The bigger the GDP (gross domestic product) of a country, the wealthier the billionaire class. Right? Yes, that is correct. The US, Germany, Japan have a plateful of super-rich that weigh $US billions aplenty. Now, look at it from the angle of the GDP per capita. The higher it is, the heavier the billionaires' share, right? No — this time you have got it wrong. Swaziland with a low GDP per capita of $US 3,717 can have a billionaire's wealth weighing 87.9% of the country's GDP, a performance only exceeded by the unique and very rich Monaco. The sleight of hand is that wealth and income are so unevenly distributed that billionaires' net worth bears close to zero relationship to the GDP per capita.

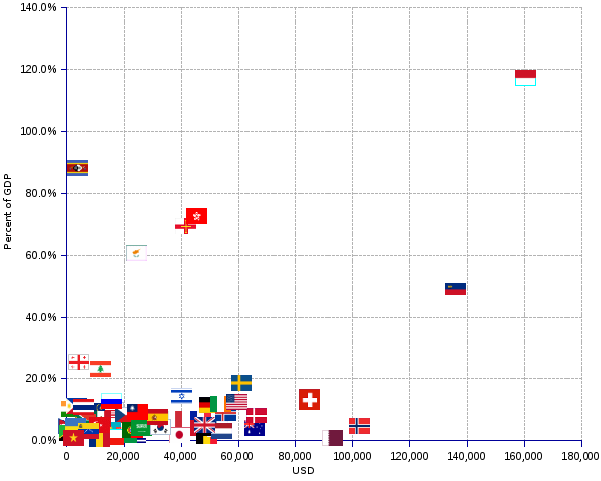

The chart shows the scatter of the billionaires' net worth as percent of GDP (y-axis), as a function of the country's GDP per capita (x-axis). The billionaires' wealth is strongly correlated to the country's GDP (r = 0.92, R² = 0.85), but not the least with the GDP per capita (r = 0.10, R² = 0.01). In other words, the average financial condition of people, as measured by the GDP per capita, has no bearing on the relative weight of the billionaires' wealth.

The 2016 world billionaires are a set of 1,810 individuals, owning net assets worth of $US 6,5 trillion or about 8% of the world's total output. Their distribution is uneven. Net worth weighs between 0.4% of the country GDP for Romania, and 117% for Monaco. The mass of data points is concentrated close to the x-axis — indeed, fifty percent of billionaires' wealth weighs less than 5.1% of GDP, although the billionaire citizens of Liechtenstein, Cyprus, Guernsey, Hong Kong, Swaziland and Monaco hold assets that are worth between 49% and 117% of their home country GDP.

The distribution of billionaires' wealth provides one more instance of the overall inequality pattern that has been identified elsewhere for the distribution of incomes. Many impecunious economies, for example Vietnam, India, Tanzania or Nepal, harbor huge private fortunes in spite of their minuscule GDP per capita, far below the listed countries average and median values. In the last two countries, GDP per capita is below the $US 1,000 mark, but they have billionaires owning fortunes worth 1.3 million to 1.4 million times as much. No need to comment, the facts are a strong enough indictment.

2016 Billionaire Net Worth |

||||||

Nation |

Number of billionaires |

Net Worth |

GDP |

Population |

GDP per capita |

Billionaire net worth as percent of GDP |

| ($US current billion) | ($US current billion) | (million) | ($US current) | |||

