areppim: information, pure and simple

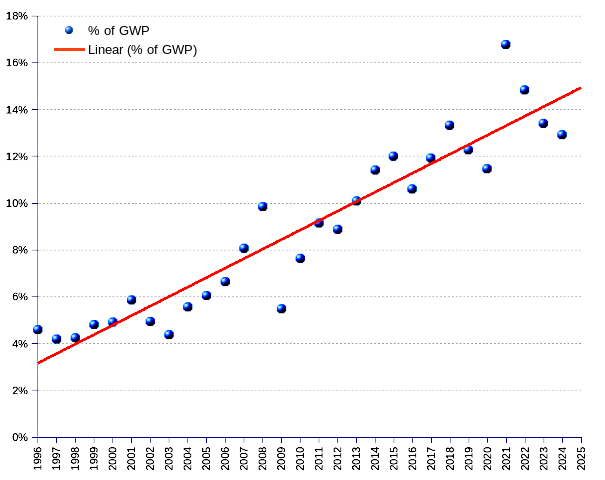

Don’t pity the billionaires! They had a couple of not-so-good years in 2022 and 2023, but they managed a turnaround in 2024. The world billionaires aggregate net worth as percent of GWP (gross world product) did not entirely recover from the pandemic and the on-going wars, and stays at about the 1919 level. But it still follows the trend line. In 1996, they were a gang of 423, weighing US$B 1,918, or the equivalent to 4.6% of an estimated US$T 41.8 GWP. They multiplied to become a crowd of 2,781, worth of US$B 14,200 or 12.9% of an estimated GWP of US$T 95.8 in 2024 (see table for details). In this race of a sort, billionaires took the fast lane, growing at an average annual rate of 7.4%, while GWP strolled at an yearly rate of 3%.

Contrary to their obnoxious reputation, ordinary workers, simple folks like you and me, are astoundingly prodigal. Non content with letting go between one third and one half of their output to the tax office, they still provide extra hard work to make billionaires richer. This is a fact. By letting the billionaires’ share grow from 4.6% to 12.9% of GWP, the common people allowed billionaires to deflect to their balance sheets an increasingly larger cut of the world's output.

How much did the commoners lose in this zero-sum game? By lack of comparable data, we shall use a proxy, in this instance the U.S. statistics on households and individual salary and wage-earners. The numbers give serious reasons for concern. The U.S. disposable personal income per capita progressed by a shy 1.66% per annum during the same period, lagging behind GDP (gross domestic product) growth (2.3% as above mentioned). In parallel, the household debt grew at an annual rate of 2.78 %, thus outpacing GDP. To put it simply, worker compensation has been allocated a declining share of the GDP cake, inducing households to incur debt at a faster rate than the economy growth.

Ours is a magnificent era of wealth accumulation. The world’s gross output grows at an average rate of 3% per annum, allowing it to double in size every 23.5 years. Not bad, but it fails to meet the billionaires’ expectations. They don’t aim just to be wealthy. They are intent on becoming wealthier, and much faster than what the world’s growth should allow. So far, they have good reasons to feel proud of their performance. Their percent share of GWP achieved a 7.4% average growth rate, allowing their slice of the cake to double not in 23.5, but in a much faster 10-year period. Is there a limit to their entitlement?

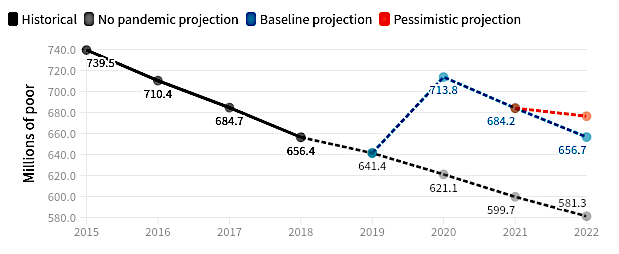

The widening differential between the world’s gross output and the billionaires’ collective worth finds its reflection on the deepening inequalities between the rich and the poor. Wile the lucky ones keep climbing sky-high, the ordinary folks get impoverished every passing day, and are caught in the quicksand of insolvency.

