![]() US Business Cycles, 2006-2016 | US Business Cycles, NBER, 2007-2010 |

US Business Cycles, 2006-2016 | US Business Cycles, NBER, 2007-2010 |

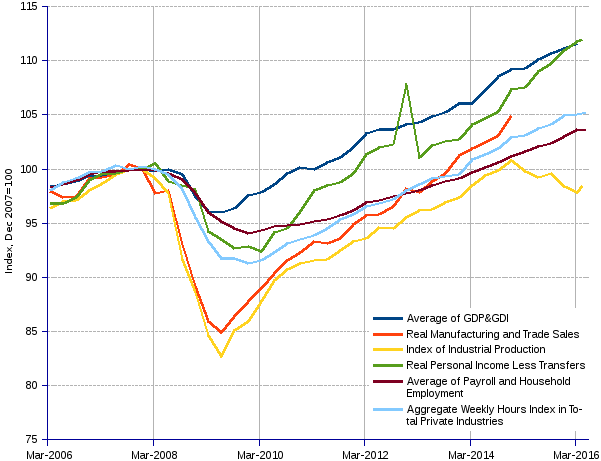

The US real economy has followed a jumpy course since 2006. Everyone, and not only in the United States but everywhere, is well aware of the deleterious consequences of the sub-prime triggered financial crisis of 2008 that quickly degenerated into an economic worldwide debacle, hitting most families and individuals in their flesh and bones.

Measuring the magnitude of the crash in terms of such a high-level aggregate as GDP (gross domestic product) falls quite short of sensitizing one to the many ways in which the crisis actually harms a person's everyday life. The method adopted by NBER (National Bureau of Economic Research) to track the ups and downs of business cycles has the merit of putting a finger on a set of variables that mean a lot for the common citizen — we are speaking of employment, personal income, working schedules, or of sales and industrial production that function as a sort of weather forecast for the economy.

By adopting a similar approach and picking the data from US official sources, we can observe the variables' ( duly indexed to Dec 2007=100 for the sake of comparison) behavior from 2006 through early 2016. The 2008 crisis is clearly portrayed by the steep fall of all the variables, starting with sales and industrial production — shrinking orders command immediate slowdown of production —, and rapidly followed by the unescapable chain of sequels: contracting work schedules (shorter jobs to perform), growing unemployment (who needs idle manpower), diminishing incomes (less worked hours, less wages), and at the higher level of aggregation a declining GDP (here measured as the average of GDP and GDI (gross domestic income) for the purpose of cutting in half the "statistical discrepancy" between the two ways of gauging the same output.

By mid-2009, sales and industrial production take an upward turn, signaling a positive change of the economy mood. Working hours and employment follow suit at a slower pace, eventually causing income and GDP to invert their previously downward course. The economy entered into an expansion cycle since 2009, but the downturn of the industrial production index as from December 2014 may read as an ominous foretaste of another impending recession.

US Business Cycles | ||||||

Average of GDP&GDI ¹ | Real Manufacturing and Trade Sales ² | Index of Industrial Production ³ | Real Personal Income Less Transfers ⁴ | Average of Payroll and Household Employment ⁵ | Aggregate Weekly Hours Index in Total Private Industries ⁶ | |

| index Dec 2007=100 | index Dec 2007=100 | index Dec 2007=100 | index Dec 2007=100 | index Dec 2007=100 | 2007=100 | |

