areppim: information, pure and simple

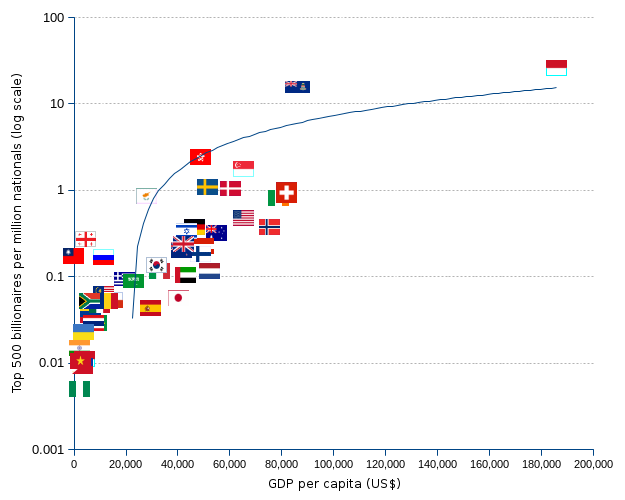

The scatter chart shows the world top 500 billionaire headcount index (number of billionaires per million inhabitants: y-axis, logarithmic scale) as a function of their home country's GDP (Gross Domestic Product) per capita (x-axis). The trend is indicated by the blue regression curve. The r and the R² statistics indicate that the billionaires per million index has only a flimsy correlation to the country's GDP per capita, and that the variance of GDP cannot predict the variance of the per-million index.

If asked about their nationality, should billionaires pick Latin as their lingua franca, they would likely adopt the ancient motto Ubi pane ibi patria

— in modern lingo: my homeland is where they feed me. Their assets are spread across the globe, knowing no borders, no colors, no creeds. If assets were the criterion for defining citizenship, billionaires would surely hold a universal passport. But, as global as the wealth may be, it still does not define the owner’s nationality. Then, what do their passports — obviously many a billionaire finds it convenient to hold not one but several identity papers — confess?

Take the American billionaires. Of course they are citizens of the United States. Why shouldn’t they ? You cannot find nowhere another place, another tax-haven, another asset shelter as welcoming as this country. Let us check some bare facts.

Having accessed a vast cache of IRS information, ProPublica compared how much in taxes the 25 richest Americans paid each year to how much [...] their wealth grew in that same time period. [...] The results are stark. [...] Those 25 people saw their worth rise a collective $401 billion from 2014 to 2018. They paid a total of $13.6 billion in federal income taxes in those five years, the IRS data shows. That’s a staggering sum, but it amounts to a true tax rate of only 3.4%. [...] For comparison, it would take 14.3 million ordinary American wage earners put together to equal that same amount of wealth. The personal federal tax bill for the top 25 in 2018: $1.9 billion. The bill for the wage earners: $143 billion.

You may think that there must be some fishy scheme at work where the 25 super-rich pay only 1.3% of what the IRS would tax the common people? In fact no, it is all clean and legitimate to the last dot. It is just that the US cares and cherishes their ultra-rich. The richer they are, the better treat they get. The tax-break champions are amongst the world wealthiest billionaires:

| Name | Ranking worldwide | Total income | Total taxes paid | Real tax rate | |

|---|---|---|---|---|---|

| Wealth growth | Income reported | ||||

| Warren Buffett | 6 | $24.3B | $125M | $23.7M | 0.10% |

| Jeff Bezos | 1 | $99.0B | $4.22B | $973M | 0.98% |

| Michael Bloomberg | 20 | $22.5B | $10.0B | $292M | 1.30% |

| Elon Musk | 2 | $13.9B | $1.52B | $455M | 3.27% |

It is plain common sense that, the source of the wealth being global, billionaires choose to become citizens, or at least residents, of the most benign tax sanctuary. This explains why we find in the chart, above the (logarithmic) regression curve, those countries whose prosperity is boosted by luring the ultra-wealthy foreigners who earn their income elsewhere, for example Hong Kong, the Cayman Islands, Cyprus or Monaco. The latter provides a shining example, it is an agreeable harbor for the rich and famous of the sports, the performing arts, the finance world. A paradigmatic free-loader.

