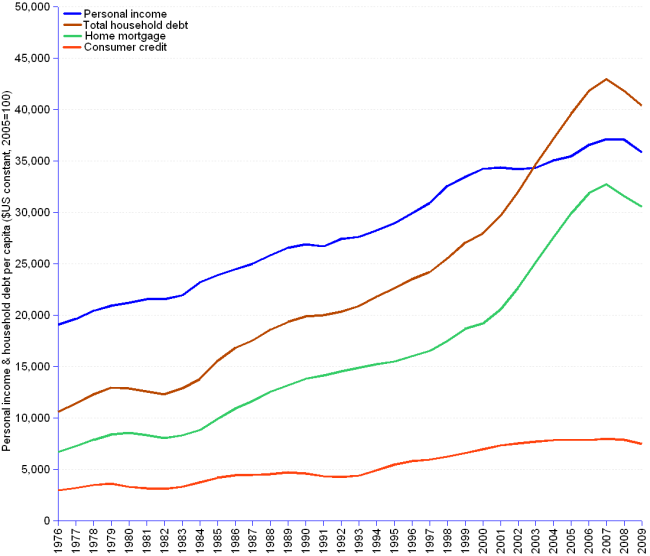

Household debt gained momentum in 1993 (beginning of Clinton's first term), broke the personal income ceiling in 2003, and took a steep ascension until the 2008 financial crash. The growths of personal income on one hand and, on the other hand, of total debt outstanding, mortgage, or consumer credit are unrelated (covariances near zero): borrowing is disassociated from financial capability.

The scenario presents unique features:

As a consequence, most households were short of discretionary income and unable to fuel the 5.87% annual economy growth. To overcome the scarcity of income of the vast masses, the latter were provided with financial resources through lending, irrespective of actual income capabilities. Key instruments have been mortgages that include loans made under home equity lines of credit, also used for consumer purposes, and consumer credit that includes revolving credit, mostly credit card lending.

Unsurprisingly, the 21st century witnessed the free ride of mortgage, including home equity credit. Mortgage and income became disassociated. Their correlation still strong in 1982 (r=0.9), significantly weakened in 1985 (r = 0.63), took a tumble in 1999 (r=0.5) and vanished in 2004 (r=0.14). Credit card lending, another popular form of credit, went from 15.73% in 1976 to 54.43% of other consumer credit loans in 2009. Other factors contributed to the increase in indebtedness during the same period, such as the accelerated rise of university fees that could only be met with heavier student loans. Debt, not income based consumption, became the driver of economic growth.

It was in fact a rotten apple. Debt nurtured the "subprime crisis" that triggered the financial meltdown that caused the 2009 economic recession. The major economic indicators turned upside down. Borrowing, both mortgage (-2.5%) and consumer credit (-4.0%), reverted the trend too. However, the average household, struggling with shrinking incomes and evaporating jobs, remains tied to financial obligations, including debt service and other payments such as car leases, home rentals and insurance, amounting to 17.76% of disposable personal income (2009 Q3).

Will the havoc made by the inequality of income distribution and indebtedness be as short-lived as their benefits have been?

Personal Income & Household Debt Outstanding | |||||||||||||

Year |

Population |

Personal Income |

Household Debt Outstanding |

Home Mortgage |

Consumer Credit |

Personal Income |

Household Debt Outstanding |

Home Mortgage |

Consumer Credit |

Personal Income |

Household Debt Outstanding |

Home Mortgage |

Consumer Credit |

| US$ billion (constant 2005=100) | Percent change | Per capita, US$ (constant 2005=100) | |||||||||||

| 2009 | 307,006,550 | 10,997 | 12,402 | 9,375 | 2,295 | -2.5% | -2.5% | -2.5% | -4.0% | 35,820 | 40,396 | 30,538 | 7,475 |

| 2008 | 304,374,846 | 11,282 | 12,717 | 9,616 | 2,389 | 0.7% | -1.8% | -2.6% | -0.5% | 37,065 | 41,781 | 31,594 | 7,850 |

| 2007 | 301,579,895 | 11,198 | 12,949 | 9,872 | 2,403 | 2.6% | 3.7% | 3.7% | 2.7% | 37,132 | 42,938 | 32,734 | 7,967 |

| 2006 | 298,593,212 | 10,913 | 12,486 | 9,516 | 2,339 | 4.1% | 6.6% | 7.5% | 0.8% | 36,547 | 41,816 | 31,871 | 7,833 |

| 2005 | 295,753,151 | 10,486 | 11,717 | 8,849 | 2,320 | 2.1% | 7.5% | 9.6% | 1.1% | 35,455 | 39,616 | 29,920 | 7,844 |

| 2004 | 293,045,739 | 10,269 | 10,901 | 8,076 | 2,294 | 3.0% | 8.2% | 10.6% | 2.7% | 35,042 | 37,198 | 27,560 | 7,827 |

| 2003 | 290,326,418 | 9,966 | 10,079 | 7,304 | 2,234 | 1.3% | 9.4% | 11.9% | 3.1% | 34,327 | 34,715 | 25,159 | 7,696 |

| 2002 | 287,803,914 | 9,835 | 9,212 | 6,526 | 2,168 | 0.4% | 9.0% | 11.5% | 3.9% | 34,174 | 32,007 | 22,674 | 7,532 |

| 2001 | 285,081,556 | 9,800 | 8,451 | 5,854 | 2,087 | 1.5% | 7.2% | 8.1% | 6.2% | 34,375 | 29,643 | 20,534 | 7,320 |