The super-rich and their clerks claim that a dollar to the rich is money that trickles down to the poor, through consumption or investment. This is pure baloney. The accumulated wealth is hardly channeled to job and income-generating investments. Instead, it is vastly used to play weird financial games aimed at increasing the value of the portfolio holdings. The impact on the quality of life of the average person is devastating: unemployment, precarious jobs, lower and insecure income, poisonous indebtedness, economic dependency, failed public services, crumbling infrastructure, etc. Not to speak of the deleterious ecological effects of consumerism, or the abrasive social consequences of the inequality chasm between the 2,781 world billionaires, and the legions of people including the 7% of employed population below the international poverty line, the 23% of youth (aged 15-24 years) not in education, employment or training, or the 12% prevalence of severe food insecurity.

Crises exist indeed, and they are an affliction for common people. At this very moment, the social and economic consequences of the COVID-19 pandemic are still looming. The on-going conflicts in Ukraine and in Western Asia, the cold-war tensions threatening the entire world, and the striving to build a new multi-polar world order, all these factors compound a scenery bleak enough. For the billionaire 0.00034 per thousand of the world population, though, crises are a just another convenient lever to push their fortunes further up. Both the 2001 dot.com burst and the 2008 global financial meltdown have been quickly outdistanced. The 2015–2016 stock market selloff caused murderous commotion among world billionaires, to an extent unparalleled since 2009. But the course returned to normalcy in 2017. The 2019 pandemic reshuffled the billionaire list, but 2021 shone brighter than ever for the extra-rich. It is expectable that the financial and economic impact of the 2022 geopolitical crisis can hardly rock the billionaire boat keel over.

One should probably do something to iron things out and change this unfair state of play, but that is another story.

"

"

| Year | World Billionaires | GDP (gross world product) ¹ | Billionaire Net Worth as percent of GDP | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Number | Net Worth | Average | Median ² | (trillion US$ current) | (trillion US$ constant, 2015 =100) | |||||

| (billion US$ current) | (billion US$ constant, 2017=100) ³ | (billion US$ current) | (billion US$ constant, 2017=100) ³ | (billion US$ current) | (billion US$ constant, 2017=100) ³ | |||||

| 1996 | 423 | 1,049.5 | 1,918 | 2.5 | 4.5 | 1.9 | 3.5 | 31.858 | 41.820 | 4.59% |

| 1997 | 224 | 1,010.0 | 1,814 | 4.5 | 8.1 | 2.9 | 5.2 | 31.752 | 43.464 | 4.17% |

| 1998 | 209 | 1,069.1 | 1,899 | 5.1 | 9.1 | 3.3 | 5.9 | 31.697 | 44.704 | 4.25% |

| 1999 | 298 | 1,270.9 | 2,226 | 4.3 | 7.5 | 2.9 | 5.0 | 32.731 | 46.291 | 4.81% |

| 2000 | 322 | 1,386.1 | 2,374 | 4.3 | 7.4 | 2.9 | 5.0 | 33.839 | 48.389 | 4.91% |

| 2001 | 538 | 1,728.6 | 2,896 | 3.2 | 5.4 | 1.9 | 3.2 | 33.627 | 49.369 | 5.87% |

| 2002 | 472 | 1,515.5 | 2,500 | 3.2 | 5.3 | 1.8 | 3.0 | 34.918 | 50.505 | 4.95% |

| 2003 | 476 | 1,403.3 | 2,270 | 2.9 | 4.8 | 1.7 | 2.7 | 39.152 | 52.073 | 4.36% |

| 2004 | 587 | 1,917.2 | 3,020 | 3.3 | 5.1 | 1.9 | 3.0 | 44.116 | 54.401 | 5.55% |

| 2005 | 691 | 2,236.2 | 3,415 | 3.2 | 4.9 | 2.0 | 3.1 | 47.760 | 56.580 | 6.04% |