Sanctimonious national administrations and international organizations consider any attempt to evade taxation a crime and a moral felony justifying harsh punishment and social reprobation. But that is for the common citizen. The state itself is exempt. States see it fit to increase their revenue by outplaying each other in attracting foreign taxpayers, preferably the rich ones, although middle-class pensioners will also do, by means of tax exemptions, lump sum taxation schemes and other fiscal asylum benefits. While enforcing patriotic jingoism in the school curricula, states may sell citizenship to foreigners wealthy enough to pay. They may also issue residence permits, aptly called "gold visas", to rich foreigners keen to circumvent residence regulations or to launder dirty money. No big deal — it is just good, sound, creative, pragmatic statesmanship. Not comparable to the greedy, mean, despicable maneuvering by the nameless taxpayer who tries to put a couple of hard-won dimes out of the way.

Towards the center of the chart and close to the curve, one finds the group of prosperous economies such as Switzerland, the Scandinavian, Germany, the Netherlands, United States, Australia, etc. with a high GDP per capita, typically twice the median, and a sizable number of billionaires. It makes sense.

The lower left area is crowded with low GDP per capita countries, of which some concede a large percentage of people living below the US$1.9 per day poverty line. India, Indonesia, Philippines and South Africa have millions of people struggling in dire poverty while at the same time feeding billionaire fortunes.

China may be the very paradigm of the billionaire extravagance. Still ruled by a so-called communist regime, whose avowed goals are to build an egalitarian, class-less, profiteer-less, zero-exploitation society, a true paradise on earth for the workers, China embodies the antinomy of a GDP per capita that is about one third of the median or the average, and the second largest set of billionaires, in number as well as in aggregate net assets, just after the United States.

| Nation (see the 2021 list of top 500 billionaires by country) |

Population 2021 (million) |

Top 500 Billionaires | GDP ¹ | Extremely Poor ² | ||||

|---|---|---|---|---|---|---|---|---|

| Net Worth USD billion | Number | Per million nationals | USD billion | GDP per capita (USD) | Percent of population below $1.9/day | Poverty Gap at $1.9/day | ||

