![]() ITR (International Tourism Receipts) : Actual ITR | World ITR and GWP (Gross World Product) | World ITR Forecast (S-curve) |

ITR (International Tourism Receipts) : Actual ITR | World ITR and GWP (Gross World Product) | World ITR Forecast (S-curve) |

In 2011 tourism generated revenues of 1,030 billion current $US — 909 billion constant $US (2005=100) — roughly the size of Republic of Korea's GDP (gross domestic product), or the sum of France's and United Kingdom's 2011 merchandise exports. The economic relevance of the industry is unquestionable.

At the regional level, Europe is the strongest exporter of tourism services, having been able to attract 517.5 million tourists that generated $US 463.4 billion (409 $US constant, 2005=100) in 2011. In relative terms, Europe's performance meets the average (1950-2011 growth rate of 7% against 7.1% for the world), but in the last 3 years, since 2008, it has been mediocre, both as regards the number of tourists (growth rate of 2.3% against the world's 2.8%) and especially the volume of tourism receipts (negative change rate of -2.1% against the world's 1.5%). In absolute terms the second best has been Asia and Pacific, with 218.1 million tourists that generated $US 289.4 billion receipts (255 $US constant, 2005=100). Asia and Pacific is also the best performing region, with the highest growth rates both for ITA (1950-2011 growth rate of 12.1%) and ITR (1950-2011 growth rate of 11.9%). The region resisted the 2008-2011 lean years very successfully (ITA growth of 5.8%, and ITR growth of 10.1%). Americas, a traditionally strong tourism provider, take the third rank both in ITA and ITR, and are having a hard time, although not as much as Europe, to cope with the current slowdown.

Trends may be signaling dark clouds in the skies. Indeed tourism business has been growing regularly since 1950, at an annual average rate of 7% (doubling time 10 years), slightly faster than tourist arrivals (6.21%). But tourism receipts have practically crashed with the 2008 financial and economic crises, the average rate receding to a low 1.5% (doubling time 48 years), an even stronger deceleration than the one of tourist arrivals (growth rate of 2.8%) . This means both the braking of the growth of tourist arrivals, and a shrinking revenue per tourist, suggesting a significant spending avoidance trend.

One may be tempted to blame the hard landing on the extraneous economic circumstances. Nevertheless, the latter may explain the contraction only partially. The fact is that growth has been slowing significantly even before 2008. The annual average rate for the period 1980 through 2011 is a moderate 4.7% (doubling time 15 years), and about the same for the period 2000 through 2011 (4.8%). Meanwhile tourist arrivals grew respectively at the falling rates of 4.2% and 3.5%. These figures suggest a decelerating trend of the industry business. Considering the prospects of the current global economic crisis, compounded with the energy crunch that will eventually force transportation prices to reflect the real costs, and the the widening global income distribution chasm between high and low income earners, one can wager that the numbers of tourist arrivals will meet increasing difficulties to keep climbing, causing tourism revenue to lose momentum, and the industry to see its profitability melt.

International Tourism Receipts | ||||||||||||

Year |

Africa |

Americas |

Asia & Pacific |

Europe |

Middle East |

World |

||||||

| Current $US billion | Constant $US billion, 2005=100 | Current $US billion | Constant $US billion, 2005=100 | Current $US billion | Constant $US billion, 2005=100 | Current $US billion | Constant $US billion, 2005=100 | Current $US billion | Constant $US billion, 2005=100 | Current $US billion | Constant $US billion, 2005=100 | |