| Mar-2006 | 98.4 | 97.9 | 96.3 | 96.9 | 98.3 | 98.0 |

| Jun-2006 | 98.6 | 97.4 | 97.0 | 96.9 | 98.6 | 98.8 |

| Sep-2006 | 98.9 | 97.4 | 97.1 | 97.4 | 98.9 | 99.1 |

| Dec-2006 | 99.4 | 99.1 | 98.0 | 98.9 | 99.5 | 99.7 |

| Mar-2007 | 99.3 | 99.3 | 98.7 | 99.6 | 99.8 | 99.8 |

| Jun-2007 | 99.8 | 99.5 | 99.5 | 99.6 | 99.8 | 100.3 |

| Sep-2007 | 99.8 | 100.4 | 99.9 | 99.9 | 99.9 | 100.0 |

| Dec-2007 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.2 |

| Mar-2008 | 99.7 | 97.7 | 99.1 | 100.5 | 99.9 | 100.0 |

| Jun-2008 | 100.0 | 98.0 | 97.7 | 98.8 | 99.6 | 99.5 |

| Sep-2008 | 99.5 | 93.0 | 91.6 | 98.5 | 99.0 | 98.1 |

| Dec-2008 | 97.5 | 89.2 | 88.6 | 98.1 | 97.7 | 95.5 |

| Mar-2009 | 96.1 | 85.9 | 84.7 | 94.2 | 96.0 | 93.3 |

| Jun-2009 | 96.0 | 84.9 | 82.7 | 93.5 | 95.2 | 91.7 |

| Sep-2009 | 96.4 | 86.4 | 85.1 | 92.6 | 94.5 | 91.7 |

| Dec-2009 | 97.5 | 87.8 | 86.0 | 92.9 | 94.1 | 91.3 |

| Mar-2010 | 97.8 | 89.0 | 87.8 | 92.4 | 94.4 | 91.6 |

| Jun-2010 | 98.6 | 90.3 | 89.7 | 94.1 | 94.7 | 92.3 |

| Sep-2010 | 99.6 | 91.6 | 90.7 | 94.6 | 94.7 | 93.1 |

| Dec-2010 | 100.1 | 92.3 | 91.3 | 96.1 | 94.9 | 93.5 |

| Mar-2011 | 100.0 | 93.3 | 91.6 | 98.0 | 95.2 | 93.9 |

| Jun-2011 | 100.6 | 93.2 | 91.6 | 98.5 | 95.3 | 94.5 |

| Sep-2011 | 101.0 | 93.6 | 92.5 | 98.8 | 95.7 | 95.3 |

| Dec-2011 | 102.0 | 94.9 | 93.3 | 99.6 | 96.2 | 95.8 |

| Mar-2012 | 103.3 | 95.7 | 93.6 | 101.4 | 96.9 | 96.5 |

| Jun-2012 | 103.6 | 95.8 | 94.6 | 102.0 | 97.1 | 96.8 |

| Sep-2012 | 103.7 | 96.5 | 94.5 | 102.3 | 97.5 | 97.2 |

| Dec-2012 | 104.1 | 98.2 | 95.6 | 107.8 | 97.8 | 98.0 |

| Mar-2013 | 104.3 | 97.8 | 96.1 | 101.1 | 98.0 | 98.6 |

| Jun-2013 | 104.8 | 98.9 | 96.3 | 102.2 | 98.4 | 99.1 |

| Sep-2013 | 105.3 | 99.6 | 96.9 | 102.5 | 98.8 | 99.3 |

| Dec-2013 | 106.1 | 101.3 | 97.4 | 102.7 | 99.1 | 99.5 |

| Mar-2014 | 106.1 | 101.9 | 98.5 | 104.1 | 99.7 | 100.9 |

| Jun-2014 | 107.3 | 102.5 | 99.4 | 104.7 | 100.1 | 101.3 |

| Sep-2014 | 108.5 | 103.1 | 99.9 | 105.4 | 100.6 | 101.9 |

| Dec-2014 | 109.2 | 104.9 | 100.7 | 107.3 | 101.1 | 102.9 |

| Mar-2015 | 109.3 | 99.8 | 107.5 | 101.6 | 103.1 | |

| Jun-2015 | 110.1 | 99.2 | 109.0 | 102.0 | 103.7 | |

| Sep-2015 | 110.7 | 99.6 | 109.8 | 102.3 | 104.1 | |

| Dec-2015 | 111.2 | 98.4 | 111.0 | 103.0 | 104.9 | |

| Mar-2016 | 111.6 | 97.9 | 111.8 | 103.6 | 105.0 | |

| Apr-2016 | 98.5 | 111.9 | 103.6 | 105.1 | ||

| May-2016 | 103.6 | 105.2 | ||||

| Data from: ¹ Bureau of Economic Analysis, NIPA Table 1.7.6. ² Bureau of Economic Analysis, Table 2BU. ³ Board of Governors of the Federal Reserve System (US), INDPRO, G.17 Industrial Production and Capacity Utilization. ⁴ Bureau of Economic Analysis, NIPA Table 2.6. ⁵ Bureau of Labor Statistics, Series CES0000000001, and LNS12000000. ⁶ Bureau of Labor Statistics, Series CES0500000016. | ||||||

![]() US Business Cycles, 2006-2016 | US Business Cycles, NBER, 2007-2010 |