| 2006 | 793 | 2,645.5 | 3,920 | 3.3 | 4.9 | 2.0 | 3.0 | 51.750 | 59.094 | 6.63% |

| 2007 | 946 | 3,452.0 | 4,980 | 3.6 | 5.3 | 2.1 | 3.0 | 58.315 | 61.678 | 8.07% |

| 2008 | 1,125 | 4,381.0 | 6,200 | 3.9 | 5.5 | 2.2 | 3.1 | 64.072 | 62.950 | 9.85% |

| 2009 | 793 | 2,414.7 | 3,397 | 3.0 | 4.3 | 1.8 | 2.5 | 60.718 | 62.097 | 5.47% |

| 2010 | 1,011 | 3,567.8 | 4,958 | 3.5 | 4.9 | 3.5 | 4.9 | 66.514 | 64.909 | 7.64% |

| 2011 | 1,210 | 4,496.3 | 6,122 | 3.7 | 5.1 | 3.7 | 5.1 | 73.958 | 67.069 | 9.13% |

| 2012 | 1,226 | 4,574.5 | 6,115 | 3.7 | 5.0 | 2.1 | 2.8 | 75.604 | 68.886 | 8.88% |

| 2013 | 1,426 | 5,431.8 | 7,140 | 3.8 | 5.0 | 2.1 | 2.8 | 77.751 | 70.862 | 10.08% |

| 2014 | 1,645 | 6,446.5 | 8,328 | 3.9 | 5.1 | 2.2 | 2.8 | 79.894 | 73.075 | 11.40% |

| 2015 | 1,826 | 7,063.2 | 9,041 | 3.9 | 5.0 | 2.1 | 2.7 | 75.360 | 75.360 | 12.00% |

| 2016 | 1,810 | 6,482.6 | 8,220 | 3.6 | 4.5 | 2.1 | 2.6 | 76.588 | 77.485 | 10.61% |

| 2017 | 2,043 | 7,668.0 | 9,552 | 3.8 | 4.7 | 2.1 | 2.6 | 81.551 | 80.166 | 11.91% |

| 2018 | 2,208 | 9,059.6 | 11,032 | 4.1 | 5.0 | 2.2 | 2.7 | 86.687 | 82.801 | 13.32% |

| 2019 | 2,153 | 8,700.0 | 10,420 | 4.0 | 4.8 | 9.9 | 11.9 | 87.946 | 84.989 | 12.26% |

| 2020 | 2,095 | 8,000.0 | 9,456 | 3.8 | 4.5 | 0.0 | 85.578 | 82.497 | 11.46% | |

| 2021 | 2,755 | 13,000.1 | 14,693 | 4.7 | 5.3 | 9.9 | 11.2 | 97.527 | 87.661 | 16.76% |

| 2022 | 2,668 | 12,700 | 13,410 | 4.8 | 5.0 | 0.0 | 101.225 | 90.370 | 14.84% | |

| 2023 | 2,640 | 12,200 | 12,429 | 4.6 | 4.7 | 8.46 | 8.6 | 105.435 | 92.827 | 13.39% |

| 2024 | 2,781 | 14,200 | 14,200 | 5.1 | 5.1 | 11.00 | 11.0 | 110.065 | 95.798 | 12.90% |

| Average annual change rate | 7.0% | 9.7% | 7.4% | 2.6% | 0.4% | 6.5% | 4.2% | 4.5% | 3.0% | 3.8% |

| ¹ GDP is the GWP (gross world product) as per the most recent data provided by the World Bank (WB) at the time of the building of the table. Value for 2024 (constant 2015=100) obtained by applying the 2024 WB 3.2 percent growth estimate to the 2023 value. ² Until 2018, medians are computed on the total billionaire population as listed by Forbes. From 2019 onwards, only the world top 500 billionaires listed by Bloomberg are included. ³ US$ constant (2017=100) computed by applying the US$ GDP deflator. | ||||||||||

Sources: The Bloomberg Billionaires Index, The Forbes Billionaires List, The World Bank-DataBank.