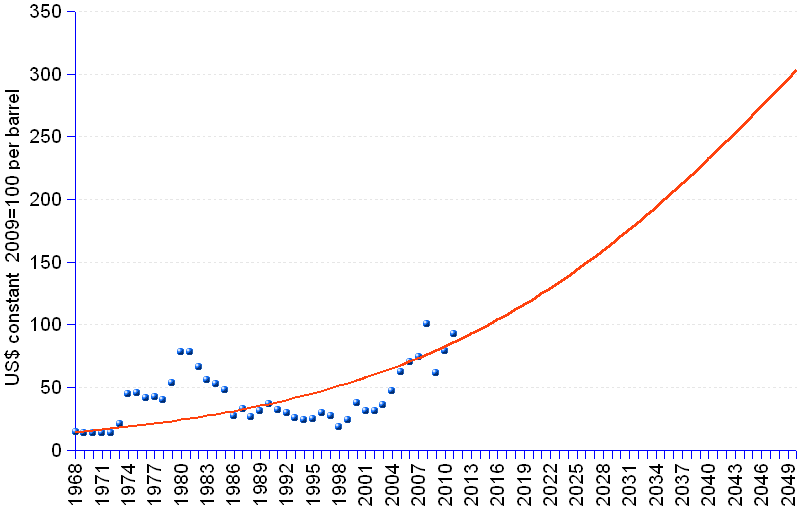

The chart blue dots are the historical average barrel prices (in constant US$, 2009=100) of crude oil, while the red line provides the non-linear projection until 2050. The chart does not intend to be a prediction tool of future prices, but only a strong reminder that the upwards trend will drive oil prices to stratospheric values. Since kerosene and gas prices at the pump closely follow crude oil prices, it is foreseeable that a flight ticket or a car ride will become unaffordable for the common person in a not so far away future.

However hard it may be to tell what the barrel of crude oil will be worth after-tomorrow, it is an easy guess to foresee that it will move significantly up in the long run. The market price of oil is influenced by a complex set of interrelated factors, which render the final outcome of a small change upstream quite unexpected or outright counter intuitive. Take the 2008 "subprime" mortgage collapse – the average barrel price dipped from around $120 to below $60.

Volatility of crude prices is probably to be blamed on political and speculative actions that cause prices to unexpectedly go through the roof and suddenly crash on the floor, rather than to the economic and demographic fundamentals that drive the long-term trends.

Some demand factors are obvious and can be planned for, to a large extent:

Other factors are less adept to planning:

The intricate interplay of all these factors do not allow for reliable forecasts. The US energy information administration (EIA), the source of data in this page, periodically reports on the energy situation using their own energy modeling system. In its 2011 energy outlook EIA presents a high oil price case that places the price of the barrel at $200 (2009=100) by 2035.

The issue with such econometric models is the underlying assumption that there are no limits. GDP can grow, housing can multiply, transportation can spread forever, and energy sources will pop up inextinguishable, from somewhere, be it a supposedly unlimited planet or the fathomless technological human genius, in order to quench the insatiable demand for energy.

But efficiency gains and energy source substitution will not suffice. We must plan for a radical change of our energy consuming habits or else, someday, our own dark and greedy persona will provoke a painful settling of scores.