| 1950 | 0.1 | 0.7 | 1.1 | 8 | 0.04 | 0.3 | 0.9 | 6 | 0.03 | 0.2 | 2 | 14 |

| 1960 | 0.2 | 1.1 | 2.5 | 13 | 0.2 | 1.1 | 4 | 21 | 0.1 | 0.5 | 7 | 37 |

| 1965 | 0.3 | 1.5 | 3.4 | 17 | 0.5 | 2.5 | 7 | 36 | 0.3 | 1.5 | 12 | 58 |

| 1970 | 0.5 | 2.1 | 5 | 20 | 1.2 | 5 | 11 | 45 | 0.4 | 1.6 | 18 | 74 |

| 1975 | 1.3 | 3.9 | 10 | 30 | 2.5 | 7 | 26 | 77 | 0.9 | 2.7 | 41 | 121 |

| 1980 | 3.4 | 7 | 25 | 52 | 11 | 23 | 62 | 129 | 4 | 7 | 104 | 218 |

| 1981 | 3.7 | 7 | 28 | 53 | 13 | 25 | 57 | 109 | 4 | 8 | 106 | 203 |

| 1982 | 3.4 | 6 | 26 | 46 | 13 | 24 | 56 | 100 | 2 | 4 | 100 | 181 |

| 1983 | 3.5 | 6 | 26 | 46 | 14 | 24 | 55 | 96 | 4 | 8 | 103 | 179 |

| 1984 | 3.2 | 5 | 32 | 53 | 15 | 25 | 57 | 96 | 5 | 8 | 112 | 188 |

| 1985 | 3.1 | 5 | 33 | 54 | 16 | 26 | 62 | 101 | 4 | 7 | 119 | 193 |

| 1986 | 3.6 | 6 | 38 | 61 | 21 | 33 | 79 | 125 | 4 | 6 | 145 | 230 |

| 1987 | 5 | 7 | 43 | 66 | 28 | 43 | 99 | 153 | 5 | 7 | 179 | 276 |

| 1988 | 6 | 8 | 51 | 77 | 37 | 55 | 110 | 164 | 4 | 6 | 208 | 310 |

| 1989 | 6 | 8 | 60 | 87 | 41 | 59 | 154 | 221 | 5 | 7 | 266 | 382 |

| 1990 | 6 | 9 | 69 | 96 | 47 | 64 | 143 | 198 | 5 | 7 | 270 | 374 |

| 1991 | 6 | 8 | 76 | 102 | 48 | 64 | 148 | 198 | 5 | 7 | 283 | 379 |

| 1992 | 7 | 9 | 84 | 109 | 56 | 73 | 172 | 225 | 8 | 10 | 327 | 426 |

| 1993 | 7 | 9 | 89 | 114 | 62 | 79 | 167 | 213 | 8 | 10 | 333 | 425 |

| 1994 | 8 | 10 | 92 | 116 | 72 | 90 | 181 | 226 | 9 | 12 | 362 | 453 |

| 1995 | 9 | 10 | 98 | 121 | 81 | 99 | 212 | 260 | 11 | 13 | 411 | 503 |

| 1996 | 10 | 12 | 108 | 130 | 91 | 109 | 225 | 270 | 13 | 15 | 446 | 536 |

| 1997 | 10 | 11 | 114 | 135 | 89 | 105 | 224 | 264 | 14 | 16 | 450 | 532 |

| 1998 | 10 | 12 | 115 | 135 | 78 | 91 | 235 | 274 | 14 | 16 | 451 | 527 |

| 1999 | 11 | 13 | 120 | 138 | 84 | 97 | 234 | 269 | 16 | 18 | 465 | 535 |

| 2000 | 11 | 12 | 131 | 147 | 90 | 102 | 233 | 262 | 18 | 20 | 482 | 543 |

| 2001 | 12 | 13 | 120 | 132 | 93 | 102 | 228 | 251 | 18 | 20 | 470 | 518 |

| 2002 | 12 | 13 | 114 | 123 | 101 | 110 | 242 | 262 | 19 | 21 | 488 | 530 |

| 2003 | 16 | 17 | 114 | 121 | 98 | 105 | 283 | 301 | 23 | 24 | 535 | 568 |

