who said the United States risked a bond market crisis of the kind that engulfed the United Kingdom under former Prime Minister Liz Truss. In that instance, investors effectively rejected the UK government’s plan to pay for extra spending and tax cuts by borrowing more money, leading to a selloff in UK government bonds.

Our comments a few months ago:

The covid-19 pandemic took its toll on the U.S. federal finances. The gap between GDP and a skyrocketing federal debt took a gargantuan shape. The future looks ominous for the average US taxpayer, and for that matter, for everybody in the U.S. and elsewhere, exception made of the ultra-rich and of the opportunistic profiteers. The pandemic took just three months to turn the tables of the world economy, brutally exposing its frailties.

As if one evil were not enough, at the beginning of 2022, the USA succeeded in lure Russia into a military enterprise in Ukraine which, Washington hopes, should bleed to death the Russian nation militarily, economically and politically. After the Afghan fiasco, the USA might finally record a nice victory. And without losing a single American life, at least officially

, since the cannon fodder should be provided by Ukraine.

The economic effects of this proxy war reverberate around the world. The train of economic sanctions against Russia dictated by the USA and dutifully endorsed by the NATO, the European Union and the other G7 members, triggered a streak of woldwide inflation, and is causing the accelerated industrial demise and the subsequent economic ruin of Europe. In the USA and in Europe, the government programmes to help people overcome the inflation burden are causing heavy strain on public finances. As yet, the sole beneficiary of the war is the USA, that can supply Europe with oil and gaz at prices fourfold the now embargoed Russian supplies, can export its agricultural surplus to fill the void created by the blocked food shipments from Ukraine and Russia, and can sell vast quantities of arms and ammunition to replenish the arsenals emptied by the operations in Ukraine.

This will not last long. Contrary to expectations, Russia did not yield. Russia's military industrry outclasses the NATO's capabilities both qualitatively and quantitatively. Economnically, Russia did not suffer much damage from the sanctions, found ways to substtute national agricultural and industrial production to imports, and resumed its growth.

Most important, US, NATO's and G7's ruthlessness opened the eyes of the Rest of the World. Waking up to the risks anyone faces in a dollar-dominated and West-owned financial system, and witnessing the ways and means by which Russia extricates itself from the sanctions trap, the Rest of the World decided it was time to build a safe haven to escape the bleak fate of the sanctioned

nations. Cuba, North Vietnam, Iran, Venezuela, Afghanistan, Russia, and others provided a rich enough illustration of the havoc that the West can bring forth to whomever displeases it. Setting aside their differences, the Rest of the World countries gathered to explore, design and implement new financial and trade instruments and mechanisms enabling them to foster their economic and political development without bowing to the political, financial and economic ukases uttered by Washington, Brussels or Ottawa. Should this endeavor succeed, it might entail the Europe's descent to the abyss, and the retreat of the US Empire to its American courtyard...bad luck for its neighbours, the assigned targets of the US Monroe doctrine

policy.

One wonders how things will shape up in the near future. The crisis knocked down all the economic fundamentals. Central banks pour diluvian torrents of phantom

money in the economy. Debt piles up reaching unseen levels. A growing number of households have a hard time making ends meet, and a huge percentage of them may lose their homes soon. Unemployment (and concomitant labor shortage) is surging. Output goes down the drain. Consumption is on the rocks. Investment is frozen dead. Supply chains have been dislocated. Airports, harbors and railway terminals are intermittently empty. The neo-liberal economics model, unable to continue creating value, runs straight into the wall. Amazingly the only route out of the crisis that the experts

are capable of devising is more of the same, with a keynesian touch. Time is up to realize that the current economic model based on consumerism, indebtedness, creeping unemployment, product waste, resource dilapidation and dilution of the social nets may well provide the lucky few with awesome opportunities but, despite all the magic of the finance wizards, it is doomed – we need something deeply different.