| 2000 | 282,171,957 | 9,656 | 7,884 | 5,414 | 1,964 | 5.9% | 6.9% | 6.4% | 9.7% | 34,219 | 27,939 | 19,188 | 6,961 |

| 1999 | 272,690,813 | 9,117 | 7,371 | 5,090 | 1,791 | 3.6% | 6.8% | 7.7% | 6.2% | 33,434 | 27,032 | 18,665 | 6,566 |

| 1998 | 270,248,003 | 8,801 | 6,904 | 4,725 | 1,686 | 6.3% | 6.6% | 6.8% | 6.0% | 32,565 | 25,546 | 17,485 | 6,237 |

| 1997 | 267,783,607 | 8,279 | 6,478 | 4,422 | 1,590 | 4.4% | 4.0% | 4.3% | 3.7% | 30,918 | 24,192 | 16,515 | 5,937 |

| 1996 | 265,228,572 | 7,933 | 6,231 | 4,241 | 1,533 | 4.3% | 4.9% | 4.2% | 7.0% | 29,911 | 23,492 | 15,990 | 5,781 |

| 1995 | 262,803,276 | 7,605 | 5,938 | 4,070 | 1,433 | 3.4% | 4.6% | 2.7% | 12.1% | 28,938 | 22,593 | 15,489 | 5,452 |

| 1994 | 260,327,021 | 7,355 | 5,674 | 3,963 | 1,279 | 3.3% | 5.4% | 3.4% | 12.9% | 28,254 | 21,795 | 15,223 | 4,911 |

| 1993 | 257,782,608 | 7,118 | 5,382 | 3,833 | 1,133 | 1.9% | 3.7% | 3.3% | 5.1% | 27,613 | 20,879 | 14,871 | 4,395 |

| 1992 | 255,029,699 | 6,987 | 5,188 | 3,711 | 1,078 | 3.8% | 2.9% | 4.0% | -1.2% | 27,396 | 20,342 | 14,551 | 4,226 |

| 1991 | 252,153,092 | 6,730 | 5,042 | 3,567 | 1,091 | 0.3% | 1.7% | 3.5% | -4.5% | 26,691 | 19,997 | 14,148 | 4,327 |

| 1990 | 249,464,396 | 6,713 | 4,960 | 3,447 | 1,142 | 2.4% | 3.9% | 6.1% | -1.9% | 26,909 | 19,881 | 13,818 | 4,577 |

| 1989 | 246,819,230 | 6,556 | 4,774 | 3,250 | 1,164 | 3.8% | 5.1% | 6.0% | 4.6% | 26,561 | 19,343 | 13,168 | 4,717 |

| 1988 | 244,498,982 | 6,316 | 4,544 | 3,067 | 1,112 | 4.2% | 6.8% | 8.6% | 3.1% | 25,834 | 18,583 | 12,542 | 4,550 |

| 1987 | 242,288,918 | 6,060 | 4,254 | 2,822 | 1,079 | 3.2% | 5.5% | 7.8% | 1.9% | 25,010 | 17,558 | 11,649 | 4,452 |

| 1986 | 240,132,887 | 5,873 | 4,031 | 2,619 | 1,059 | 3.4% | 9.0% | 11.2% | 6.8% | 24,455 | 16,789 | 10,906 | 4,409 |

| 1985 | 237,923,795 | 5,679 | 3,699 | 2,354 | 992 | 3.8% | 13.8% | 13.2% | 12.5% | 23,868 | 15,548 | 9,895 | 4,168 |

| 1984 | 235,824,902 | 5,469 | 3,252 | 2,079 | 881 | 6.7% | 8.1% | 7.3% | 14.1% | 23,193 | 13,788 | 8,818 | 3,736 |

| 1983 | 233,791,994 | 5,125 | 3,007 | 1,938 | 772 | 2.6% | 5.7% | 4.1% | 7.9% | 21,922 | 12,861 | 8,288 | 3,304 |

| 1982 | 231,664,458 | 4,993 | 2,845 | 1,861 | 716 | 1.0% | -1.4% | -2.6% | -1.1% | 21,553 | 12,280 | 8,032 | 3,090 |

| 1981 | 229,465,714 | 4,945 | 2,886 | 1,911 | 724 | 2.6% | -1.3% | -1.5% | -3.5% | 21,548 | 12,577 | 8,330 | 3,153 |

| 1980 | 227,224,681 | 4,820 | 2,923 | 1,940 | 750 | 2.4% | 0.3% | 2.7% | -7.5% | 21,212 | 12,866 | 8,539 | 3,299 |

| 1979 | 225,055,487 | 4,706 | 2,916 | 1,889 | 810 | 3.5% | 6.6% | 7.7% | 5.2% | 20,911 | 12,957 | 8,394 | 3,600 |

| 1978 | 222,584,545 | 4,546 | 2,736 | 1,754 | 771 | 5.1% | 9.1% | 9.8% | 9.8% | 20,425 | 12,293 | 7,880 | 3,462 |

| 1977 | 220,239,425 | 4,324 | 2,508 | 1,597 | 702 | 4.1% | 8.7% | 9.6% | 8.7% | 19,635 | 11,386 | 7,253 | 3,186 |

| 1976 | 218,035,164 | 4,155 | 2,307 | 1,457 | 645 | 19,058 | 10,583 | 6,681 | 2,959 | ||||

| Average annual change rate | 3.0% | 5.2% | 5.8% | 3.9% | |||||||||

Sources: US Federal Reserve, US Census Bureau.