| 2004 | 19 | 20 | 132 | 136 | 130 | 134 | 329 | 339 | 26 | 26 | 635 | 656 |

| 2005 | 22 | 22 | 145 | 145 | 141 | 141 | 348 | 348 | 28 | 28 | 683 | 683 |

| 2006 | 25 | 24 | 154 | 149 | 157 | 152 | 377 | 365 | 30 | 29 | 742 | 719 |

| 2007 | 28 | 27 | 171 | 161 | 189 | 178 | 433 | 408 | 34 | 32 | 856 | 806 |

| 2008 | 30 | 28 | 188 | 173 | 208 | 191 | 474 | 436 | 45 | 41 | 944 | 869 |

| 2009 | 29 | 26 | 166 | 151 | 203 | 185 | 411 | 374 | 42 | 38 | 851 | 776 |

| 2010 | 30 | 27 | 181 | 163 | 255 | 230 | 409 | 369 | 52 | 47 | 927 | 835 |

| 2011 | 33 | 29 | 199 | 176 | 289 | 255 | 463 | 409 | 46 | 41 | 1,030 | 909 |

| Average annual change rate 1950-2011 | 9.95% | 6.33% | 8.90% | 5.30% | 15.68% | 11.87% | 10.78% | 7.13% | 12.77% | 9.05% | 10.69% | 7.04% |

| Average annual change rate 2008-2011 | 2.56% | 1.11% | 1.91% | 0.47% | 11.71% | 10.13% | -0.72% | -2.12% | 0.66% | -0.76% | 2.95% | 1.49% |

| ¹ Change of time scale: 1-year scale from 1980 onwards. | ||||||||||||

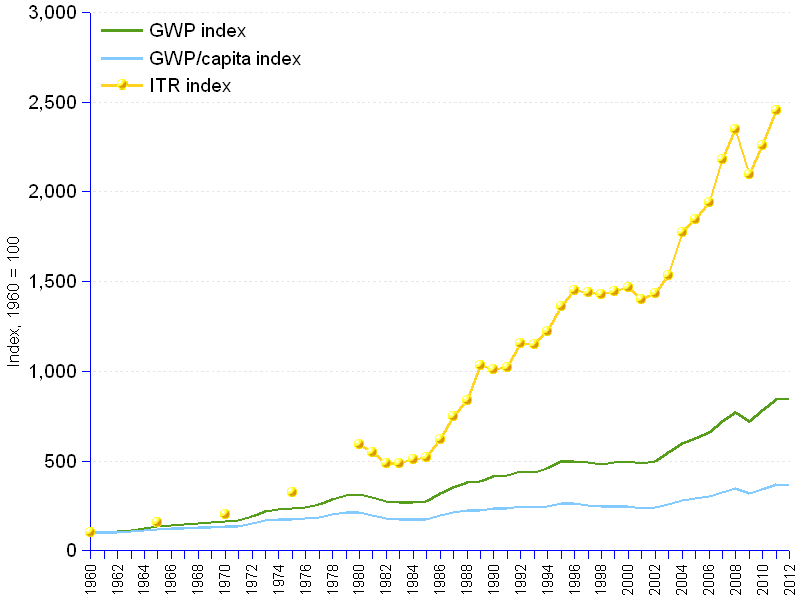

Since 1960 the tourism business (measured in ITR, international tourism receipts) is strongly associated to the overall economy (statistic r = 0.99). When the economy thrives, tourism revenues blossom, when it softens ITR depress — the R² value of 0.98 says that up to 98% of the variation of ITR is explained by the variation of the economy measured in gross product terms (GWP, gross world product). The same statistics applied to the GWP per capita, taking therefore into consideration the variations of the world population, produce values not very different, only slightly lower : r = 0.97, and R² = 0.94.

Given this close relationship, the comparison of trends between ITR and GWP may provide a good overview of the relative performance of the tourism industry along time. The chart shows the evolution of tourism revenue, GWP and GWP per capita since 1960. The values have been adjusted to inflation by applying the GDP deflator for 2005=100, and the variables were rendered more easily comparable through normalization, making the data point values for 1960 equal to 100.