| Algeria | 1 | 3.1 | 249 | 40.2 | 6,179 | 1.2% |

| Angola | 1 | 3.0 | 152 | 22.8 | 6,682 | 2.0% |

| Argentina | 4 | 9.2 | 556 | 42.9 | 12,956 | 1.7% |

| Australia | 25 | 61.7 | 1,590 | 24.2 | 65,768 | 3.9% |

| Austria | 6 | 29.0 | 466 | 8.6 | 54,192 | 6.2% |

| Belgium | 3 | 7.5 | 554 | 11.3 | 48,991 | 1.4% |

| Brazil | 31 | 135.1 | 2,469 | 206.1 | 11,979 | 5.5% |

| Canada | 33 | 112.4 | 1,956 | 36.2 | 54,056 | 5.7% |

| Chile | 10 | 29.0 | 298 | 18.0 | 16,538 | 9.7% |

| China | 251 | 593.0 | 12,235 | 1,381.1 | 8,859 | 4.8% |

| Colombia | 3 | 13.6 | 454 | 48.8 | 9,300 | 3.0% |

| Cyprus | 5 | 13.4 | 22 | 0.9 | 24,415 | 60.4% |

| Czech Republic | 5 | 17.8 | 217 | 10.6 | 20,511 | 8.2% |

| Denmark | 6 | 29.4 | 375 | 5.6 | 66,481 | 7.8% |

| Egypt | 6 | 14.2 | 366 | 88.8 | 4,120 | 3.9% |

| Finland | 6 | 10.5 | 292 | 5.5 | 52,866 | 3.6% |

| France | 39 | 212.0 | 3,027 | 64.5 | 46,895 | 7.0% |

| Georgia | 1 | 4.8 | 19 | 4.4 | 4,250 | 25.4% |

| Germany | 120 | 469.1 | 4,063 | 81.1 | 50,097 | 11.5% |

| Greece | 2 | 4.5 | 266 | 11.0 | 24,156 | 1.7% |

| Guernsey | 1 | 1.9 | 3 | 0.1 | 41,495 | 69.3% |

| Hong Kong | 64 | 241.3 | 333 | 7.3 | 45,370 | 72.4% |

| Iceland | 1 | 1.6 | 18 | 0.3 | 55,583 | 8.8% |

| India | 84 | 248.4 | 2,447 | 1,293.1 | 1,893 | 10.1% |

| Indonesia | 20 | 49.8 | 975 | 258.7 | 3,770 | 5.1% |

| Ireland | 6 | 30.7 | 262 | 4.9 | 53,785 | 11.7% |

| Israel | 17 | 48.2 | 337 | 8.4 | 40,157 | 14.3% |

| Italy | 43 | 150.8 | 2,223 | 60.5 | 36,749 | 6.8% |

| Japan | 27 | 85.4 | 5,001 | 126.3 | 39,586 | 1.7% |

| Kazakhstan | 5 | 9.3 | 277 | 17.9 | 15,434 | 3.4% |

| Lebanon | 7 | 12.5 | 54 | 4.6 | 11,846 | 23.0% |

| Liechtenstein | 1 | 2.5 | 5 | 0.0 | 135,897 | 48.9% |

| Malaysia | 10 | 39.5 | 413 | 31.5 | 13,124 | 9.6% |

| Mexico | 14 | 99.6 | 1,437 | 122.0 | 11,777 | 6.9% |

| Monaco | 4 | 7.1 | 6 | 0.0 | 160,690 | 117.1% |

| Morocco | 2 | 3.2 | 132 | 33.8 | 3,896 | 2.4% |

| Nepal | 1 | 1.1 | 23 | 28.8 | 796 | 4.8% |

| Netherlands | 9 | 28.2 | 918 | 17.0 | 54,099 | 3.1% |

| New Zealand | 2 | 9.1 | 220 | 4.6 | 47,753 | 4.1% |

| Nigeria | 5 | 29.9 | 702 | 183.6 | 3,824 | 4.3% |

| Norway | 13 | 24.8 | 539 | 5.3 | 102,443 | 4.6% |

| Oman | 1 | 1.5 | 83 | 4.0 | 21,061 | 1.8% |

| Peru | 3 | 3.8 | 238 | 32.4 | 7,350 | 1.6% |

| Philippines | 11 | 41.5 | 369 | 103.5 | 3,569 | 11.2% |

| Poland | 3 | 7.9 | 630 | 38.5 | 16,341 | 1.3% |

| Portugal | 3 | 7.8 | 241 | 10.5 | 22,959 | 3.2% |

| Qatar | 1 | 2.0 | 244 | 2.6 | 93,167 | 0.8% |

| Romania | 1 | 1.0 | 230 | 19.7 | 11,637 | 0.4% |

| Russia | 77 | 282.6 | 2,236 | 143.7 | 15,557 | 12.6% |

| Saudi Arabia | 6 | 34.6 | 840 | 31.9 | 26,357 | 4.1% |

| Singapore | 17 | 44.5 | 331 | 5.5 | 59,867 | 13.4% |

| South Africa | 6 | 21.8 | 369 | 55.2 | 6,695 | 5.9% |

| South Korea | 31 | 75.1 | 1,677 | 50.9 | 32,958 | 4.5% |

| Spain | 21 | 113.2 | 1,469 | 46.3 | 31,735 | 7.7% |

| Swaziland | 1 | 3.7 | 4 | 1.1 | 3,717 | 87.9% |

| Sweden | 26 | 112.0 | 604 | 9.9 | 61,297 | 18.5% |

| Switzerland | 32 | 91.6 | 691 | 8.1 | 84,855 | 13.2% |

| Taiwan | 25 | 54.1 | 588 | 23.5 | 24,985 | 9.2% |

| Tanzania | 1 | 1.1 | 44 | 50.6 | 876 | 2.5% |

| Thailand | 16 | 44.9 | 418 | 69.2 | 6,040 | 10.7% |

| Turkey | 30 | 45.4 | 911 | 79.0 | 11,536 | 5.0% |

| Ukraine | 5 | 7.1 | 148 | 45.1 | 3,292 | 4.8% |

| United Arab Emirates | 5 | 18.4 | 462 | 9.9 | 46,865 | 4.0% |

| United Kingdom | 50 | 161.8 | 3,149 | 65.4 | 48,162 | 5.1% |

| United States | 540 | 2,399.0 | 19,197 | 322.6 | 59,503 | 12.5% |

| Venezuela | 3 | 7.2 | 242 | 31.4 | 7,718 | 3.0% |

| Vietnam | 1 | 1.8 | 219 | 92.5 | 2,371 | 0.8% |

| Average | 27 | 97 | 32,533 | 12.7% | ||

| Median | 6 | 25 | 22,959 | 5.1% | ||

| r = 0.92 (Coefficient of correlation Net Worth-GDP). R² = 0.85 (Coefficient of determination Net Worth-GDP). r = 0.10 (Coefficient of correlation Net Worth-GDP per capita). R² = 0.01 (Coefficient of determination Net Worth-GDP per capita). | ||||||

Sources: see Forbes List of Billionaires, International Monetary Fund, World Economic Outlook Database, and United Nations Population Division.