US Business Cycles, 2006-2016 | US Business Cycles, NBER, 2007-2010 |

As convenient as it may appear to learned academics and savvy politicians, the concept of GDP can hardly turn on the normally built person, even the better educated one. It encompasses far too many apples and pears to make true sense — building or razing a house are treated just about the same. It is oblivious to a huge number of economic realities that enliven our daily life — the priceless time and care provided by parents to their newly born child are overlooked as inconsequential. It stubbornly acknowledges solely what is entered as an accountancy record — staying overnight in a hotel is eligible, not spending a month in your friend's beach cabin. But in the first place, measuring GDP is a messy undertaking — theoretically GDP should be identical to GDI, since they are nothing but two different ways of appraising the same reality — no way, you get two different outputs, and a weird appendix called "statistical discrepancy".

Notwithstanding, most business press and self-promoted experts insist in using GDP as the unique gauge to measure the ups and downs of the economy, in other words the business cycles. When the economy registers two consecutive quarters of declining real GDP, they say, it enters into recession — as simple as that. Such a scanty indicator will never capture the broad range of families' discomfiture, individuals' distress and social anomie that characterize a sick economy.

NBER's researchers, while also using GDP, more precisely an average of GDP and GDI to lessen the statistical discrepancy, to track the peaks and troughs of the economy cycles, they extend the analysis to other macroeconomic aggregates more adept to suggest what is actually going on on the stage of the real economy inhabited by real people. The chart shows NBER's set of six variables for the US business cycles from 2007 until 2010: average of GDP and GDI, real manufacturing and trade sales, index of industrial production, real personal income less transfers, average of payroll and household employment, and aggregate weekly hours index in total private industries.

NBER's US Business Cycles | |||||||||||

Macro Advisors Real GDP | Stock-Watson Real GDP | Stock-Watson Real GDI | Stock-Watson Average of GDP&GDI | Real Manufacturing and Trade Sales | Index of Industrial Production | Real Personal Income Less Transfers | Payroll Survey Employment | Household Survey Employment | Average of Payroll and Household Employment | Aggregate Weekly Hours Index in Total Private Industries | |

| Indexed, Dec 2007 = 100 | |||||||||||

| Jan-07 | 97.3 | 97.3 | 99.2 | 98.2 | 99.0 | 97.8 | 98.3 | 99.4 | 99.9 | 99.6 | 99.4 |

| Feb-07 | 97.8 | 97.8 | 99.8 | 98.8 | 99.5 | 99.0 | 98.5 | 99.4 | 99.9 | 99.7 | 99.5 |

| Mar-07 | 97.2 | 97.3 | 99.5 | 98.4 | 99.9 | 99.1 | 98.8 | 99.6 | 100.1 | 99.9 | 99.9 |

| Apr-07 | 98.2 | 98.1 | 99.8 | 99.0 | 99.9 | 99.8 | 99.0 | 99.7 | 99.7 | 99.7 | 100.3 |