Mass tourism is a relatively recent phenomenon that took off very fast, growing at a much quicker pace than GWP : the 1960-2011 average annual change rate of ITR is 6.5% (doubling time 11 years), against a significantly lower 4.3% (doubling time 16.5 years) for GWP and an even lower 2.6% (doubling time 27 years) for GWP per capita. However, from the turn of the century onwards, tourism revenue growth slowed down, with a rate below that of GWP : 4.8% against 4.91%, but still higher than GWP per capita (3.66%). The inflection became steeper after the 2008 global financial and economic crisis. Between 2008 and 2011, tourism receipts grew at the rate of 1.5%, lower than the growth rates of GWP per capita (1.9%,) and GWP (3.1%). In other words, comparing ITR to the GWP benchmark strengthens the above-stated conjecture that tourism business stopped its acceleration and initiated a decelerating path.

World International Tourism Receipts | ||||||

Year |

World ITR Actuals |

GWP |

GWP per capita |

|||

| (Constant $US billion, 2005=100) | (Index, 1960=100) | (Constant $US trillion, 2005=100) | (Index, 1960=100) | (Constant $US, 2005=100) | (Index, 1960=100) | |

| 1960 | 37 | 100 | 7.305 | 100 | 2,409 | 100 |

| 1961 | 7.421 | 102 | 2,402 | 100 | ||

| 1962 | 7.843 | 107 | 2,490 | 103 | ||

| 1963 | 8.347 | 114 | 2,599 | 108 | ||

| 1964 | 9.001 | 123 | 2,747 | 114 | ||

| 1965 | 58 | 157 | 9.757 | 134 | 2,919 | 121 |

| 1966 | 10.290 | 141 | 3,017 | 125 | ||

| 1967 | 10.620 | 145 | 3,051 | 127 | ||

| 1968 | 10.981 | 150 | 3,091 | 128 | ||

| 1969 | 11.515 | 158 | 3,177 | 132 | ||

| 1970 | 74 | 200 | 11.901 | 163 | 3,218 | 134 |

| 1971 | 12.523 | 171 | 3,319 | 138 | ||

| 1972 | 13.869 | 190 | 3,603 | 150 | ||

| 1973 | 16.048 | 220 | 4,089 | 170 | ||

| 1974 | 16.977 | 232 | 4,244 | 176 | ||

| 1975 | 121 | 327 | 17.302 | 237 | 4,245 | 176 |

| 1976 | 17.816 | 244 | 4,292 | 178 | ||

| 1977 | 18.960 | 260 | 4,487 | 186 | ||

| 1978 | 20.861 | 286 | 4,852 | 201 | ||

| 1979 | 22.363 | 306 | 5,112 | 212 | ||

| 1980 | 218 | 590 | 23.063 | 316 | 5,181 | 215 |

| 1981 | 203 | 549 | 21.637 | 296 | 4,777 | 198 |

| 1982 | 181 | 488 | 20.195 | 276 | 4,382 | 182 |

| 1983 | 179 | 485 | 19.849 | 272 | 4,233 | 176 |

| 1984 | 188 | 507 | 19.858 | 272 | 4,162 | 173 |

| 1985 | 193 | 522 | 20.242 | 277 | 4,169 | 173 |

| 1986 | 230 | 622 | 23.433 | 321 | 4,742 | 197 |

| 1987 | 276 | 747 | 25.867 | 354 | 5,143 | 213 |

| 1988 | 310 | 838 | 27.974 | 383 | 5,466 | 227 |