| Australia | 25.37 | 115.62 | 8 | 0.32 | 1,397 | 55,057 | 0.4 | 0.5 |

| Austria | 8.88 | 27.67 | 2 | 0.23 | 445 | 50,122 | 0.5 | 0.6 |

| Brazil | 211.05 | 89.56 | 6 | 0.03 | 1,840 | 8,717 | 1.7 | 4.6 |

| Canada | 37.59 | 121.49 | 15 | 0.40 | 1,736 | 46,190 | 0.1 | 0.2 |

| Cayman Islands | 0.06 | 7.04 | 1 | 15.40 | 6 | 85,975 | .. | .. |

| Chile | 18.95 | 22.50 | 1 | 0.05 | 282 | 14,896 | 0.2 | 0.3 |

| China | 1,397.72 | 1,254.54 | 79 | 0.06 | 14,280 | 10,217 | 0.1 | 0.5 |

| Colombia | 50.34 | 23.06 | 2 | 0.04 | 324 | 6,429 | 1.9 | 4.9 |

| Cyprus | 1.20 | 10.30 | 1 | 0.83 | 25 | 27,858 | 0 | 0 |

| Denmark | 5.81 | 46.88 | 6 | 1.03 | 350 | 60,213 | 0.1 | 0.2 |

| Egypt | 100.39 | 7.25 | 1 | 0.01 | 303 | 3,019 | 0.6 | 3.8 |

| Finland | 5.52 | 7.04 | 1 | 0.18 | 269 | 48,771 | 0 | 0.1 |

| France | 67.06 | 502.67 | 16 | 0.24 | 2,716 | 40,496 | 0 | 0 |

| Georgia | 3.72 | 5.92 | 1 | 0.27 | 17 | 4,698 | 0.8 | 3.8 |

| Germany | 83.09 | 398.61 | 31 | 0.37 | 3,861 | 46,468 | 0 | 0 |

| Greece | 10.72 | 16.20 | 1 | 0.09 | 210 | 19,581 | 0.1 | 0.1 |

| Hong Kong | 7.51 | 287.94 | 18 | 2.40 | 366 | 48,713 | .. | .. |

| India | 1,366.42 | 390.55 | 20 | 0.01 | 2,869 | 2,100 | 4.6 | 22.5 |

| Indonesia | 270.63 | 38.13 | 3 | 0.01 | 1,119 | 4,136 | 0.3 | 2.9 |

| Ireland | 4.93 | 58.92 | 4 | 0.81 | 389 | 78,779 | 0.2 | 0.2 |

| Israel | 9.05 | 25.77 | 3 | 0.33 | 395 | 43,589 | 0 | 0.2 |

| Italy | 60.30 | 108.86 | 7 | 0.12 | 2,004 | 33,226 | 1.1 | 1.4 |

| Japan | 126.26 | 127.41 | 7 | 0.06 | 5,082 | 40,247 | 0.2 | 0.7 |

| Kazakhstan | 18.51 | 6.06 | 1 | 0.05 | 182 | 9,813 | 0 | 0 |

| Korea, Republic of | 51.71 | 62.88 | 7 | 0.14 | 1,647 | 31,846 | 0 | 0.2 |

| Malaysia | 31.95 | 28.00 | 2 | 0.06 | 365 | 11,414 | 0 | 0 |

| Mexico | 127.58 | 122.33 | 6 | 0.05 | 1,269 | 9,946 | 0.5 | 1.7 |

| Monaco | 0.04 | 11.10 | 1 | 25.66 | 7 | 185,829 | .. | .. |

| Netherlands | 17.34 | 23.72 | 2 | 0.12 | 907 | 52,295 | 0.1 | 0.1 |

| New Zealand | 4.98 | 10.80 | 1 | 0.20 | 207 | 41,558 | .. | .. |

| Nigeria | 200.96 | 17.00 | 1 | 0.00 | 448 | 2,230 | 12.5 | 39.1 |

| Norway | 5.35 | 12.60 | 2 | 0.37 | 403 | 75,420 | 0.2 | 0.3 |

| Philippines | 108.12 | 6.11 | 1 | 0.01 | 377 | 3,485 | 0.5 | 2.7 |

| Romania | 19.37 | 8.17 | 1 | 0.05 | 250 | 12,913 | 0.8 | 2.4 |

| Russian Federation | 144.41 | 375.66 | 24 | 0.17 | 1,700 | 11,585 | 0 | 0 |

| Saudi Arabia | 34.27 | 34.09 | 3 | 0.09 | 793 | 23,140 | .. | .. |

| Singapore | 5.70 | 117.91 | 10 | 1.75 | 372 | 65,233 | .. | .. |

| South Africa | 58.56 | 24.98 | 3 | 0.05 | 351 | 6,001 | 6.1 | 18.7 |

| Spain | 47.13 | 93.60 | 2 | 0.04 | 1,393 | 29,565 | 0.6 | 0.9 |

| Sweden | 10.28 | 118.33 | 11 | 1.07 | 531 | 51,648 | 0.6 | 0.7 |

| Switzerland | 8.58 | 76.81 | 8 | 0.93 | 703 | 81,989 | 0 | 0 |

| Taiwan | 23.57 | 25.61 | 4 | 0.17 | 611 | 25.939 | .. | .. |

| Thailand | 69.63 | 25.17 | 2 | 0.03 | 544 | 7,807 | 0 | 0.1 |

| Ukraine | 44.39 | 10.30 | 1 | 0.02 | 154 | 3,659 | 0 | 0 |

| United Arab Emirates | 9.77 | 6.22 | 1 | 0.10 | 421 | 43,103 | 0 | 0 |

| United Kingdom | 66.84 | 160.52 | 16 | 0.24 | 2,829 | 42,329 | 0.2 | 0.3 |

| United States | 328.24 | 3,281.80 | 155 | 0.47 | 21,433 | 65,298 | 0.9 | 1 |

| Viet Nam | 96.46 | 9.85 | 1 | 0.01 | 262 | 2,715 | 0.3 | 1.8 |

| Total | 8,363.55 | 500 | 78,442.52 | |||||

| Average | 174.24 | 1.15 | 34,382.15 | |||||

| Median | 27.84 | 0.13 | 30,705.48 | |||||

| r | 0.74 | |||||||

| R² | 0.54 | |||||||

| ¹ World Bank estimates for Population and GDP in current US dollars for 2019 are the most recent ones available. GDP data for Cayman Islands and Monaco relate to 2018. Data for Taiwan is extracted from CIA World Factbook. ² Poverty headcount ratio at $1.90 a day (2011 PPP) (% of population), and Poverty gap at $1.90 a day (2011 PPP) (%) are the most recent estimates available from the World Bank. ³ .. = not available. ⁴ Coefficient of correlation (Number of billionaires per million nationals , GDP per capita). Indicates the statistical relationship between the two variables. ⁵ Coefficient of determination (Number of billionaires per million nationals , GDP per capita). Indicates the proportion of the variance in the dependent variable that is predictable from the independent variable. | ||||||||

Sources: The Bloomberg Billionaires Index, 2021, United Nations Population Division, The World Bank-DataBank, CIA - The World Factbook.