|

Insight : Another oil crisis |

|

|

You are here: areppim > Economy > Another oil crisis

Oil prices signal a major energy crisis

In different European countries, fishermen block the harbours; truck drivers obstruct the roads and the regular citizens moan and grumble in protest against the inconveniences caused by skyrocketing prices of fuel in their everyday's life.

In different European countries, fishermen block the harbours; truck drivers obstruct the roads and the regular citizens moan and grumble in protest against the inconveniences caused by skyrocketing prices of fuel in their everyday's life.

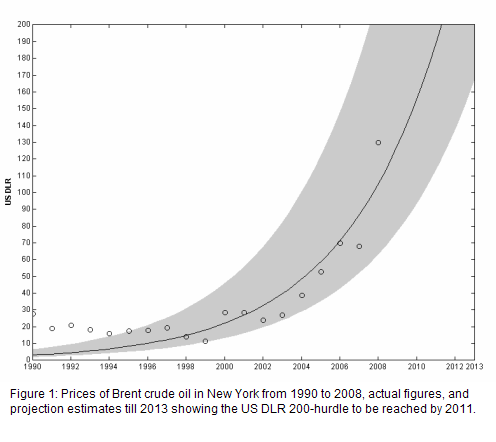

Unfortunately, prices will go up, partially driven by the cost of crude oil. A projection of the price of Brent crude in New York suggests that the 200 dollar ceiling will be reached by 2010-2011. (see chart: dots indicate the actual prices of Brent crude oil in New York from 1990 to June 2008; the curve is a logistic function, the grey area corresponding to the confidence level of the estimate)

Energy consumption per capita may vary widely from one nation to the other. However, it correlates quite well with the total economic output per capita (GDP). The linear relationship between the two variables is unquestionable. In the current economic environment, it is safe to forecast a growing demand for energy. On one hand, governments of developed countries try by all means to boost the economy with a view to placate the social unrest triggered by unemployment and plummeting incomes. On the other hand, newly industrialized economies, China, India, Brazil, etc. show high rates of GDP growth, while other developing countries try to escape poverty by improving their own GDP growth. All together, they will apply huge pressure on the demand for energy. Since resources are limited, and the marginal cost of exploiting new oil reserves is higher, it is guaranteed that prices will eventually grow to unaffordable levels, breeding a potentially major economic crisis.

This should not come as a surprise. In the early 1970's, even before the first oil crisis in 1973-1974, the famous "Limits to Growth" report warned against the risk of collapse somewhere in the first half of the 21st century, if our economies remained in the same path of growing by dilapidating scarce resources. In 1971, the economist Georgescu-Roegen ("The Entropy Law and the Economic Process"), debunked the hoax of inexhaustible wealth favoured by the soothsayers of the GDP growth ideology.

More to the point, in the late 1950's, the controversial King Hubbert proposed his model, known as "Hubbert's peak", by which he predicted a worldwide peak oil production at "about half a century", that is approximately today. If the Hubbert's peak oil theory is true and somehow current events so suggest, we are up for an age of big challenges indeed.

Go toTop

Go toTop

Home

Home