| 1989 | 382 | 1,032 | 28.286 | 387 | 5,432 | 225 |

| 1990 | 374 | 1,011 | 30.424 | 416 | 5,746 | 238 |

| 1991 | 379 | 1,024 | 30.825 | 422 | 5,728 | 238 |

| 1992 | 426 | 1,152 | 32.193 | 441 | 5,888 | 244 |

| 1993 | 425 | 1,148 | 31.932 | 437 | 5,751 | 239 |

| 1994 | 453 | 1,224 | 33.671 | 461 | 5,974 | 248 |

| 1995 | 503 | 1,360 | 36.501 | 500 | 6,382 | 265 |

| 1996 | 536 | 1,450 | 36.550 | 500 | 6,300 | 261 |

| 1997 | 532 | 1,438 | 35.827 | 490 | 6,090 | 253 |

| 1998 | 527 | 1,426 | 35.291 | 483 | 5,917 | 246 |

| 1999 | 535 | 1,446 | 36.070 | 494 | 5,967 | 248 |

| 2000 | 543 | 1,467 | 36.444 | 499 | 5,951 | 247 |

| 2001 | 518 | 1,400 | 35.429 | 485 | 5,712 | 237 |

| 2002 | 530 | 1,431 | 36.220 | 496 | 5,766 | 239 |

| 2003 | 568 | 1,535 | 39.918 | 546 | 6,277 | 261 |

| 2004 | 656 | 1,772 | 43.685 | 598 | 6,787 | 282 |

| 2005 | 683 | 1,845 | 45.712 | 626 | 7,017 | 291 |

| 2006 | 719 | 1,943 | 47.964 | 657 | 7,275 | 302 |

| 2007 | 806 | 2,178 | 52.558 | 719 | 7,878 | 327 |

| 2008 | 869 | 2,350 | 56.399 | 772 | 8,356 | 347 |

| 2009 | 776 | 2,096 | 52.797 | 723 | 7,732 | 321 |

| 2010 | 835 | 2,257 | 56.937 | 779 | 8,244 | 342 |

| 2011 | 909 | 2,456 | 61.752 | 845 | 8,841 | 367 |

| 2012 | 62.084 | 850 | 8,790 | 365 | ||

| Average annual change rate 60-11 | 6.48% | 6.48% | 4.27% | 4.27% | 2.58% | 2.58% |

| Average annual change rate 00-11 | 4.80% | 4.80% | 4.91% | 4.91% | 3.66% | 3.66% |

| Average annual change rate 08-11 | 1.49% | 1.49% | 3.07% | 3.07% | 1.90% | 1.90% |

| Pearson r | 0.99 | 0.97 | ||||

| R² | 0.98 | 0.94 | ||||

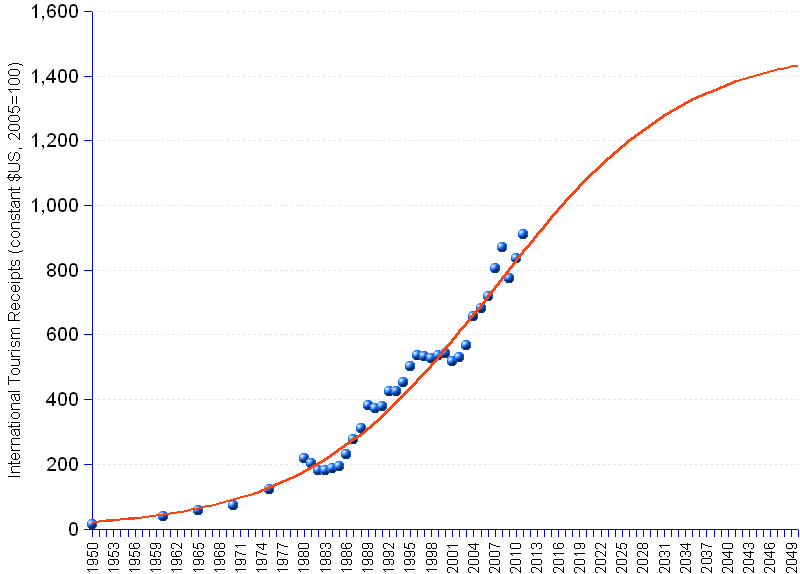

The chart shows in blue the historical values of ITR, from 1950 to 2011. The red line shows the S-curve logistic function forecast, fitted to the actual ITR, and extended into the future. By iteration, the following parameters have been computed :

The forecast does not claim to be a prediction of ITR for the coming years, but only a suggestion, among others, of the possible development of ITR as provided by a plain mathematical model, and assuming that other factors remain unaltered. What it tells us is nevertheless eye-opening. First the good news : the tourism business still has a good many years to live. However, the fast growing track is over : from 2007 onwards, growth has been slowly decelerating, moving towards eventual market saturation at about 1.5 $US trillion. Again, this is still far away, in about a quarter of century, says the model — but the halt is lurking there, patient and inescapable.

