areppim: information, pure and simple

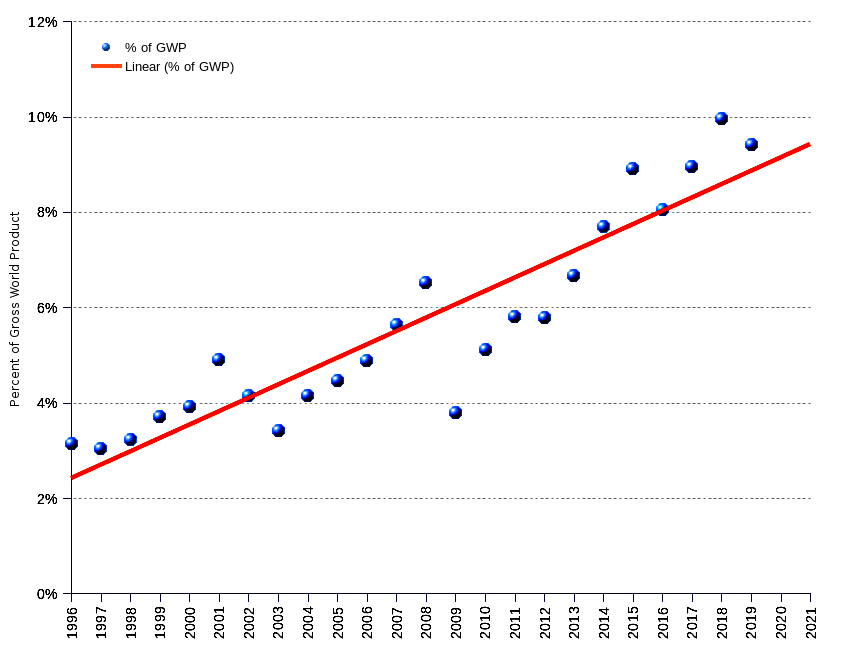

The world billionaires aggregate net worth as percent of GWP (gross world product) has been on a fast ride since 1996, as highlighted by the trend (red regression line). A plain metaphor will help us to grasp the magnitude of the phenomenon. In 1996 the whole world should have to work 8 solid days to produce an output equivalent to the total net worth of the then existing billionaires. A quarter of a century later, in 2021, the world should have to contribute an additional 28 workdays to match the wealth of the contemporary 2,755 billionaires.

Ordinary workers, contrary to their obnoxious reputation, are astoundingly liberal. Non content with letting go between one third and one half of their output to the tax office, they still provide extra hard work to make billionaires richer. This is not an assumption, but the plain fact. Between 1996 and 2021 the billionaires' wealth grew at the rate of 7.8% each year, climbing from 3.6% to 10% (for 2019, the last year available) of GWP. In other words, billionaires have been allowed to deflect to their balance sheets a growing cut of the world's output. Ours is a magnificent era of wealth accumulation, with inequalities climbing sky-high, and the poor getting steadily poorer.

The super-rich and their clerks claim that a dollar to the rich is money that trickles down to the poor, through consumption or investment. This is a bunch of baloney. The accumulated wealth is hardly channeled to job and income-generating investments. On the contrary, it is vastly used to play sophisticated financial games aimed at increasing the value of the stock holdings. The impact on the quality of life of the average person is devastating: unemployment, precarious jobs, lower and insecure income, indebtedness, economic dependency, failed public services, and so on. Not to speak of the deleterious ecological effects of consumerism, or the abrasive social consequences of the inequality chasm between the 2,755 billionaires, and the extremely poor, those 698 million people who must survive upon an income of $1.90 a day.

Crises exist indeed, they are an affliction for common people. At this very moment, the social and economic consequences of the COVID-19 pandemic are still looming, and they look bleak enough to scare the hell out of everybody. With the obvious exception of the billionaire 0.00004% of the world population. For them, crises are a flash in the pan, if not a convenient lever to push their fortunes further up. Both the 2001 dot.com burst and the 2008 global financial meltdown have been quickly outdistanced. The 2015 depression caused murderous commotion among world billionaires, to an extent unparalleled since 2009. But the course returned to normalcy in 2017. The pandemic reshuffled the billionaire list, but 2021 is shining brighter than ever for the extra-rich.

Billionaires, as a caste, have demonstrated their power to stand the test virtually unscathed. But the situation dynamics may lead the world to an unsurmountable deadlock. On the one hand, a minute group of individuals who owned 3% of GWP in 1996, 10% in 2019, possibly more than 30% in 2035… On the other hand, a huge crowd comprising 700 million of extremely poor people, 220 million of unemployed, 470 million of underutilized labor… The former will be intent on preserving their privileges. The latter are already saying loud and clear (e.g. France in 2018-19, Colombia in 2021) that enough is enough, and that they won’t take it anymore. There are reasonable grounds to believe that the clash will be as inevitable as brutal, and the issue may come as a surprise for the believers of “might is right”.