| May-07 | 98.3 | 98.4 | 99.4 | 98.9 | 100.4 | 99.8 | 98.9 | 99.8 | 99.8 | 99.8 | 100.4 |

| Jun-07 | 98.1 | 98.2 | 99.4 | 98.8 | 99.7 | 99.6 | 98.9 | 99.8 | 99.9 | 99.9 | 100.4 |

| Jul-07 | 98.1 | 98.0 | 99.1 | 98.6 | 99.4 | 99.9 | 99.1 | 99.8 | 99.8 | 99.8 | 100.2 |

| Aug-07 | 98.8 | 98.7 | 98.9 | 98.8 | 100.0 | 99.8 | 99.2 | 99.8 | 99.7 | 99.7 | 99.8 |

| Sep-07 | 99.4 | 99.6 | 99.1 | 99.4 | 100.1 | 100.2 | 99.5 | 99.8 | 100.0 | 99.9 | 100.0 |

| Oct-07 | 99.0 | 99.2 | 99.4 | 99.3 | 100.4 | 99.5 | 99.6 | 99.9 | 99.8 | 99.8 | 99.8 |

| Nov-07 | 99.3 | 99.3 | 99.6 | 99.4 | 100.6 | 99.9 | 99.6 | 99.9 | 100.2 | 100.1 | 100.2 |

| Dec-07 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.0 | 100.5 |

| Jan-08 | 100.1 | 100.1 | 99.9 | 100.0 | 100.4 | 99.7 | 99.9 | 100.0 | 100.2 | 100.1 | 99.9 |

| Feb-08 | 98.7 | 98.8 | 99.8 | 99.3 | 98.8 | 99.4 | 99.9 | 100.0 | 100.0 | 100.0 | 99.8 |

| Mar-08 | 99.0 | 99.1 | 99.9 | 99.5 | 98.5 | 99.1 | 99.9 | 99.9 | 100.0 | 100.0 | 100.4 |

| Apr-08 | 99.0 | 99.3 | 99.5 | 99.4 | 99.1 | 98.3 | 99.4 | 99.8 | 100.1 | 100.0 | 99.9 |

| May-08 | 99.2 | 99.3 | 99.3 | 99.3 | 98.2 | 97.9 | 99.0 | 99.7 | 99.9 | 99.8 | 99.7 |

| Jun-08 | 100.1 | 99.8 | 99.0 | 99.4 | 97.8 | 97.5 | 98.5 | 99.5 | 99.7 | 99.6 | 99.5 |

| Jul-08 | 99.2 | 99.2 | 98.8 | 99.0 | 96.3 | 97.5 | 98.1 | 99.4 | 99.5 | 99.5 | 99.0 |

| Aug-08 | 98.3 | 98.4 | 98.8 | 98.6 | 94.9 | 96.3 | 98.5 | 99.1 | 99.3 | 99.2 | 98.4 |

| Sep-08 | 97.7 | 97.7 | 98.2 | 97.9 | 92.8 | 92.5 | 98.3 | 98.8 | 99.2 | 99.0 | 98.0 |

| Oct-08 | 97.3 | 97.2 | 97.1 | 97.2 | 92.2 | 93.4 | 98.6 | 98.4 | 99.0 | 98.7 | 97.6 |

| Nov-08 | 97.4 | 97.5 | 97.3 | 97.4 | 90.8 | 92.5 | 99.1 | 97.9 | 98.4 | 98.2 | 96.6 |

| Dec-08 | 95.5 | 95.4 | 96.2 | 95.8 | 90.3 | 90.6 | 98.1 | 97.4 | 98.0 | 97.7 | 95.8 |

| Jan-09 | 95.7 | 95.9 | 96.3 | 96.1 | 88.9 | 88.7 | 96.5 | 96.8 | 97.3 | 97.1 | 95.1 |