World International Tourism Receipts | ||

Year |

World ITR |

World ITR Forecast |

| (Constant $US billion, 2005=100) | ||

| 1950 | 14 | 21 |

| 1951 | 23 | |

| 1952 | 25 | |

| 1953 | 27 | |

| 1954 | 29 | |

| 1955 | 31 | |

| 1956 | 33 | |

| 1957 | 36 | |

| 1958 | 38 | |

| 1959 | 41 | |

| 1960 | 37 | 44 |

| 1961 | 48 | |

| 1962 | 51 | |

| 1963 | 55 | |

| 1964 | 59 | |

| 1965 | 58 | 63 |

| 1966 | 68 | |

| 1967 | 73 | |

| 1968 | 78 | |

| 1969 | 84 | |

| 1970 | 74 | 90 |

| 1971 | 97 | |

| 1972 | 104 | |

| 1973 | 111 | |

| 1974 | 119 | |

| 1975 | 121 | 127 |

| 1976 | 136 | |

| 1977 | 146 | |

| 1978 | 156 | |

| 1979 | 166 | |

| 1980 | 218 | 177 |

| 1981 | 203 | 189 |

| 1982 | 181 | 202 |

| 1983 | 179 | 215 |

| 1984 | 188 | 229 |

| 1985 | 193 | 244 |

| 1986 | 230 | 260 |

| 1987 | 276 | 276 |

| 1988 | 310 | 293 |

| 1989 | 382 | 311 |

| 1990 | 374 | 330 |

| 1991 | 379 | 349 |

| 1992 | 426 | 369 |

| 1993 | 425 | 390 |

| 1994 | 453 | 412 |

| 1995 | 503 | 435 |

| 1996 | 536 | 458 |

| 1997 | 532 | 482 |

| 1998 | 527 | 506 |

| 1999 | 535 | 531 |

| 2000 | 543 | 557 |

| 2001 | 518 | 583 |

| 2002 | 530 | 610 |

| 2003 | 568 | 637 |

| 2004 | 656 | 664 |

| 2005 | 683 | 691 |

| 2006 | 719 | 719 |

| 2007 | 806 | 747 |

| 2008 | 869 | 774 |

| 2009 | 776 | 802 |

| 2010 | 835 | 829 |

| 2011 | 909 | 856 |

| 2012 | 883 | |

| 2013 | 910 | |

| 2014 | 936 | |

| 2015 | 962 | |

| 2016 | 987 | |

| 2017 | 1,011 | |

| 2018 | 1,035 | |

| 2019 | 1,058 | |

| 2020 | 1,081 | |

| 2021 | 1,103 | |

| 2022 | 1,124 | |

| 2023 | 1,144 | |

| 2024 | 1,163 | |

| 2025 | 1,182 | |

| 2026 | 1,200 | |

| 2027 | 1,217 | |

| 2028 | 1,233 | |

| 2029 | 1,249 | |

| 2030 | 1,264 | |

| 2031 | 1,278 | |

| 2032 | 1,291 | |

| 2033 | 1,304 | |

| 2034 | 1,316 | |

| 2035 | 1,327 | |

| 2036 | 1,337 | |

| 2037 | 1,347 | |

| 2038 | 1,357 | |

| 2039 | 1,366 | |

| 2040 | 1,374 | |

| 2041 | 1,382 | |

| 2042 | 1,389 | |

| 2043 | 1,396 | |

| 2044 | 1,403 | |

| 2045 | 1,409 | |

| 2046 | 1,415 | |

| 2047 | 1,420 | |

| 2048 | 1,425 | |

| 2049 | 1,430 | |

| 2050 | 1,434 | |

Sources: UNWTO : World Tourism Barometer, Tourism Highlights | World Bank : World DataBank | United Nations Population Division.