| Year | World Billionaires | GDP (gross world product) ¹ | Billionaire Net Worth as percent of GDP | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Number | Net Worth | Average | Median | (trillion US$ current) | (trillion US$ constant, 2010 =100) | |||||

| (billion US$ current) | (billion US$ constant, 2012=100) ² | (billion US$ current) | (billion US$ constant, 2012=100) | (billion US$ current) | (billion US$ constant, 2012=100) | |||||

| 1996 | 423 | 1,049.5 | 1,572.9 | 2.5 | 3.9 | 1.9 | 3.0 | 31.6 | 43.7 | 3.60% |

| 1997 | 224 | 1,010.0 | 1,486.5 | 4.5 | 7.0 | 2.9 | 4.5 | 31.5 | 45.2 | 3.29% |

| 1998 | 209 | 1,069.1 | 1,546.8 | 5.1 | 7.8 | 3.3 | 5.0 | 31.4 | 46.3 | 3.34% |

| 1999 | 298 | 1,270.9 | 1,818.3 | 4.3 | 6.4 | 2.9 | 4.3 | 32.6 | 47.8 | 3.80% |

| 2000 | 322 | 1,386.1 | 1,954.9 | 4.3 | 6.4 | 2.9 | 4.3 | 33.6 | 49.9 | 3.91% |

| 2001 | 538 | 1,728.6 | 2,384.6 | 3.2 | 4.7 | 1.9 | 2.8 | 33.4 | 50.9 | 4.68% |

| 2002 | 472 | 1,515.5 | 2,045.8 | 3.2 | 4.6 | 1.8 | 2.6 | 34.7 | 52.0 | 3.93% |

| 2003 | 476 | 1,403.3 | 1,864.8 | 2.9 | 4.1 | 1.7 | 2.4 | 38.9 | 53.6 | 3.48% |

| 2004 | 587 | 1,917.2 | 2,501.3 | 3.3 | 4.5 | 1.9 | 2.6 | 43.9 | 55.9 | 4.47% |

| 2005 | 691 | 2,236.2 | 2,841.0 | 3.2 | 4.3 | 2.0 | 2.7 | 47.5 | 58.1 | 4.89% |

| 2006 | 793 | 2,645.5 | 3,259.5 | 3.3 | 4.3 | 2.0 | 2.6 | 51.5 | 60.7 | 5.37% |

| 2007 | 946 | 3,452.0 | 4,128.2 | 3.6 | 4.6 | 2.1 | 2.6 | 58.0 | 63.3 | 6.52% |

| 2008 | 1,125 | 4,381.0 | 5,102.2 | 3.9 | 4.8 | 2.2 | 2.7 | 63.7 | 64.5 | 7.91% |

| 2009 | 793 | 2,414.7 | 2,758.5 | 3.0 | 3.7 | 1.8 | 2.2 | 60.4 | 63.4 | 4.35% |

| 2010 | 1,011 | 3,567.8 | 4,045.0 | 3.5 | 4.2 | 3.5 | 4.2 | 66.1 | 66.1 | 6.12% |

| 2011 | 1,210 | 4,496.3 | 5,038.9 | 3.7 | 4.4 | 3.7 | 4.4 | 73.5 | 68.2 | 7.39% |

| 2012 | 1,226 | 4,574.5 | 5,021.7 | 3.7 | 4.3 | 2.1 | 2.4 | 75.2 | 69.9 | 7.18% |

| 2013 | 1,426 | 5,431.8 | 5,850.6 | 3.8 | 4.3 | 2.1 | 2.4 | 77.3 | 71.8 | 8.15% |

| 2014 | 1,645 | 6,446.5 | 6,823.8 | 3.9 | 4.4 | 2.2 | 2.5 | 79.5 | 73.8 | 9.24% |

| 2015 | 1,826 | 7,063.2 | 7,340.7 | 3.9 | 4.2 | 2.1 | 2.3 | 75.2 | 76.0 | 9.66% |

| 2016 | 1,810 | 6,482.6 | 6,673.8 | 3.6 | 3.9 | 2.1 | 2.2 | 76.4 | 77.9 | 8.56% |

| 2017 | 2,043 | 7,668.0 | 7,812.2 | 3.8 | 4.0 | 2.1 | 2.3 | 81.3 | 80.5 | 9.70% |

| 2018 | 2,208 | 9,059.6 | 9,059.6 | 4.1 | 4.3 | 2.2 | 2.3 | 86.4 | 82.9 | 10.93% |

| 2019 | 2,153 | 8,700.0 | 8,496.0 | 4.0 | 4.2 | 9.9 ³ | 10.2 | 87.7 | 84.8 | 10.01% |

| 2020 | 2,095 | 8,000.0 | 7,675.4 | 3.8 | 3.9 | .. | .. | .. | .. | .. |

| 2021 | 2,755 | 13,000.1 | 12,322.6 | 4.7 | 4.7 | 9.9 | 9.9 | .. | .. | .. |

| Average annual change rate | 7.78% | 10.59% | 8.58% | 2.60% | 0.74% | 6.82% | 5.46% | 4.54% | 2.93% | 4.55% |

| ¹ GDP is the GWP (gross world product) as per the most recent data provided by the World Bank at the time of the building of the table. ² US$ constant (2012=100) are estimated by applying the US$ GDP deflator for the preceding year. ³ Until 2018, medians are computed on the total billionaire population as listed by Forbes. From 2019 onwards, only the world top 500 billionaires listed by Bloomberg are included. | ||||||||||

Sources: The Bloomberg Billionaires Index, 2021, The Forbes Billionaires List, The World Bank-DataBank.