|

Insight : Oil outlook |

|

|

You are here: areppim > Economy > Oil outlook

Oil reserves nearing depletion, oil prices bound to rise

"Every Cadillac or every Zim -- let alone any instrument of war -- means fewer plowshares for some future generations, and implicitly, fewer future human beings, too." [Nicholas Georgescu-Roegen, in 'Energy and Economic Myths', 1975]

When soaring oil prices hammered the world in the first half of 2008, an optimistic Business Week wrote: "expensive energy is a powerful medicine. It may hurt when taken, but it brings long-term cures for a host of ills" (BW July 23, 2008). The cures the authors had in mind are the conventional ones. Less waste, more efficient energy use, production of alternative energy, exploitation of formerly unaffordable reserve deposits.

In spite of the tangible benefit of these measures, the logic has two major flaws.

The saving attitude is a luxury for the good times, when the economy booms and energy prices go through the roof. Shortly thereafter, as the economy cools down and demand for energy weakens, prices tumble and oil is again plentiful. The new concern is to stimulate the economy, and energy savings cease to be a priority.

This cycle has been evidenced by past oil crises, especially the 1980 one. The barrel ascended to $103 (2007 dollars) and energy efficiency became the motto of the day. In 1986, the barrel came down to $22 (2007 dollars), the shortage of oil was forgotten and business went back to usual.

More recently, in the 2nd quarter of 2008, the streets were panic stricken with the barrel at $148. The usual talk about tax incentives for energy savings, revamping of the nuclear and the like filled the air. A couple of months later, the world financial meltdown and the ensuing first symptoms of a global recession changed priorities altogether. In parallel, demand for oil collapsed and so did the price of the barrel ($149/barrel in mid July down to $73/barrel in the first week of October). The big concern now is to find ways and means to relaunch the economy and boost GDP growth.

The second flaw is the underlying assumption that the world must be awash in oil to support the insatiable voracity of its economy.

Obviously, saving is a rewarding policy for an economy of flows. If one has an investment producing reasonable returns, it is possible both to enjoy a rent, and to grow the capital by adding to it a portion of the revenue. Theoretically, growth may never end.

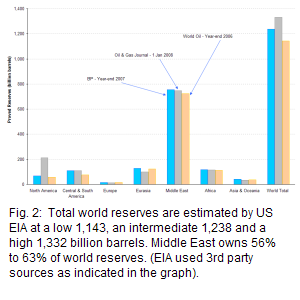

But it is a different matter with an economy of stocks. If the capital does not produce any return, as it would be the case of gold ingots in a safe, it can only be maintained on the condition that nothing is taken away from it. Savings or no savings, as long as one goes on picking a bit now and then, total depletion will be reached sooner or later. The issue with oil reserves is that they are physically limited and the limit is getting closer every year (see enlarged Figure 1 chart).

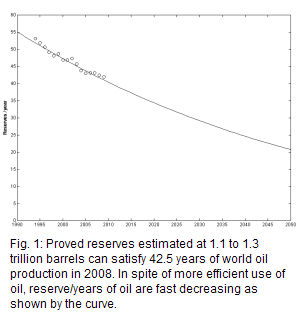

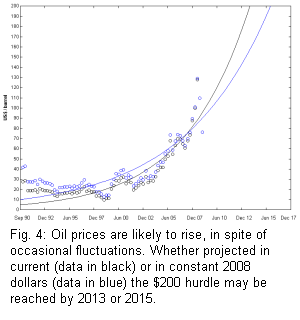

The earth holds a million-year old stock of oil, of unknown size, that cannot be enlarged by human means. The proven reserves of available oil are currently estimated at 1,100 to 1,300 billion barrels (see enlarged Figure 2 chart). The current world oil extraction amounts to 31 billion barrels per year (see enlarged Figure 3 chart).

Whatever the energy saving and energy substitution policies, demand grows every year in response to economic growth, and extraction is increased to meet the demand. In 2008, proven oil reserves satisfy 42.5 years of supply at current oil consumption rates. Should the production trend from 1994 onwards apply, in 2010 reserves would cover 41 years, and in 2040 a mere 25 years of oil supply. Savings cannot restore oil stocks, but only delay the depletion deadline.

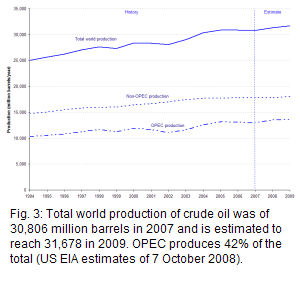

In this context of shrinking resources, it is very likely that the law of offer and demand will push oil prices substantially up, notwithstanding the short-term economic ups and downs. Taking into account the latest data available, the barrel should hit the $200 hurdle by the second half of 2013 (see enlarged Figure 4 chart).

The last areppim forecast, produced before the current financial and economic world crisis, suggested that the $200 hurdle would be reached by 2011. The revised forecast points to a date 2 years later. In fact, if the present recession lasts long enough, the 2013 deadline may move even further away. However, one, two or five years sooner or later is not the crucial parameter – the alarming fact is that we shall hit exorbitant energy costs in the near future.

areppim oil price and supply forecasts convey three plain messages:

- Mankind's limited oil endowment is approaching exhaustion; at most, we can delay the inevitable by avoiding any unnecessary depletion of resources.

- Substituting new and alternative energy to oil, supposing a favourable occurrence of innovation, will hopefully buy us some time, without fundamentally changing the problem – available and exploitable energy is limited.

- Oil prices are bound to rise to astronomic values, irrespective of all manipulations to keep them under control; the only unknown is the speed at which they will fare.

A consumption based economy, thriving on a never-ending and continuously renewed wave of throw-away, passing fashion, obsolete-by-design, show-off gadget and junk products, is essentially an energy ogre that inexorably depletes limited resources. In the end, we must face a choice. Present gratification at the price of a bleak future, or a sensible approach to material goods consumption and the prospect of an amenable life on the blue planet.

It's time to decide: the useless Cadillac right now, or the life-sustaining tools tomorrow.

- Sources of data:

- Oil prices: Historical Commodity Futures Charts.

- EIA: 'International Energy Outlook 2008', Report DOE/EIA-0484(2008) released September 2008.

- EIA: 'World Proved Reserves of Oil and Natural Gas, Most Recent Estimates', Table Posted: August 27, 2008.

- EIA: 'International Petroleum Supply, Consumption, and Inventories', Short Term Energy Outlook, Published October 7, 2008.

- areppim forecasts:

- Reserves/year forecasts (Figure 1) are obtained by a non-linear logistic function based on the actual annual world oil production volumes in million barrels for the period 1994 to 2007, and EIA projection for 2008 and 2009.

- Price forecasts (Figure 4) are obtained by a non-linear logistic function based on actual quarterly barrel prices both in current and in constant 2008 dollars for the period September 1990 to October 2008.

- GDP deflator (used for adjusting current to constant dollars in Figure 4) is obtained from BEA: Table 1.1.9. Implicit Price Deflators for Gross Domestic Product.]

Download

Go toTop

Go toTop

Home

Home