| Feb-09 | 95.5 | 95.6 | 95.3 | 95.5 | 89.5 | 88.0 | 95.2 | 96.3 | 96.9 | 96.6 | 94.2 |

| Mar-09 | 95.4 | 95.2 | 95.4 | 95.3 | 88.3 | 86.8 | 94.7 | 95.7 | 96.4 | 96.0 | 93.3 |

| Apr-09 | 95.4 | 95.4 | 95.2 | 95.3 | 88.0 | 86.1 | 94.9 | 95.4 | 96.4 | 95.9 | 92.5 |

| May-09 | 95.6 | 95.6 | 95.5 | 95.6 | 87.8 | 85.3 | 95.0 | 95.1 | 96.1 | 95.6 | 92.2 |

| Jun-09 | 95.0 | 95.1 | 95.1 | 95.1 | 87.5 | 85.1 | 94.4 | 94.7 | 95.8 | 95.3 | 91.5 |

| Jul-09 | 95.3 | 95.3 | 95.0 | 95.1 | 88.8 | 86.3 | 94.0 | 94.4 | 95.7 | 95.0 | 91.3 |

| Aug-09 | 95.8 | 95.8 | 95.3 | 95.5 | 88.6 | 87.3 | 93.8 | 94.3 | 95.4 | 94.8 | 91.1 |

| Sep-09 | 96.1 | 96.1 | 95.5 | 95.8 | 88.8 | 88.0 | 93.4 | 94.1 | 94.9 | 94.5 | 90.9 |

| Oct-09 | 97.2 | 97.4 | 96.2 | 96.8 | 89.2 | 88.2 | 93.3 | 94.0 | 94.6 | 94.3 | 90.5 |

| Nov-09 | 97.0 | 97.0 | 96.9 | 96.9 | 90.5 | 88.7 | 93.5 | 94.0 | 94.7 | 94.3 | 91.1 |

| Dec-09 | 96.5 | 96.4 | 97.3 | 96.9 | 90.9 | 89.2 | 93.7 | 93.9 | 94.3 | 94.1 | 90.7 |

| Jan-10 | 97.4 | 97.7 | 97.6 | 97.7 | 90.5 | 90.1 | 93.5 | 93.9 | 94.6 | 94.3 | 91.3 |

| Feb-10 | 97.7 | 97.6 | 97.8 | 97.7 | 91.1 | 90.0 | 93.5 | 94.0 | 94.8 | 94.4 | 91.1 |

| Mar-10 | 98.2 | 98.1 | 98.0 | 98.0 | 92.7 | 90.6 | 93.5 | 94.1 | 95.0 | 94.6 | 91.5 |

| Apr-10 | 98.4 | 98.6 | 98.2 | 98.4 | 92.8 | 90.9 | 94.0 | 94.4 | 95.4 | 94.9 | 91.9 |

| May-10 | 98.0 | 98.3 | 98.4 | 98.4 | 92.1 | 92.1 | 94.4 | 94.7 | 95.4 | 95.0 | 92.2 |

| Jun-10 | 97.6 | 97.7 | 98.4 | 98.1 | 92.5 | 92.1 | 94.4 | 94.5 | 95.2 | 94.9 | 92.0 |

| Jul-10 | 93.0 | 94.4 | 94.5 | 95.1 | 94.8 | 92.4 | |||||

| Aug-10 | 94.5 | 95.3 | 94.9 | 92.4 | |||||||

| Sep-10 | |||||||||||

| Oct-10 | |||||||||||

| Nov-10 | |||||||||||

| Source: NBER, National Bureau of Economic Research, Inc., USA, https://nber.org/cycles/cyclesmain.html | |||||||||||

Sources: NBER, National Bureau of Economic Research, Inc., BEA-US Bureau of Economic Analysis, BLS-Bureau of Labor Statistics, U.S. Department Of Labor, Federal Reserve Board of Governors.