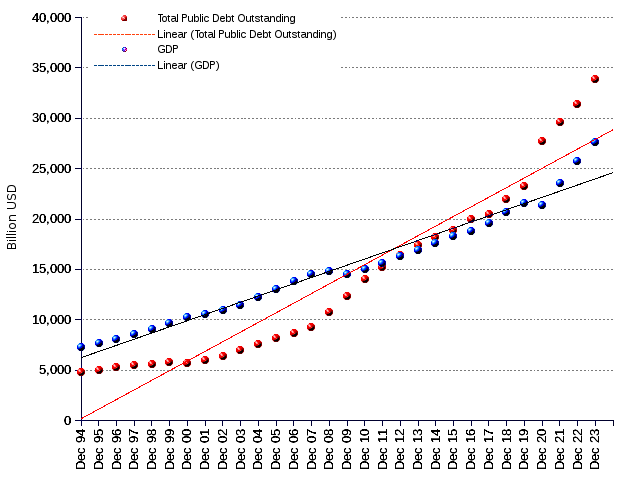

The US federal debt has ran on the fast track since 2009, overtook GDP in 2012, and keeps faring ahead of GDP since 2017. Presidents G.W. Bush and Obama's huge budget deficits have compounded the problem, adding to the burden. Trump's presidency, with its flurry of tax hand-outs, and trade war tariffs, did not contribute to close the gap. The economic standstill caused by the 2020 coronavirus pandemic will certainly enlarge the chasm between federal debt and GDP. The combined effect of the pandemic and the war in Ukraine on supplies has led to a rise in prices that threatens economies with inflation and anemic growth. It is likely that at 125 percent of GDP, the US federal debt will climb to higher levels. The federal administration enjoys the benefit of a (so far) co-operative Federal Reserve willing to buy whatever amounts of debt the former decides to sell. Creating money becomes a handy expedient to finance the debt, especially when the rest of the world is avid, sometimes only resigned, to collect dollar bills. The print shop sleight of hand can hardly be seen as a sensible solution to the debt issue. It comes heavy on the taxpayer. It is a hindrance to sound, future-building investment. It may induce second thoughts in the minds of all dollar labeled currency holders about the soundness of the US dollar as a reserve currency. However, short of being an ever-lasting solution, it is likely to still enjoy plenty of easy-going days.

Total outstanding debt breaks down into debt held by the public, currently representing 78.4 percent of the total, and intra-governmental holdings making the 21.6 percent balance. The latter comprises mainly obligations to social security beneficiaries, retired military and other federal employees. The former, debt held by the public, is all the debt held by any entities, private or public, outside the U.S. Government, under the form of Treasury Bills, Notes, Bonds, TIPS, United States Savings Bonds, and State and Local Government Series securities. It requires management care, because, as Jerome Powell, the current Chairman of the Federal Reserve, said during his Congress hearing on February 27, 2018, "there could come a time when the public, the global debt-buying public, would come to the view that we either weren't prepared to honor our debts or that we couldn't service them". This would entail dire consequences even for an economy as strong as the U.S.

Currently, the debt held by the public ascends to 102 percent of the U.S. economy. The Congressional Budget Office (CBO) was alarmed that it could rise to 91% by 2027. It seems it will reach much higher levels. Although nobody can reasonably tell what the right level of debt should be, CBO believes that the current growth rate of debt is unsustainable. Instead of letting it grow, it should be brought down to 70% in that period, and over the longer term, closer toward the historical level of around 40% of GDP, in order to provide enough slack to deal with unforeseen developments and crises.

Working towards such goals would require major budget savings such as:

President Trump's administration and the Republican-controlled congress have taken quite the opposite legislative path. The scenario was one of massive tax-cuts for corporations and high-income individuals, huge spending increases in the military, gigantic allocations for new weapon systems. Only the converts can believe that the dubious trickle-down economic effect of tax-cutting or the trade-balance benefits expected from the tariff wars engaged by the administration against the U.S. trade partners will ever produce tax revenues strong enough to start filling the debt gap. So far, facts refuse to support the theory — GDP has grown, but debt grew much faster. President elect Joe Biden promised to reverse some Trump administration tax cuts, but that remains as yet just a promise. Powell's warning that the global debt-buying public might suspect that the U.S. could not and would not honor their debts looks increasingly like a somber prognosis.