World Average Crude Oil Price ¹ | ||||||

Year |

Quarter 1 |

Quarter 2 |

Quarter 3 |

Quarter 4 |

Average Annual Price |

Forecast (logistic function) |

| (per barrel – constant US$ 2009=100) | ||||||

| 1968 | 14.83 | 14.55 | 14.28 | 13.96 | 14.41 | 14.41 |

| 1969 | 13.70 | 13.41 | 13.35 | 13.37 | 13.46 | 15.04 |

| 1970 | 13.37 | 13.36 | 13.48 | 13.55 | 13.44 | 15.71 |

| 1971 | 13.58 (1) | 13.62 | 13.57 | 13.51 | 13.57 | 16.40 |

| 1972 | 13.36 | 13.33 | 13.94 | 14.64 | 13.82 | 17.12 |

| 1973 | 15.33 (2) | 15.93 | 22.48 | 30.11 | 20.96 | 17.87 |

| 1974 | 42.91 | 47.05 | 44.68 | 43.17 | 44.45 | 18.66 |

| 1975 | 43.62 | 44.82 | 45.71 | 47.23 | 45.35 | 19.48 |

| 1976 | 42.05 | 41.85 | 41.56 | 41.05 | 41.63 | 20.33 |

| 1977 | 42.72 | 42.57 | 42.05 | 41.45 | 42.20 | 21.22 |

| 1978 | 40.46 (3) | 39.68 | 39.05 | 38.98 | 39.54 | 22.15 |

| 1979 | 41.26 | 48.69 | 59.50 | 65.37 | 53.71 | 23.11 |

| 1980 | 76.38 (4) | 79.31 | 78.37 | 77.71 | 77.94 | 24.12 |

| 1981 | 83.54 | 79.98 | 74.76 | 73.25 | 77.88 | 25.17 |

| 1982 | 70.71 | 66.10 | 65.11 | 64.28 | 66.55 | 26.26 |

| 1983 | 58.39 | 54.71 | 55.45 | 55.20 | 55.94 | 27.40 |

| 1984 | 53.63 | 53.73 | 52.73 | 51.79 | 52.97 | 28.59 |

| 1985 | 48.91 | 49.05 | 47.23 | 47.15 | 48.09 | 29.82 |

| 1986 | 34.21 (5) | 24.26 | 24.06 | 26.60 | 27.28 | 31.11 |

| 1987 | 31.18 | 32.98 | 34.40 | 31.24 | 32.45 | 32.45 |

| 1988 | 27.75 | 28.41 | 24.70 | 23.83 | 26.17 | 33.84 |

| 1989 | 29.50 | 32.27 | 30.34 | 31.76 | 30.97 | 35.29 |

| 1990 | 33.59 | 27.09 | 39.90 | 47.76 | 37.09 | 36.80 |

| 1991 | 32.41 (6) | 30.53 | 31.63 | 31.55 | 31.53 | 38.36 |

| 1992 | 27.31 | 30.43 | 30.96 | 29.10 | 29.45 | 40.00 |

| 1993 | 27.98 | 27.76 | 24.89 | 22.84 | 25.87 | 41.69 |

| 1994 | 20.51 | 24.49 | 25.31 | 24.03 | 23.59 | 43.45 |

| 1995 | 24.89 | 26.10 | 23.96 | 24.23 | 24.80 | 45.29 |

| 1996 | 26.22 | 28.68 | 29.51 | 32.25 | 29.17 | 47.19 |

| 1997 | 29.64 (7) | 25.89 | 25.64 | 25.73 | 26.73 | 49.17 |

| 1998 | 20.56 | 18.83 | 18.20 | 16.51 | 18.53 | 51.22 |

| 1999 | 16.60 (8) | 22.34 | 27.40 | 30.91 | 24.31 | 53.35 |

| 2000 | 35.93 | 35.69 | 38.98 | 39.24 | 37.46 | 55.56 |

| 2001 | 35.10 | 33.77 | 32.16 (9) | 24.53 | 31.39 | 57.86 |

| 2002 | 25.95 | 31.31 | 33.66 | 33.32 | 31.06 | 60.24 |

| 2003 | 39.97 | 33.87 | 35.11 | 36.07 | 36.26 | 62.71 |

| 2004 | 40.40 | 43.59 | 49.51 | 54.10 | 46.90 | 65.27 |

| 2005 | 55.19 (10) | 58.48 | 68.95 | 64.92 | 61.89 | 67.92 |

| 2006 | 67.95 | 74.95 | 74.39 | 63.08 | 70.09 | 70.67 |

| 2007 | 60.43 | 67.08 | 77.52 | 93.02 | 74.51 | 73.51 |

| 2008 | 99.94 | 125.42 | 118.13 (11) | 58.56 | 100.51 | 76.46 |

| 2009 | 42.96 (12) | 59.47 | 68.12 | 76.02 | 61.64 | 79.50 |

| 2010 | 78.40 | 77.17 | 75.13 | 83.99 | 78.67 | 82.66 |

| 2011 | 92.51 | 92.51 | 85.92 | |||

| 2012 | 89.28 | |||||

| 2013 | 92.76 | |||||

| 2014 | 96.36 | |||||

| 2015 | 100.06 | |||||

| 2016 | 103.89 | |||||

| 2017 | 107.83 | |||||

| 2018 | 111.90 | |||||

| 2019 | 116.08 | |||||

| 2020 | 120.39 | |||||

| 2021 | 124.82 | |||||

| 2022 | 129.38 | |||||

| 2023 | 134.07 | |||||

| 2024 | 138.88 | |||||

| 2025 | 143.81 | |||||

| 2026 | 148.88 | |||||

| 2027 | 154.07 | |||||

| 2028 | 159.38 | |||||

| 2029 | 164.82 | |||||

| 2030 | 170.39 | |||||

| 2031 | 176.08 | |||||

| 2032 | 181.89 | |||||

| 2033 | 187.81 | |||||

| 2034 | 193.86 | |||||

| 2035 | 200.02 | |||||

| 2036 | 206.29 | |||||

| 2037 | 212.67 | |||||

| 2038 | 219.16 | |||||

| 2039 | 225.75 | |||||

| 2040 | 232.43 | |||||

| 2041 | 239.21 | |||||

| 2042 | 246.07 | |||||

| 2043 | 253.02 | |||||

| 2044 | 260.04 | |||||

| 2045 | 267.13 | |||||

| 2046 | 274.29 | |||||

| 2047 | 281.51 | |||||

| 2048 | 288.78 | |||||

| 2049 | 296.10 | |||||

| 2050 | 303.45 | |||||

| ¹ Crude oil f.o.b. price: The crude oil price actually charged at the oil producing country's port of loading. Includes deductions for any rebates and discounts or additions of premiums, where applicable. It is the actual price paid with no adjustment for credit terms. | ||||||

| (1) US spare capacity exhausted | ||||||

| (2) Arab oil embargo | ||||||

| (3) Iranian revolution | ||||||

| (4) Iran-Iraq war | ||||||

| (5) Saudis abandon swing producer role | ||||||

| (6) Iraq invades Kuwait | ||||||

| (7) Asian financial crisis | ||||||

| (8) OPEC cuts production targets 1.7 mmbpd | ||||||

| (9) 9-11 attacks | ||||||

| (10) Low spare capacity | ||||||

| (11) Global financial collapse | ||||||

| (12) OPEC cuts production targets 4.2 mmbpd | ||||||

Sources: EIA - Energy Information Administration